Spiralling Bitcoin Pullback Snowballs to Brutal $58 Billion Crypto Market Dump

Bitcoin leads the steep retreat as the crypto market begins a corrective phase. | Source: Shutterstock

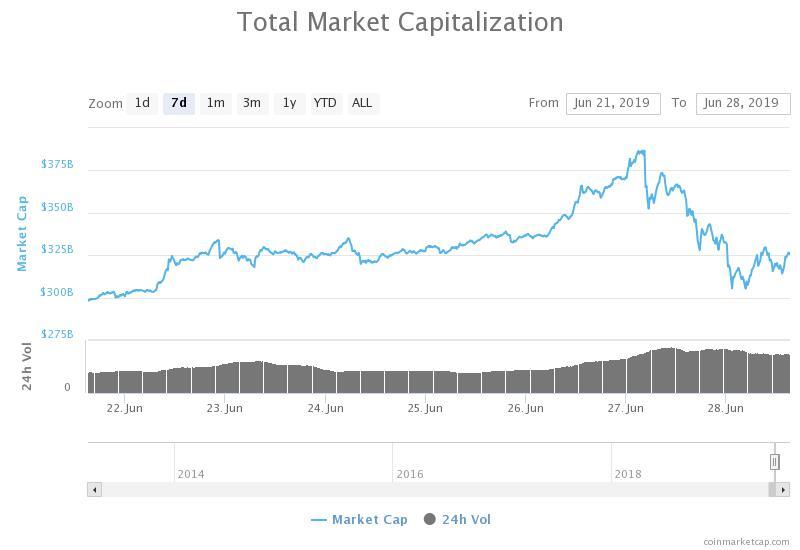

In the past 24 hours, the valuation of the crypto market has dropped from $386 billion to $328 billion as the bitcoin price declined from $13,800 to $10,500.

The bitcoin price dropped by 23.9 percent overnight as it neared the $14,000 mark which traders have acknowledged as a heavy resistance level for the dominant crypto asset.

The abrupt decline in the price of bitcoin is widely considered to be technical and as explained by Blockhead Capital general partner Matt Kaye, bitcoin tends to go through major pullbacks in a bull market.

In the last bull market, bitcoin saw eight major pullbacks

As it is with any other asset, even in a strong upside movement, the bitcoin price tends to demonstrate wild volatility in short time frames.

In 2017, when the bitcoin price reached a record high at $20,000, the asset experienced eight major pullbacks with an average retracement of 36 percent against the U.S. dollar.

“The previous bull cycle had 8 major pullbacks. On average, each pull back: Retraced 36%; Lasted 16.3 days; Reached a new cycle high 55.2 days after bottoming,” said Kaye.

Since retracing to $10,500, within a span of hours, the asset has swiftly recovered to $11,500, nearly recording a 10 percent increase in price.

Luke Martin, a cryptocurrency trader and technical analyst, said

Above 11.4k and the recent BTC action starts to look like what happened at the beginning of June around 8400. Previous resistance -> breakout -> breakdown -> reclaim & trend higher. Would like to see the reclaim before I’m convinced. Recent local top is also a little different.

Bitcoin has still not experienced a pullback larger than 30 percent since surpassing $10,000 for the first time in early June.

Hence, if the asset begins to stabilize at $11,400 and continues to show signs of sustained momentum, traders anticipate that in the near term, the asset would test the $13,800 to $13,900 range and aim for record highs.

“About to battle magnificents foes, the monthly and quarterly resistances at $13,800-$13,900. Fight might be bloody and tiresome, but once we claim victory, lads, by all means, all bets are off,” Adaptive Fund Head of Research David Puell said.

As soon as bitcoin came close to the $13,800 to $13,900 range mentioned by Puell, it immediately saw a 23.9 percent pullback.

Considering that the price of bitcoin has increased by nearly 30 percent in the past month including the 23.9 percent pullback, many analysts see the minor retracement as a healthy short term movement for the asset.

Fundamentals remain in tact

Earlier this week, global markets analyst Alex Krüger attributed the upside movement of bitcoin to the spike in large buyers in the market and fundamental factors in the likes of the emergence of regulated trading venues and the upcoming block reward halving of bitcoin.

“No specific trigger BTC last night. Just very large buyers. There has been a myriad of extremely bullish factors in place as of late, which include: – New trading venues => parties front-running Fidelity/Bakkt/Ameritrade/E-Trade/LedgerX flows – Libra – Various macro narratives,” Krüger said on June 26.

The macro landscape of bitcoin remains positive and the sentiment around the crypto market has improved in recent weeks amidst intensifying geopolitical risks, two factors that may contribute to the asset reclaiming its yearly high.

Click here for a real-time bitcoin price chart.