Eureka! Tesla Targets $2 Billion in Capital Raise, TSLA Shares Fly

Tesla is looking to double its war chest with a $2 billion capital raise. Elon Musk is buying 42,000 TSLA shares. | Source: Reuters/Kyle Grillot

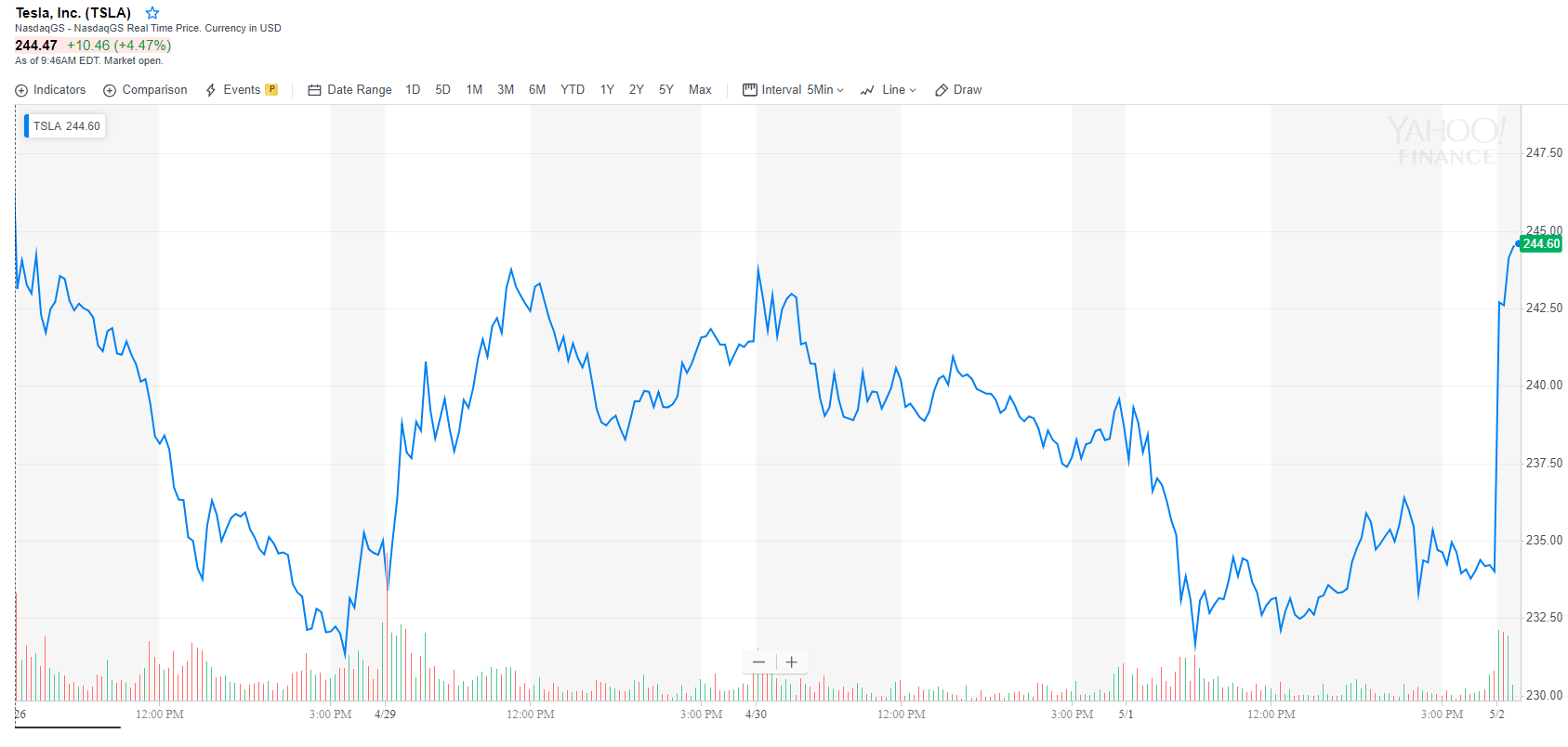

By CCN.com: Maybe Tesla could be a $4,000 stock after all. Elon Musk has unlocked the formula for gains in the Tesla (TSLA) share price. Tesla’s stock soared as much as 5% after the company unveiled details about a much-needed capital raise in which Musk kept his cards close to the vest during the company’s recent earnings call. The electric vehicle company is looking to raise $2.3 billion from a series of stock offerings that includes Elon Musk purchasing $10 million in common stock, or roughly 42,000 TSLA shares. He already owns more than $12 billion worth of Tesla shares, CNBC reports . The offerings include:

- “$650 million of common stock”

- “$1,350 million aggregate principal amount of convertible senior notes due in 2024”

Tesla has been up against rough headwinds in 2019 and now it finally has the wind at its back, or at least so it seems. The stock has taken off from recent lows and has joined the 2019 stock market bull run that it has been sidelined from until now, as evidenced by a 30% drop in TSLA shares year-to-date prior to today.

Tesla’s stock advanced 5% at the market open against a backdrop of uncertainty in the broader stock market amid Fed Chairman Jerome Powell’s recent “transitory inflation” remark.

Elon Musk on the company’s most recent earnings call addressed a share buyback, saying:

“I don’t think raising capital should be a substitute for making the company operate more effectively. At this point, I do think there’s some merit to raising capital. But this is sort of probably not the right timing.”

What a difference a couple of weeks can make, as that earnings call was on April 24. Gene Munster of Loup Ventures tells CNBC that “six months ago we would not have expected this.” So what’s changed? The catalysts for the capital raise are two-pronged.

- Model 3 demand has weakened

- Autonomous vehicles are in the spotlight with Lyft and Uber, and Tesla capitalized on that momentum with its “Autonomy Day”

What Demand Problem?

Tesla bulls are convinced that this influx of capital into the company will continue to fuel gains in the TSLA stock as the company pursues growth such as the Shanghai Gigafactory 3 planned for September. And while Elon Musk doesn’t look to the capital raise to replace efficiency in the business, the fact that he’s tapping the capital markets for cash could stoke some fears about waning demand.

“The debate’s going to continue to rage on, no doubt…But I think this does effectively derisk the business,” said Munster.

The Tesla bull points to the company’s war chest of $2.2 billion in cash that coupled with the roughly $2 billion from the capital raise – if it’s a success – “doubles” their working capital. Making “robot taxis” is a capital intensive endeavor, and Elon Musk has just given the company some cash cushion. The Tesla bulls are loving it, so at the very least Musk has bought the stock some time.