Tesla & These Two Tech Stocks Are the Nasdaq’s Hidden Gems

This shocking video shows a Tesla Model 3 burst into flames - TWICE - after a Moscow crash. That won't help Tesla's "explosive" reputation. | Source: AP Photo / Jae C. Hong

By CCN.com: The Nasdaq-100 Index may have topped out – for now – leaving big names such as Apple Inc (AAPL) and Amazon (AMZN) vulnerable to the fury of the bears. Nevertheless, not all stocks in the index have a bleak short-term outlook. Several tech giants have already suffered vicious corrections and now offer investors surprising upside. Tesla Inc. (TSLA), Nvidia Corp. (NDVA), and Intel Corp. (INTC) belong to that category.

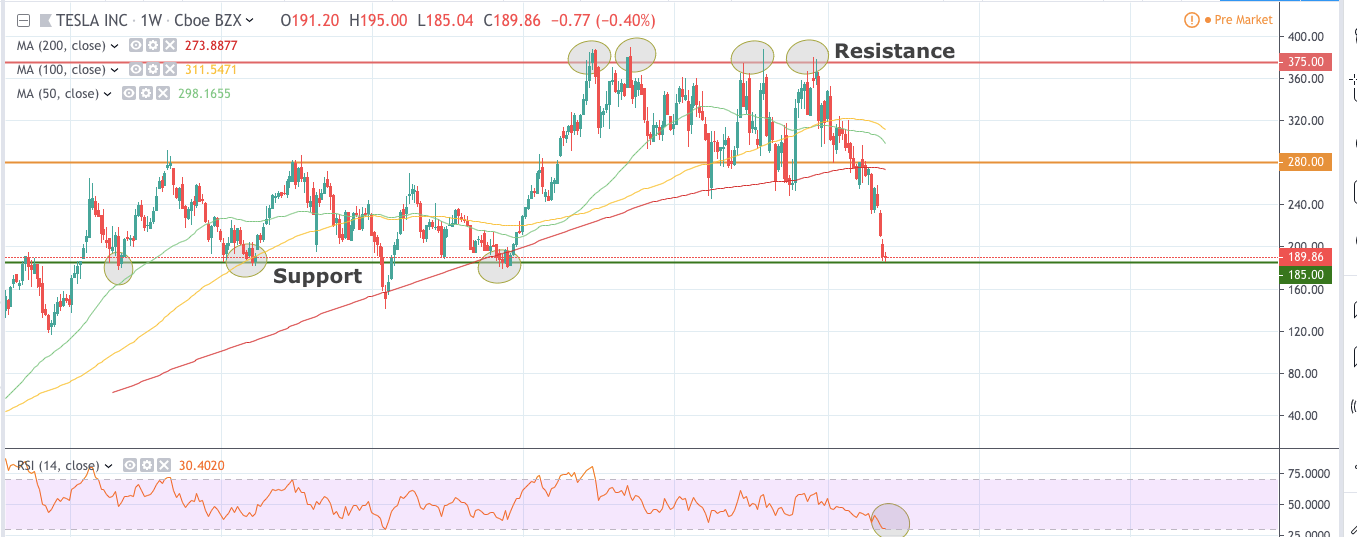

Tesla’s Huge Dump is a Setup for a Big Push

Tesla has been bearish ever since it failed to take out resistance of $375 in December 2018. The turn of the new year hasn’t been kind to the stock, but its fortune is about to change now that its Chinese subsidiary has teased a tantalizing announcement.

A quick look at the daily chart shows that TSLA is trading very close to support at $185. This is a demand area that has existed since April 2014. Bulls have always protected this territory. So far, they are holding their ground once again.

The stock touched this support on May 29, and the bulls made their presence felt. In addition, both the weekly and daily RSIs are in oversold territory. Under these conditions, we can expect supply to dry up as sellers lose interest in dumping shares at these levels. Add the fact that $185 is a proven high demand area, and we have an excellent recipe for a bounce.

If you’re interested in Tesla, buy as close to $185 as possible with profit targets at $280 and $375.

