Shell-Shocked Pinterest Slashes IPO Target After Lyft Disaster

Pinterest prices its IPO at $19 per share. | Source: REUTERS / Brendan McDermid

Someone at Lyft owes Pinterest an apology. The online pinboard company has no doubt been waiting for its public debut since the startup was first conceptualized in 2009. Now that the day of the Pinterest IPO has nearly arrived, the company can thank ride-sharing play Lyft for spoiling the party.

Underwriters and the management team were left scrambling to slash the tech unicorn’s valuation at the worst possible time — heading into the Pinterest IPO. The online vision board company has no one to blame but Lyft, whose overpriced listing was met with tepid enthusiasm among investors, setting the stage for its vulnerable peers to meet a similar fate.

Pinterest Now Valued Below the Psychologically Important $12 Billion

In Pinterest’s 2017 pre-IPO, the private company was valued at as much as $12 billion by venture capitalists and other private investors, having fetched a price of $21.54 per share. After all, the company, whose sales are fueled by ads, boasts 250 million monthly active users. And they generated more than $250 million in revenue last year. While still operating at a loss, Pinterest trimmed its annual shortfall by more than half to just $63 million. Still, it’s not enough to justify a $12 billion valuation headed into the Pinterest IPO.

Pinterest is taking quite a haircut by retooling to price shares in a range of $15-$17, the higher end of which attaches a valuation of $11.3 billion, according to reports . That’s below the psychologically important $12 billion threshold. Surely, it’s not what they had in mind when they caught IPO fever during the Lyft hoopla. Certainly, it isn’t what the team envisioned for the Pinterest IPO roadshow, which kicked off today.

Whose Bright Idea Was This, Anyway?

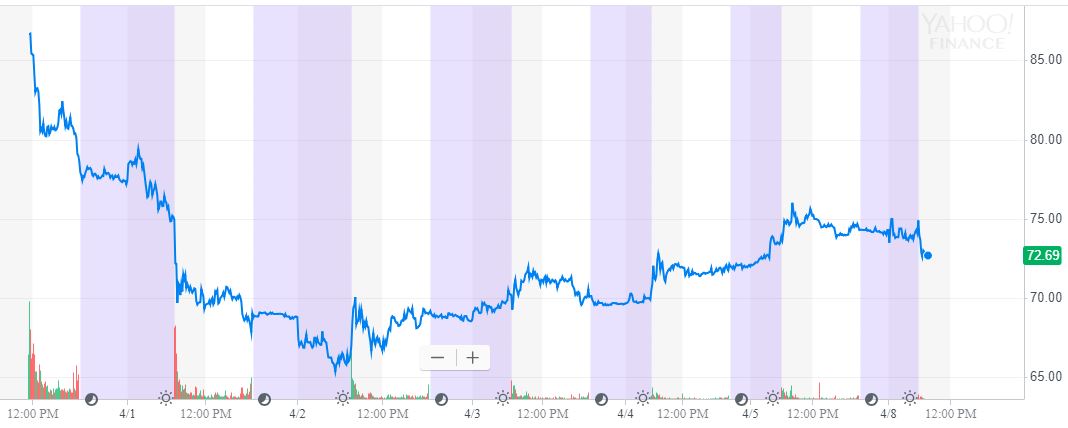

Pinterest’s eyes were opened after ride-sharing company Lyft got too greedy by setting its price range above that of its private valuation. Lyft was initially expected to price shares between $62-$68, but instead, someone came up with the bright idea to price at $72. Though it’s since recovered, Lyft couldn’t hold the initial price on day two, casting a shadow on the brightest spot for the equity markets at the moment — IPOs.

Bankers tend to advise pre-IPO companies to err on the side of caution when pricing shares. After all, there’s no guarantee of investor appetite even though conditions are ripe in the stock market. Someone at Lyft overshot, and now Pinterest has to pay.

Pinterest Left Shell-Shocked after Lyft Runs Afoul of IPO Investors

Lyft was largely considered a litmus test for the tech IPO parade this year, even seemingly inspiring Pinterest to accelerate its own IPO timeline to capitalize on the perceived enthusiasm. Ride-share rival Uber similarly rushed its IPO paperwork and is expected to be the blockbuster deal of the year. That is unless Lyft ruined things for them, too. Lyft shares faltered on the second day of trading, falling a painful 12% before recovering to around $72 in April.

Bigger tech companies have gone on to recover from a botched IPO. Facebook shares were priced at $38 during its 2012 public offering. Things were not rosy for investors after shares were stuck below that level for a year. Lyft shares rebounded much faster than that, but the Pinterest IPO will likely avoid that humiliation altogether.