Dow Falls 175 Points on Awful Retail Sales Data While Bitcoin Price Continues Slow Bleed

The US stock market cratered on Thursday, with the Dow shedding more than 175 points. | Source: Drew Angerer/Getty Images/AFP

A historically-abysmal decline in consumer spending crushed the US stock market on Thursday, causing the Dow to open to triple-digit losses just hours after it looked like the index would continue its mid-week rally. The bitcoin price, meanwhile, continued its slow bleed down toward interim support at $3,550 and could very well be on the verge of another large sell-off.

Weak Retail Sales Report Crushes Dow at Thursday Open

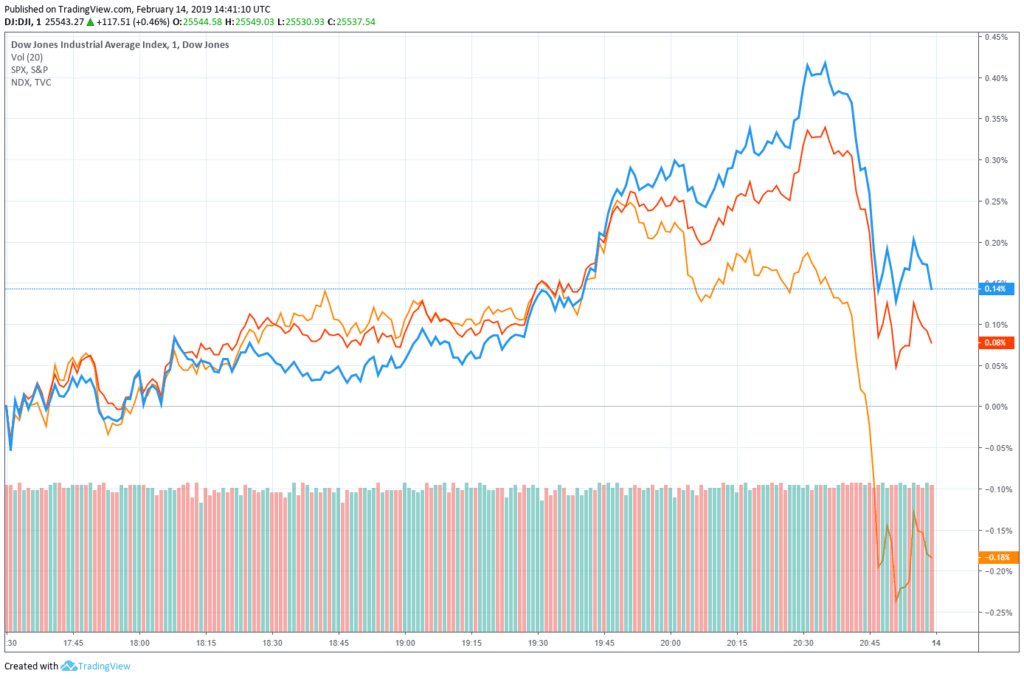

As of 9:37 am ET, the Dow Jones Industrial Average had dropped 176.86 points or 0.69 percent. The bearish trend rippled throughout the wider stock market as well, pushing the S&P 500 down by 0.55 percent and the Nasdaq down by 0.34 percent.

Thursday’s bearish open was a marked change from Wednesday’s close. The Dow had recorded its second-straight triple-digit gain, rising 117.51 points or 0.46 percent to 25,543.27. The Nasdaq rose 0.08 percent, and the S&P 500 climbed 0.3 percent in what ultimately proved to be another positive day for the US stock market.

Bloomberg: Trump Will Delay Trade Deal Deadline 60 Days

Early-morning futures trading had set the Dow up to continue its hot streak on Thursday.

That pre-market rally followed a Bloomberg report indicating that US President Donald Trump might delay the trade deal deadline by as long as 60 days. Previously, the White House had planned to place hefty tariffs on $200 billion worth of Chinese imports if the world’s two largest economies had not reached a new trade agreement by March 1.

“I think it’s going along very well,” Trump said of the state of the US-China trade talks. “They’re showing us tremendous respect.”

Rumors had also circulated in some quarters that the negotiators had agreed to extend the current round of trade talks – which are currently taking place in Beijing and feature participation from both US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin – but Global Times editor-in-chief Hu Xijin said that these reports were unfounded.