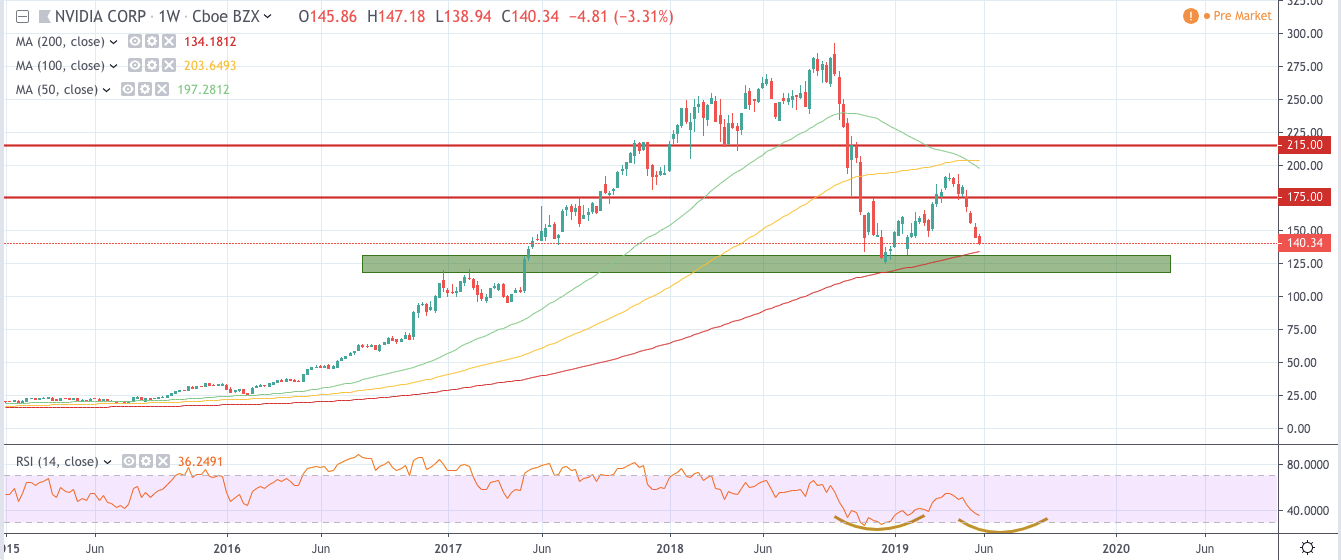

Nvidia Endured a Brutal Pummelling – Now It’s Ready to Bounce

Nvidia (NVDA) has been languishing in bear territory since October 2018. From a long-term perspective, the stock is in a downtrend, but that doesn’t mean we can’t play the bounce.

NVDA appears to be painting two double-bottom patterns. One is on the weekly chart as the stock plunges to support at $125. The other is the weekly RSI as the technical indicator bottoms out at oversold territory.

At the very least, we expect the stock to have a dead-cat bounce to a price of $175 before resuming its downtrend. Above $175, the next target is $215.

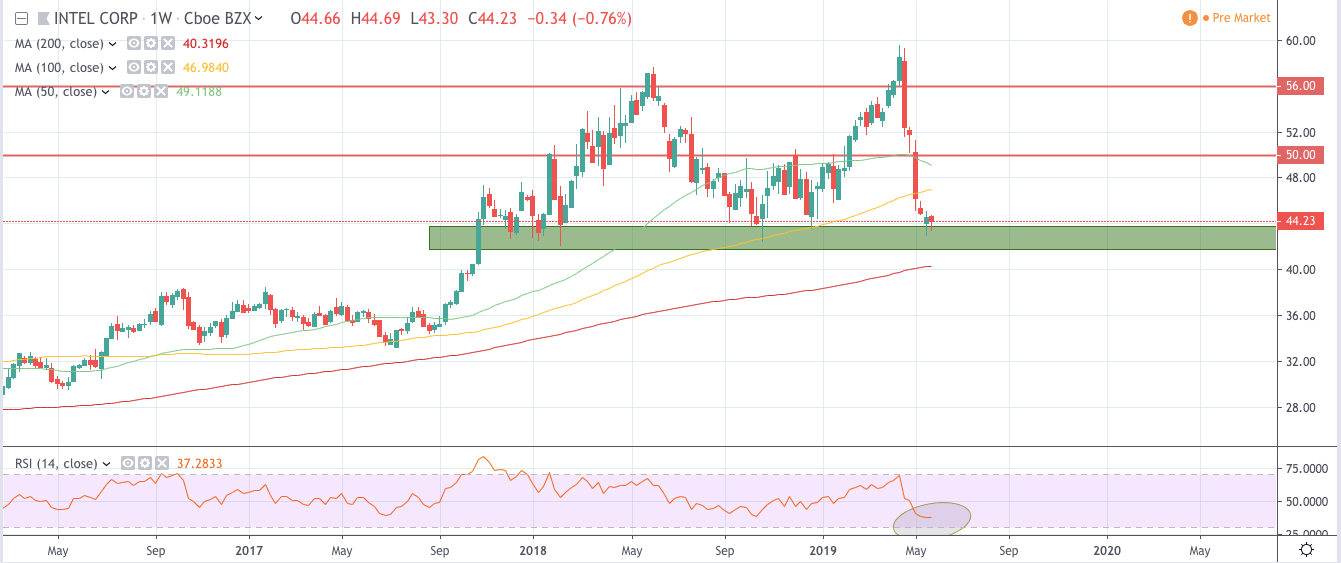

Intel’s Sharp Decline Can Spark a Sharp Rebound

Intel (INTC) posted five red candles in the last six weeks. These red candles drove the stock from $59.29 in April 2019 down to $43.30 this month. That’s a plunge of almost 27 percent in just 30 days.

Investors may be shocked with this sharp decline. Bottom-pickers, however, should rejoice because there’s an opportunity to make a quick buck, especially after the company made massive announcements at COMPUTEX 2019 .

An analysis of the weekly chart shows that the bulls are protecting the demand area, as indicated by the green rectangle. They’ve done so in the past, and they are doing it again. In addition, the stock is oversold on the daily chart while it is close to oversold on the weekly. We have a confluence of events here telling us that an INTC bounce is very likely.

If you want to play the bounce, buy as close to $42 as possible. Targets are $50 and $56.

Bottom line

The Nasdaq-100 may have a stormy outlook, but three tech stocks are already showing signs of bearish exhaustion. These equities are not exactly bullish, but they have the potential to reward you with substantial gains via strong dead-cat bounces. Watch out for Tesla, Nvidia, and Intel in the next few weeks. We are confident that they are likely to pull off remarkable rallies in the very near future.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.