Tariffs Aren’t Saving Boeing (BA) from Airbus Onslaught

Trump's EU tariffs aren't helping Boeing stave off the Airbus attack. | Image: AP Photo/Richard Drew, File

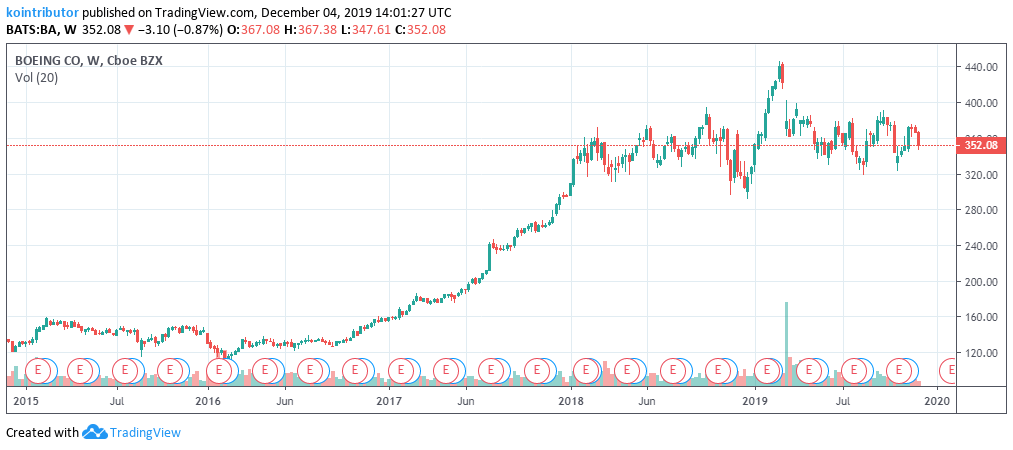

- The Dow index has gone up by nearly 18% in 2019 while Boeing has appreciated less than 10%.

- Airbus’ order book in 2019 is several times bigger than Boeing’s.

- The EU jet manufacturer has also broken Boeing’s five-decade record in sales.

Boeing (NYSE:BA) isn’t benefiting from the 10% tax slapped on Airbus civilian aircraft two months ago by the Trump administration.

The aircraft manufacturer, whose stock is now the tenth worst performer in the Dow Jones Industrial Average, is trailing its European rival significantly in the order book. So far this year, Airbus has received orders that are nearly four times those of Boeing’s.

The U.S. aircraft manufacturer’s woes can be placed squarely on its now-grounded 737 MAX jet. After a series of accidents involving the narrow-body aircraft, orders have fallen dramatically across the best-selling 737 series. Ironically, the punitive tariffs imposed on European imports including aircraft by the Trump administration have not dissuaded even U.S. carriers from turning to Airbus.

Order book shrinks as rival’s soars

According to The Wall Street Journal, Boeing’s order book stood at 170 by late October. This paled in comparison to the number of jet orders that Airbus had received this year, which is nearly four times that of Boeing at 603 planes.

And just last month the Airbus’ A320 family of jets surpassed Boeing’s 737 series for the first time in 55 years. This was based on the number of orders received for the two sets by the end of October. The A320 series recorded 15,193 orders against 737’s 15,136 orders.

At the Dubai Airshow mid-November, Airbus inked deals worth $30 billion while Boeing only managed deals worth $1.2 billion.

The bad news surrounding Boeing hasn’t subsided. The fourth-largest U.S. carrier by passenger numbers , United Airlines, has just elected to replace 53 of its Boeing 752-200 jets with 50 Airbus A321XLR planes. If Boeing investors were expecting a Santa Claus relief rally, they are unfortunately still on the Naughty List!

Boeing trails the Dow

In a year where the Dow has climbed by nearly 18% since January, Boeing’s performance has grossly under-performed. Since the beginning of 2019, the stock has only climbed by around 9%. Just like with the order book, the stock’s poor performance is largely a result of the two air accidents involving the 737 MAX that have been blamed on lax safety standards.

The first MAX crash occurred last year in Indonesia sending the stock falling by over 20% from a then record-high of nearly $400. In the ensuing months, Boeing recovered to hit an all-time high of $446 in early March.

The second MAX crash in Ethiopia saw the stock plunge and hit a 2019 low in August.

Given the tough regulatory regime Boeing is likely to come under, investors will be content with the single-digit yearly returns.