Experts Reveal the Devastating Truth About This Stock Market Rally

The Fed's dovish pivot catalyzed a major stock market recovery, but this Dow/S&P 500 rally hides a devastating truth that could punish investors. | Source: REUTERS/Brendan McDermid

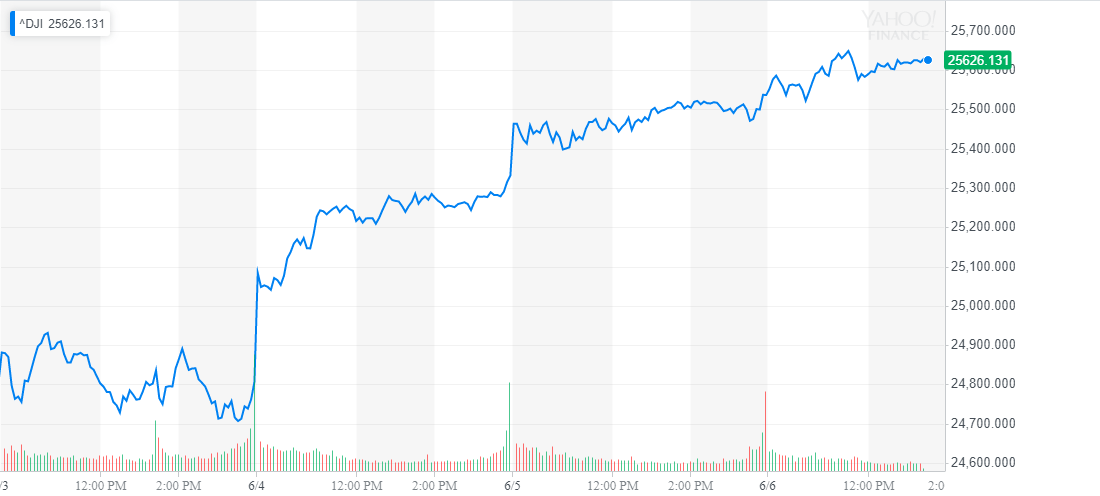

By CCN.com: In the past four days, the Dow Jones has climbed from 24,721 points to 25,677 as a dovish Federal Reserve launched the U.S. stock market into a strong short-term recovery.

Futures market traders believe there is a 75 percent chance of an interest rate cut by the end of July, subsequent to the scheduled June policy meeting.

However, UBS and JPMorgan warn that the U.S. stock market has overreacted to the possibility of a rate cut, and the consequences of that overreaction could be devastating.

UBS: Stock Market Reaction Extremely Excessive

In a note sent to clients, UBS economists revealed that investors are foreseeing a cut of around 70 basis points by the Fed based on the recovery of the stock market in the past several days.

However, the economists warned that it would take a full-blown recession for the Fed to move the benchmark interest rate to the level investors are currently anticipating.

The note read :

“Markets now imply that the Fed will cut rates by around 70 basis points this year and 35 bps next year. We find this excessive. We believe it would take a recession to provoke the magnitude of rate cuts currently being priced by the market, and this remains unlikely in our view.”

If the Fed engages in a rate cut by July as expected by investors, JPMorgan global market strategist Vincent Juvyns stated that the ECB is likely to follow, further relieving pressure on the global economy.

“There is a question in markets as to whether central banks still have the ammunition,” Juvyns said, adding “if the Fed sees the necessity [to signal possible rate cuts], it would have been very strange for the ECB to act differently.”

With Australia already having dropped its interest rate for the first time in three years, a rate cut by the U.S. and by the eurozone in the second half of 2019 could improve the sentiment around the U.S. stock market.

But not as much as investors seem to expect.

JPMorgan COO John Waldron said :

“I worry a little bit that the market is too optimistic about how much and how soon the Fed will move.”

Expect Volatility in the Dow and S&P 500 Moving Forward

If the Fed does execute a July rate cut, the stock market rally could grow even more feverish. However, with multiple rate cuts already priced in, what happens when investors sober up?

In short: expect significant volatility in the Dow and S&P 500.