The stock market would like to see Lighthizer and Mnuchin return with a draft agreement in hand, that is, a document that outlines specific areas where the two sides have found common ground and others where disputes remain. However, an extension to Trump’s self-imposed trade deal deadline would likely provide Wall Street some cover even if the two cabinet-level officials return empty-handed.

Worst Retail Sales Data in Decade Crushes US Stock Market

However, Dow futures pared gains and later slipped into the red after the US Commerce Department published data revealing that retail sales had plunged 1.2 percent in December, which represented the largest decline since September 2009.

“This number was terrible,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group, in a note cited by CNBC . “The US consumer is holding the global economy on its shoulders. After seeing today’s data, we better hope it was a one month outlier and that the rebound in stocks in January and month to date will revive consumer spending.”

Bitcoin Price Continues Slow Bleed Toward Interim Support

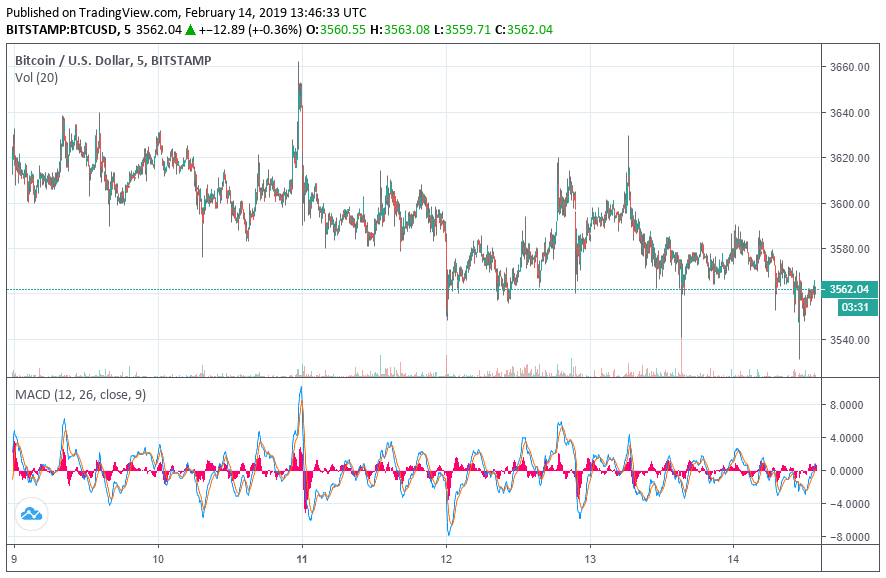

The cryptocurrency market continued to slouch into the red on Thursday, extending the slow bleed that has slowly chipped away at the bitcoin price rally that occurred last Friday.

As of the time of writing, the bitcoin price sat at $3,562 on Bitstamp, less than $15 above the $3,550 level that many analysts had flagged as providing interim support.

Bitcoin Investors are Underwater

Despite the market’s relative stagnancy, crypto analyst Willy Woo said that this remains an “exciting time” for “savvy long term investors.” Woo – who remains bearish on the crypto market’s near-term prospects – noted that bitcoin investors are collectively underwater on their holdings, which has been an extremely rare occurrence in the cryptocurrency’s decade-long history.

Woo stressed that he was not predicting that the bitcoin price had bottomed out, but this data-point should nevertheless give the bulls something to chew on as they continue to slog through the longest-ever Crypto Winter.

Bitcoin Basher Jamie Dimon Created his Own Cryptocurrency

Thursday morning also saw investment banking giant JP Morgan make the surprising announcement that it would become the first major US financial institution to launch its own cryptocurrency.

The bank, whose CEO Jamie Dimon has been among Wall Street’s most vocal bitcoin skeptics, plans to use the dollar-pegged “JPM Coin” for wholesale settlement and securities issuance.

While the privately-issued “stablecoin” will likely exist on a permissioned blockchain, the creation of JPM Coin could lead other financial institutions to ramp up their interest in blockchain technology and potentially even decentralized cryptocurrencies like bitcoin.

Crypto Market Teeters at $120 Billion

For now, though, bitcoin continues to languish in the mid-$3,000s, and every other large-cap cryptocurrency is facing minor-to-moderate losses as well.

The index’s worst performances came from EOS and binance coin, which saw single-day declines of 3.89 percent and 6.55 percent, respectively.

Altogether, the cryptocurrency market cap stands at $120 billion after losing around $1 billion over the previous 24 hours.

Featured Image from Drew Angerer/Getty Images/AFP. Price Charts from TradingView .