Tesla’s Quarterly Loss Surprises No One, Stock Rightfully Tanks

Elon Musk and Tesla burned $7.1 billion in the last four calendar years alone. That doesn’t even account for this year’s cash burn. | Source: Shutterstock

To the surprise of nobody, Tesla reported a loss this past quarter along with a ton of cash burn. Let’s look at the headline numbers and then parse why this is another disaster for Tesla, no matter what the bulls say.

Ugly Numbers

Tesla lost $1.12 per share versus the expected loss of $0.31 per share. That means a loss of $408 million in the quarter on revenue of $6.3 billion, which is about $200 million below expectations.

A positive surprise was that free cash flow was $614 million.

Elon Musk said that Tesla was now going to be self-funding going forward. While this quarter’s free cash flow is a surprise, it seems unlikely that this will be the case for the long term. Elon Musk has a history of ridiculous predictions.

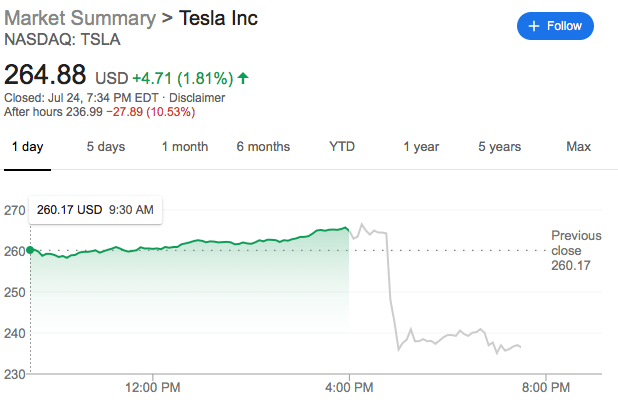

The stock market agrees. It has sent TSLA down 10 percent in after-hours trading.

We can give Elon Musk and Tesla a lot of leeway in performance because this is a revolutionary product in many ways.

Yet there are countless examples of auto manufacturers that have conquered both basic and advanced methods and technology in such a manner as to make a car usable and affordable.

Tesla does not focus on the present, it focuses on the future. That’s a problem.

Tesla’s Are Not Legos, Elon

Elon Musk is still putting Tesla cars together with electrical tape and forcing workers to put cars together under near-sweatshop conditions in order to meet modest delivery quotas.

Tesla has been around long enough that simply constructing the vehicles should not require such risible mechanics. Tesla is supposed to be a premium auto experience , not a clown car being stitched together at the last minute under third-world conditions.

Elon Musk and Tesla burned $7.1 billion in the last four calendar years alone. That doesn’t even account for this year’s cash burn.

Maybe Elon Musk should spend less time on his self-aggrandizing dog-and-pony show – where he tries to obscure the Tesla disaster by talking about flying cars and launching rockets – and spend more time focused exclusively on selling cars.

Why Tesla Will Never Become Self-Sustaining

Tesla will never become a self-sustaining enterprise with Elon Musk at the helm. It just won’t – certainly not with dirty tricks like stealth price cuts.

While gross margins have been relatively steady, SG&A expense is constantly rising. R&D expense will always be necessary in the near-term.

Interest expense alone will choke off any profit that might ever be created.

One of two things is going to happen.

The Tesla Endgame

First, Elon Musk will be replaced by an experienced auto executive. Elon Musk can stay on board, but he can no longer steer the company. This is actually less likely to occur on its own than Tesla being bought out.

A Tesla acquisition is going to happen at some point. The first thing that must happen, though, is the stock has to crater. Tesla is valued at more than 2x revenue. A buyout’s maximum price is likely to be around 1x revenue – or around $22 billion – about half of the current stock price.

That buyer will either be Google, Amazon, Apple, or a major car manufacturer. Then they will kick Elon Musk upstairs.

None of this is to say that TSLA can’t go higher. The market and Tesla are experiencing high levels of speculative buying. Institutions and funds can’t be caught not holding TSLA or they risk shareholder ire if the stock soars.

If you insist on buying or holding Tesla’s stock, make sure you have stop losses in place.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.