Tesla Will Be a Major Winner With a Progressive U.S.-China Trade Deal

Electric carmaking giant Tesla will benefit from selling its vehicles in China at cheaper prices - if tariffs are suspended.| Source: Shutterstock

Tesla, the $51 billion carmaker, could be one of the biggest beneficiaries of the U.S.-China trade deal if a comprehensive agreement is reached in the near-term.

In recent weeks, the U.S. and China have reportedly sped up the process of addressing core issues presented by both countries.

While the current deadline of the trade deal on March 1 could be delayed by 60 days, negotiators of the trade deal have become increasingly confident in the prospect of the establishment of a full accord in the months to come.

If the trade war comes to an end in the near-term as analysts and negotiators expect, Tesla could see its business in China flourish, especially following the launch of Tesla’s China gigafactory.

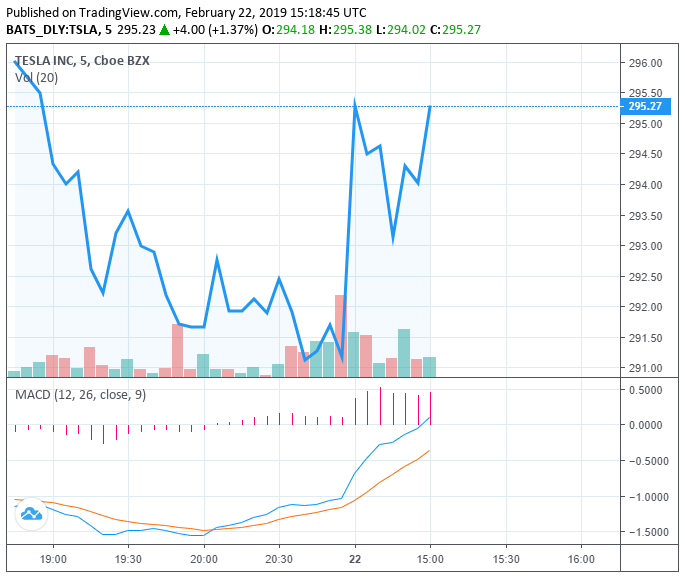

Already, the stock price of Tesla surged by 1.18 percent within less than an hour since the opening of Nasdaq, as investors build confidence in the prospect of a successful trade deal and the growing demand for Tesla in China.

Tesla Will Benefit Massively From Dissolved Tariffs

In the last week of December 2018, the government of China suspended tariffs on car imports from the U.S. until March 1, essentially as a grace period to come to an agreement with the U.S. negotiators.

Prior to the suspension of the tariffs, Tesla was forced to sell its cars $20,000 higher than the price of its models in the U.S.

While the popularity of Tesla in major Asian markets like Hong Kong and China has increased exponentially in the past several months, the tariffs led Tesla to price themselves out.

“When Tesla first opened orders for Model 3 in China in November, only the Long Range all-wheel-drive and Performance versions were available and they respectively started at 580,000 RMB (~$83,500 USD) and 690,000 RMB ($99,400 USD),” Electrek reported on December 24, 2018.

Without the tariffs in place, Tesla has been able to sell its Model S and X at $72,000, around 12 to 26 percent cheaper than its previous price.

If the U.S. and China come to a consensus on a comprehensive deal in the next two months, it will lead to the permanent elimination of tariffs on car imports, allowing Tesla China to expand and operate more aggressively.

Tesla’s China gigafactory that was launched last year was a bold and ambitious bet by the U.S. carmaker which demonstrated its intent to continue expanding in the Chinese market in the long-term.

At the time, reports indicated that Tesla allocated a significant amount of resources and capital in establishing its business in China despite the uncertainty surrounding the trade war.

The establishment of a comprehensive trade deal could massively improve the prospect of Tesla’s China gigafactory and strengthen the confidence of investors in the decision of the company to target the Chinese market.

A regulatory filing by Tesla explicitly attributed the decline in its revenues in China by 13 percent in 2018 to the tariffs imposed by China on car imports.

“Our sales of Model S and Model X in China have been negatively impacted by certain tariffs on automobiles manufactured in the U.S,” the filing read.

As the Chinese and U.S. negotiators reach the last phase of the trade talks, the probability of tariffs on car imports being restored is near to zero, which could allow the company to recover its revenues in China in the first quarter of 2019.

Sentiment Around Tesla Generally Positive

Last year, even with its struggle in China, the global revenues of the company surged 83 percent to $21.46 billion according to the report of The Wall Street Journal.

Tesla’s newest models including the model X received high-efficiency ratings in comparison to its competitors with positive reception in the U.S.

The continued strong performance of Tesla could lead to an increase in the confidence of investors in the near-term considering the pressure lifted on the company due to the progress of the trade deal.