Why This Tesla Doppelganger Surged 50%, Defying Falling Markets

Tiziana Life Sciences trades under the symbol TLSA, which bears a striking resemblance to Tesla's ticker symbol. | Source: Shutterstock

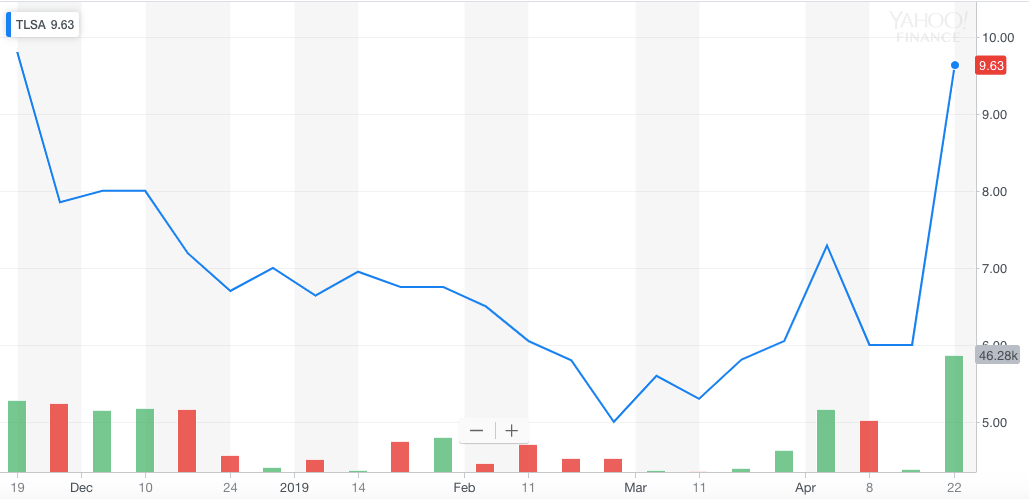

By CCN.com: Relatively unknown stock Tiziana Life Sciences (TLSA), not to be confused with Tesla (TSLA,) rocketed more than 50% today to blow the rest of the stock market out of the water. Starting the day at slightly more than $6.50 a share, the biotech company climbed to a high of almost $10.00 before pulling back into the $9.50 range.

A Case of Mistaken Tesla Identity?

As we alluded to, TLSA bears a sticking resemblance to TSLA, the ticker for automaker Tesla. Last week, ZOOM Technologies, ticker ZOOM, jumped more than 50,000% as investors mistakingly bought it during the frenzy of Zoom Video Communications’ IPO, ticker ZM. With a Tesla earnings call this past Wednesday, it looks like a similar scenario could be playing out for Tiziana.

Not So Fast

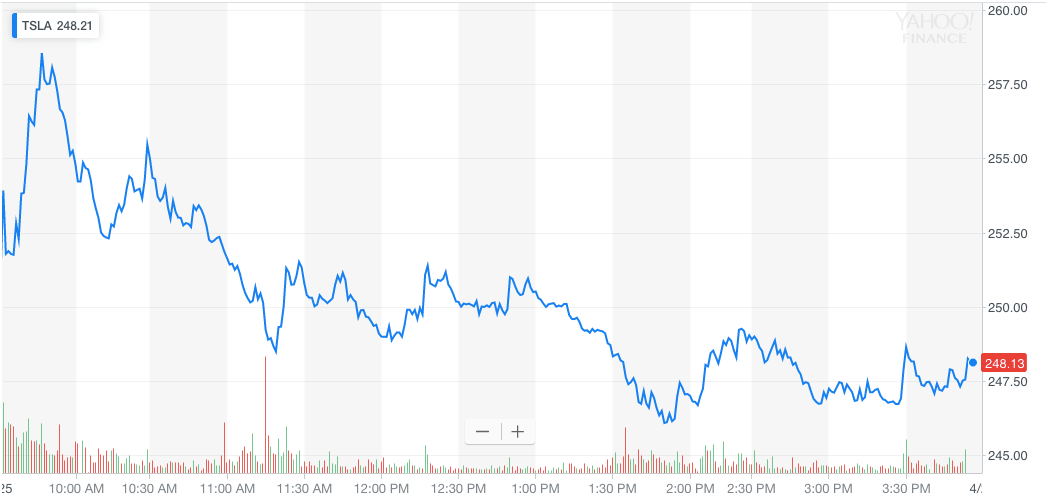

Although Elon Musk held a Q1 earnings call for Tesla yesterday, the results were unimpressive, to put it lightly. Tesla reported a $2.90 loss per share, significantly worse than the $0.69 loss per share that analysts estimated. The Tesla stock responded accordingly, falling 2% after the call and a whopping 4% today.

So it’s unlikely that mistaken investors were racing to gobble up Tiziana stock thinking it to be Tesla.

Successful Trials = Monster-Sized Gains

Instead, encouraging news from a Tiziana medical trial seems to have been the catalyst for the steep price rise. The biotech company has been running a trial on patients with advanced liver cancer for over a year, testing their milciclib solution.

Today, they released the results from an Independent Data Monitoring Committee (IDMC) safety review, and the findings are glowing. Out of the 10 patients who’ve completed the trial so far, eight have shown interest in continuing with the treatment.

Additionally, the trial has had no drug-related deaths, and patients report that the treatment is tolerable.

In regards to the trial milestone, Tiziana CEO Dr. Kunwar Shailubhai stated:

“Demonstration of safety and clinical activity is an important milestone to move forward with strategic options for further clinical development of Milciclib.”

Hold Your Horses

The 36% daily rise is impressive, but it comes on top of a microcap stock with incredibly low trading volume. Volume ballooned 35x upon news of the trial but is likely to drop back down to its previous triple-digit numbers.

The recent spike brings the TLSA stock close to a new all-time high and turns around what was previously a poor performance. In March, the stock price was down almost 50% from its IPO. As with most microcap biotech companies, Tiziana lives and dies by its trials. Another successful round could be just as lucrative while a failed trial may send the stock into a nosedive. Tesla isn’t a biotech stock, but it too is subject to the whims associated with reaching milestones.