Simply ‘Logical’ for Every Big Macro Fund to Hold 1% in Bitcoin: US Billionaire Investor

Billionaire bitcoin bull Mike Novogratz claimed every major macro fund should be investe in bitcoin, even if they're skeptics. | Source: REUTERS/Andrew KellyREUTERS/Andrew Kelly

In the last 48 hours, the Bitcoin price recovered beyond the crucial $3,500 support level and avoided a further drop below $3,000.

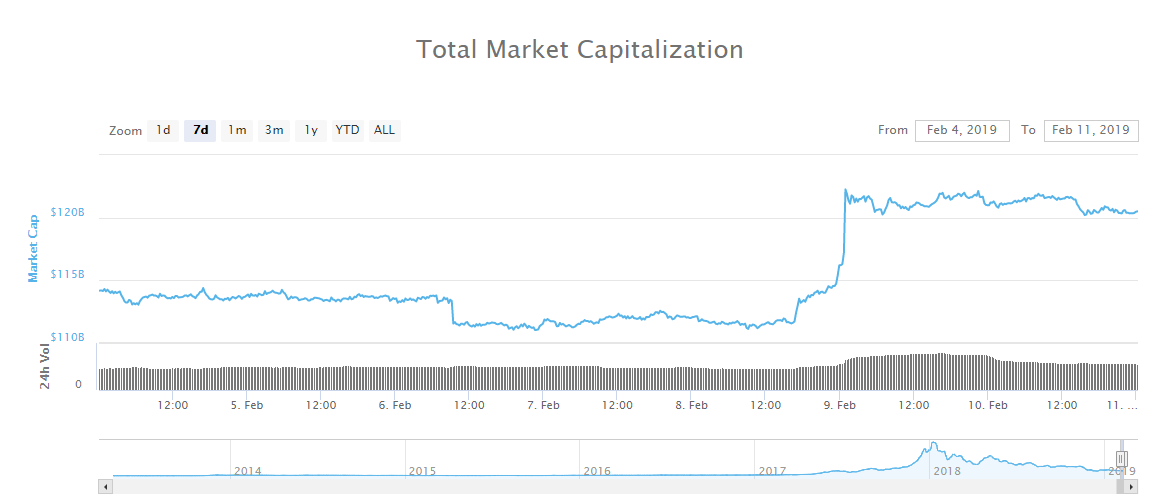

The valuation of the cryptocurrency market increased from $110 billion to $120 billion, by just over $10 billion.

Following the strong corrective rally of Bitcoin, billionaire investor Mike Novogratz stated that every major macro fund should hold at least 1 percent of their portfolios in Bitcoin.

How’s the Long-Term Prospect of Bitcoin?

Generally, analysts expect Bitcoin and the rest of the cryptocurrency market to begin recovering in the latter half of 2019.

Throughout the past 10 years, BTC has tended to rebound a year prior to its block reward halving.

Every two years or so, the Bitcoin network goes through a halvening which decreases the amount of BTC miners can generate.

As the amount of BTC that can be generated decreases, the potential circulating supply of BTC declines.

If the demand for BTC goes up or remains the same and the supply of the asset decreases, it causes the price of BTC to go up.

The Bitcoin halvening is estimated to occur in May 2020 and as such, analysts foresee the dominant cryptocurrency recovering by May of this year.

Technical indicators as shown by digital asset researcher Willy Woo also demonstrate a high probability of Bitcoin initiating a proper rally beginning by the end of the second quarter of 2019.

Given these factors, Mike Novogratz has always emphasized his belief and his long-term investment strategy in the cryptocurrency market.

Previously, he firmly stated that a wave of institutional investors will come into the market and once they do, cryptocurrencies as an asset class are likely to experience an unprecedented rally

Novogratz said :

It won’t go there ($20 trillion) right away. What is going to happen is, one of these intrepid pension funds, somebody who is a market leader, is going to say, you know what? We’ve got custody, Goldman Sachs is involved, Bloomberg has an index I can track my performance against, and they’re going to buy. And all of the sudden, the second guy buys.

The same FOMO that you saw in retail [will be demonstrated by institutional investors].

While Novogratz does not focus on short-term catalysts, there are both short-term and long-term catalysts on the horizon that could contribute to the recovery of BTC.

In the short-term, many analysts consider the launch of Bakkt, Fidelity custody, and halvening to be some of the main factors that could fuel the rally of the asset.

In the long-term, the decline in the circulating supply of Bitcoin and an increase in adoption by both retail and institutional investors are acknowledged as potential driving factors of the asset class.

Hence, Novogratz noted that macro firms should hold a small percentage in Bitcoin if they believe that it will survive and cryptocurrencies as an asset class will eventually be established as a recognized asset class.

Can the Market Sustain Recent Momentum?

The price movement of major crypto assets has slowed down slightly following a promising corrective rally on February 9.

Cryptocurrencies like EOS and Litecoin demonstrated gains in the range of 15 to 30 percent in the past three days against the U.S. dollar.

On the day, Litecoin recorded yet another 5 percent increase in value and Binance Coin, which has consistently outperformed both Bitcoin and U.S. dollar in the past month, rose by over 6 percent.

Considering various technical indicators and the recovery of the daily volume of most digital assets, some analysts expect the cryptocurrency market to sustain its momentum in the foreseeable future.

During a bear market, digital assets or blockchain projects with a high level of developer activity tend to perform better than the majority of cryptocurrencies in the global market, which may have been the key to the short-term success of Litecoin.