Risk Appetite Fuels Asian Stocks as Nikkei Surges to Four-Month High

Asian stocks feel the pinch of U.S.-China trade uncertainty. | Image: Shutterstock

Asian stocks were mostly higher on Thursday, as the prospect of U.S.-China trade talks and more stimulus from the European Central Bank (ECB) fueled risk appetite across the region.

Nikkei Leads Asia Rally

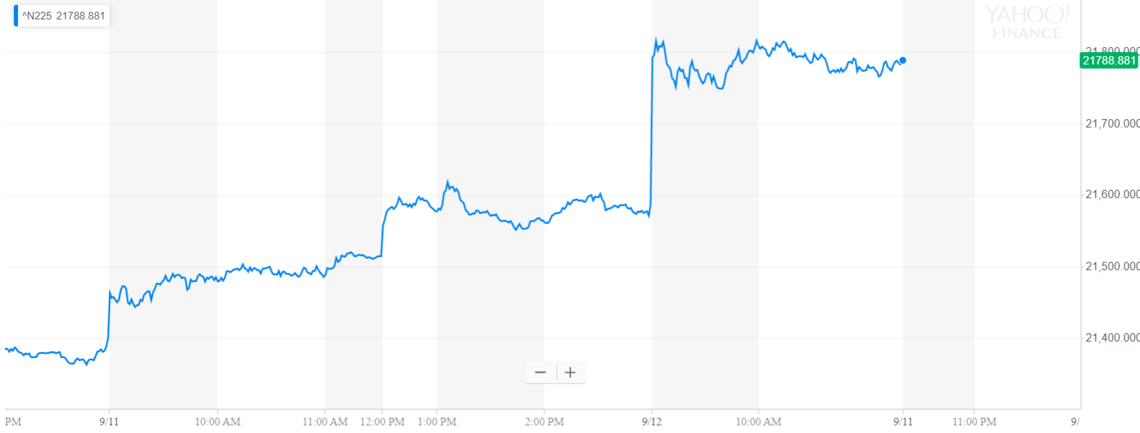

Japanese stocks were at the center of Thursday’s early-morning rally, with the Nikkei 225 index rising 190.19 points, or 0.9% to 21,787.95. The benchmark index is up more than 3% over the past five trading sessions and 6.7% in the last month.

The Topix 100 index in Tokyo also advanced 0.7% to 1,595.09.

Mainland China also booked solid gains, with the Shanghai Shenzhen CSI 300 Index climbing 0.3% to 3,940.78.

Hong Kong was the only major region exempt from the gains; the Hang Seng Index fell 0.6% to 27,008.03.

The Asia-Pacific rally follows another solid session on Wall Street, with the Dow Jones Industrial Average (DJIA) booking its sixth consecutive daily advance.

Trade War Breakthrough; ECB Focus

Global equity prices have been rising on hopes that the United States and China can finally set aside their differences and iron out a new trade agreement that will limit economic damage caused by the tariff war. With in-person talks set to resume next month, China announced Wednesday that it will exempt certain American industrial imports from tariff hikes. Penalties on soybeans and other American-made goods were left unchanged.

On the policy front, all eyes are on an upcoming meeting of the European Central Bank scheduled for early Thursday in Frankfurt. As CCN.com reported Wednesday, the ECB is expected to push its deposit rate further into negative territory by up to 20 basis points. Officials are also expected to approve another round of asset purchases.

U.S. Stock Futures Extend Rally

U.S. stock futures were eyeing another big open on Thursday, with the Dow Jones mini contract climbing 112 points, or 0.4%, in overnight trading. The S&P 500 futures contract added 0.4%. Nasdaq futures advanced 0.6%.

Wall Street has seen calmer trading conditions of late, with the CBOE Volatility Index falling to its lowest level since July. The so-called VIX has declined 25.7% from the Sept. 3 trading session. Under usual circumstances, a declining VIX means stocks are rising.