Tesla Stock Plummets to Just $10, Says Morgan Stanley in ‘Worst Case Scenario’

FILE PHOTO: Tesla Motors CEO Elon Musk speaks during the National Governors Association Summer Meeting in Providence, Rhode Island, U.S., July 15, 2017. REUTERS/Brian Snyder/File Photo

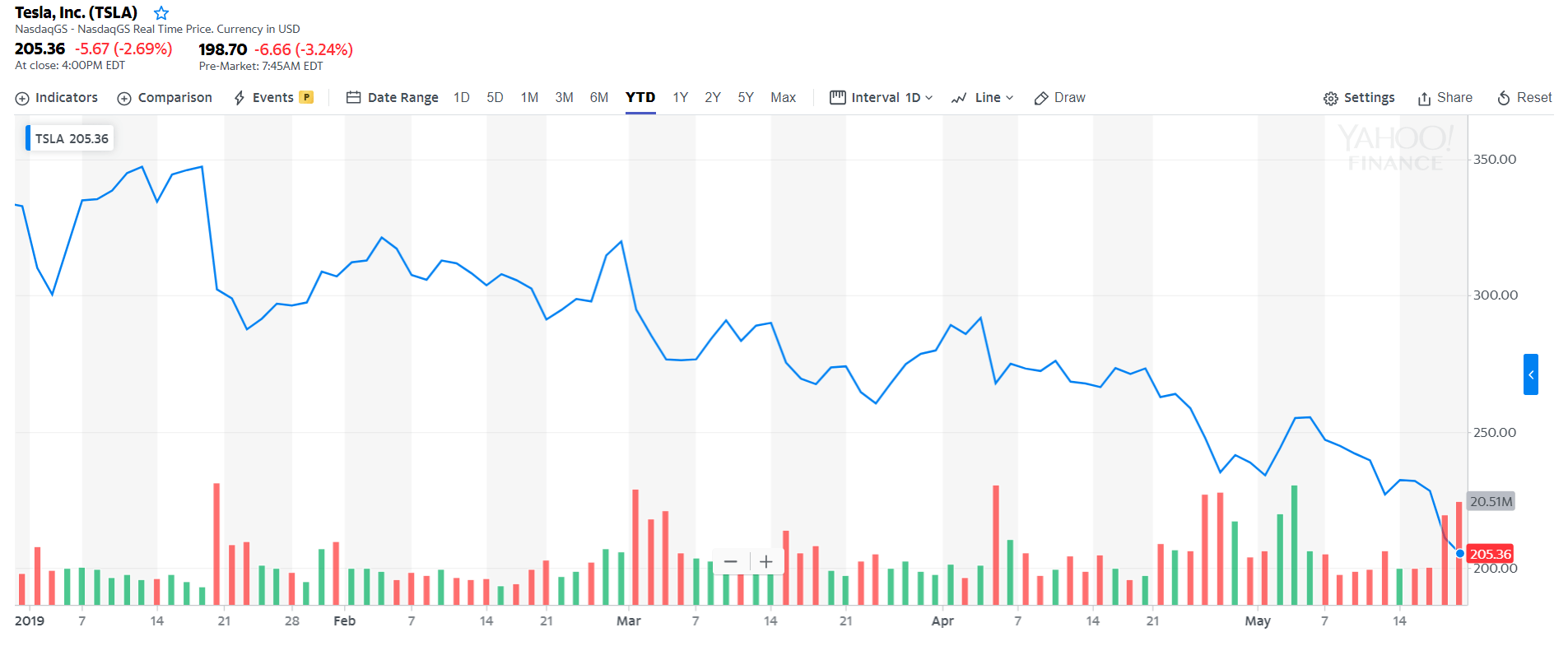

By CCN.com: Tesla stock is all set to drop below $200, but Morgan Stanley believes that shares of the electric vehicle company could be worth just $10 in the worst case scenario. Yes, that’s what Morgan Stanley analyst Adam Jonas believes in light of the many problems Tesla has been facing of late.

Morgan Stanley’s drops another bomb on Tesla stock

Tesla stock has lost nearly 40% of its value in 2019. But with Wall Street now looking past the smokescreen created by CEO Elon Musk, don’t be surprised to see the stock heading lower.

Jonas’ previous bear case price target for Tesla stock stood at $97. He has now sharply reduced his worst-case price scenario to only $10 thanks to a rapid drop in demand for Tesla cars. He said in a research note :

We have long held that Tesla’s share price performance is driven by: demand for its products, ability to generate cash flow, and access to capital markets. This year’s sharp deceleration in demand has led to a substantial curtailment of the company’s ability to self-fund through free cash flow generation, at the margin potentially impacting the firm’s access to capital.

This is the second time that Jonas has raised concerns regarding the demand for Tesla cars. Earlier this month, the Morgan Stanley analyst had pointed out that Elon Musk will find it difficult to sell new cars thanks to the growing population of old Tesla cars.

Tesla is expected to deliver one new car for every 2.5 cars that are already on the road. Given that the federal tax credits for EVs are being phased out and Tesla has raised the price of some of its vehicles, buyers may be encouraged to buy older models.

So there’s a possibility that demand for Tesla cars in the U.S. could saturate. On the other hand, Jonas believes that the company might not witness any meaningful gains in China until next year as the company faces a host of challenges in that market as well, including stiff competition from local players and the fallout of the ongoing US-China trade war.

Elon Musk’s ability to raise money will be handicapped

Morgan Stanley’s note points out that Tesla cannot fund itself, so it has to access the capital markets to raised funds. This is exactly what Elon Musk did when he recently raised $2.4 billion in capital through a stock offering. Elon Musk parroted that the money will give Tesla’s autonomous driving dreams a boost, supercharge its growth, and propel the stock to almost $3,000.

The reality, however, turned out to be way different. Musk has sent an email to employees stating that they need to enforce strict austerity measures as Tesla might run out of money in the next 10 months.

Musk pointed out that Tesla is burning through more than $200 million a month, so the money it raised will run out within a year. But if demand for Tesla cars doesn’t pick up the pace and its stock continues to tumble, not many will be willing to give the company any more money. Jonas adds in his research note:

Tesla’s recent $2.7bn equity and convertible debt raise may provide an extra year of liquidity to run a business of this size and cash consumption. However, Tesla may now find itself in a cycle where a lower share price may itself contribute to a potential deterioration of employee morale as well as potentially increased counterparty risk with both customers and business partners (suppliers, governments)… potentially further impacting fundamentals.

So investors shouldn’t take Morgan Stanley’s prediction of Tesla stock falling to just $10 lightly as the company is on a sticky ground right now. And, it might not be able to accelerate toward safety as demand for its cars is losing traction.