Shell Stock Is Reeling From Dividend Cut & Looming Oil Disaster

Is Shell's drastic dividend cut is just a taste of things to come? | Source: Tonktiti / Shutterstock.com

- Shell stock took a 13% spill Thursday after slashing its dividend.

- Oil stocks face a monumental “crisis of uncertainty” in this recession.

- But an even bigger existential threat to oil is looming ahead.

The oil price collapse just obliterated Shell’s dividend.

It’s alarming news for oil stock investors because even the 2018 and 2014 oil price crashes didn’t wipe out 66% of Shell Oil Company’s dividend.

Indeed, this is the first time Shell has cut its dividend since 1945 :

The energy giant told its shareholders, including thousands of retail investors and pension funds, that it would be in their best interests for payouts to fall for the first time in almost 80 years. The payout is being cut by 66%, from $15bn last year to $5bn this year.

Shell is the U.S.-based subsidiary of Royal Dutch Shell, which until now, had the highest dividend-paying stock on the London FTSE-100.

Shell CEO Ben van Buerden warned the oil company faces a “crisis of uncertainty.”

In response, Shell stock (NYSE:RDS.A) crashed 13% in Thursday trading. British Petroleum (NYSE:BP) took a 6% spill, but Exxon Mobil (NYSE:XOM) managed to escape the worst of the fallout, with a 2.5% decline.

Exxon reports first-quarter earnings Friday. The Irving, Texas-based oil conglomerate is expected to post earnings of 4 cents per share on $53.5 billion in revenue . That would be a 15.8% decline over last year’s first-quarter revenues of $63.6 billion.

Monumental Oil Industry Uncertainty

Back in 2008, oil prices crashed in the wake of the Great Recession. The first global economic contraction in GDP since the Great Depression halted demand for oil.

In 2014, a combination of factors crashed the price of a barrel again .

The Federal Reserve began to unwind years of quantitative easing and strengthened the purchasing power of the dollar. Oil is generally priced in U.S. dollars, so a stronger dollar pushed down prices. Meanwhile, demand in China lagged, while increased oil production in the U.S., Canada, and Saudi Arabia created a supply glut, further crashing prices.

Oil stocks correlate tightly with the oil price, which makes the last month’s rally in energy somewhat baffling. When the barrel crashed in 2008, Shell stock followed along with it. It didn’t rally until prices picked up at the beginning of 2009.

But Shell stock never fully recovered and took five years until July 2014 to get near the previous peak. That was just in time for the 2014 price collapse. Shares of Royal Dutch have never fully recovered from the 2014 crash.

Now a global economic contraction unlike any in history has cratered demand, while a price war between Russia and Saudi Arabia made the situation for oil even more dire.

Fossil Fuels Will Be On Sale Forever

Oil prices and equities will remain dampened as long as the intense global economic contraction lasts. So the medium-term outlook for oil stock investments is not great.

To make matters worse, the energy sector went into the crisis catastrophically over-leveraged with debt. The rise in debt-to-equity ratios for U.S. oil companies over the past decade is almost too extreme to believe. Smaller to mid-size companies in this sector face bankruptcy without massive government assistance during this crisis.

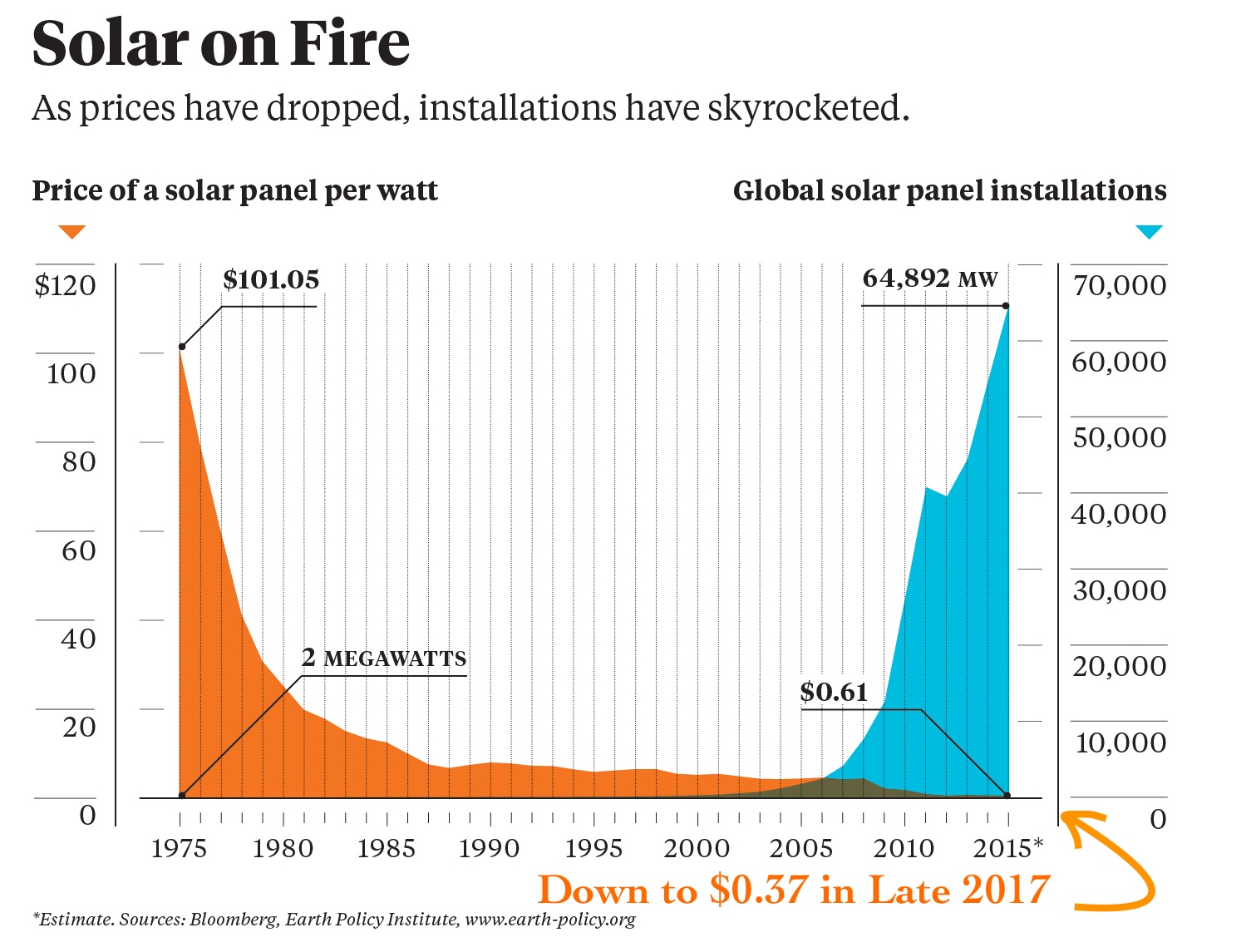

But long term valuations face an even more existential threat from the rise of alternative, clean, renewable energy sources like solar energy. Solar prices have collapsed parabolically since the 70s, sounding the death knell for fossil fuels.

As of this year, solar is now cheaper than coal , which has traditionally been the cheapest available form of energy. Meanwhile, the likes of Elon Musk are creating an all-electric, battery-powered motor infrastructure to replace fossil-fuel-burning engines.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com. The above should not be considered investment advice from CCN.com. The author holds no investment position in oil securities, nor the stocks mentioned.