S&P 500 Stock Market Bear Mark Yusko Forecasts Massive 2019 Downturn

Morgan Creek Capital CEO Mark Yusko says there's a protracted fundamental downtrend for the stock market ahead. | Image: Pixabay

By CCN.com: Morgan Creek Capital CEO Mark Yusko doesn’t think we’re headed for a bear market. He says we’ve been in a bear market since last September. Furthermore, Yusko forecasts the stock market will be down double digits for 2019 by year’s end.

That’s what Yusko told CNBC’s audience on Fast Money Halftime Report in an interview Friday. The other panelists scoffed at his analysis, but his interpretation of the market’s movements are as consistent with benchmark price movements as theirs:

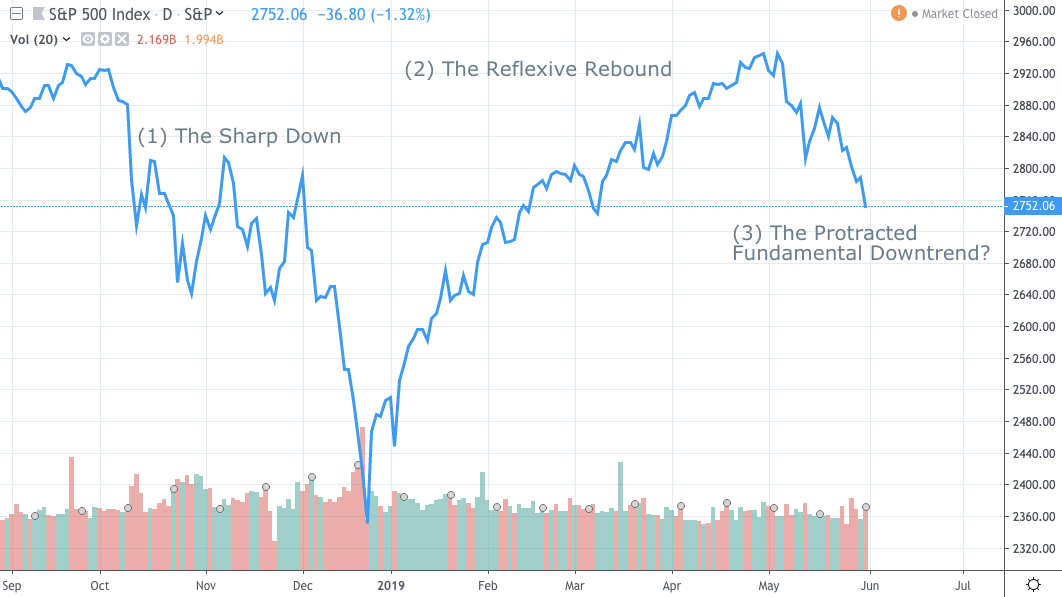

We made the case that the bear market started last September. And Bob Farrell, the famous Merrill strategist said there are three phases:

1) There’s the sharp down. We had that in the fourth quarter. 2) There’s the reflexive rebound. That occurred in the first quarter. 3) And then there’s the protracted fundamental downtrend, and I think that’s what we’re beginning. -Morgan Creek Capital CEO Mark Yusko

Is The S&P 500 In A Bear Market?

The Morgan CEO doesn’t expect to see a recession as bad as the one in 2008, but believes there’s a similar credit crunch ahead. In 2018 he correctly predicted the stock market downturn at the end of the year. If his next prediction comes true, the U.S. may be headed for another light recession like the one at the turn of the century.

Although the other panelists scoffed at his analysis, Mark Yusko is not alone in his outlook on the stock market. Even though S&P 500 is sitting at a record, CNBC’s Keris Lahiff reports nearly a quarter of its components are still at least 20% away from 52-week highs.

Technical Analysis Shows Bears Resisting 2,800

This lends credence to Mark Yusko’s hypothesis that a temporary market rebound — not a fundamental economic recovery — is what’s driving 2019’s stock market bounce back.

Lu Wang warned Friday for Yahoo Finance that analysts see the worsening tariff war sending the S&P 500 into a 10% tumble. At Seeking Alpha Philip Davis says “we’re only a month or two away from a ‘Death Cross.'”

Guggenheim Partners’ legendary co-founder Scott Minerd says rapidly diminishing bond yields show a market on the verge of recession because of the escalating trade war.

He predicts the S&P 500 will drop 16% by summer’s end, doing worse than they performed in the fourth quarter of 2018.

What’s Mark Yusko doing about it? He’s hodling bitcoin of course.