Ripple: Why Corporations, Banks Love It While Crypto Community Hates It

Except for the XRP Army, the company is not getting any love from the crypto community. | Source: Shutterstock

By CCN.com: Ripple is arguably the most divisive cryptocurrency. Earlier this year, the company surpassed a 200-customer milestone as financial institutions such as Transpaygo, WorldCom Finance, and Euro Exim Bank signed up for RippleNet. If Ripple was like any other cryptocurrency, enthusiasts would have celebrated this accomplishment. Except for the XRP Army, the company is not getting any love from the crypto community.

In this article, we explore the reasons why corporations love Ripple while almost everybody else hates it.

Why Corporations Love Ripple

It is quite easy to understand why corporations love Ripple. By using XRP, corporations such as banks can remove the middleman out of the equation when sending cross-border payments. Without third-party involvement, costs are significantly reduced. For instance, PayPal charges around 3% for electronic payments. If you use Ripple, the average transaction fee is currently 0.0009 XRP , which is negligible considering that the price of one XRP is around $0.37.

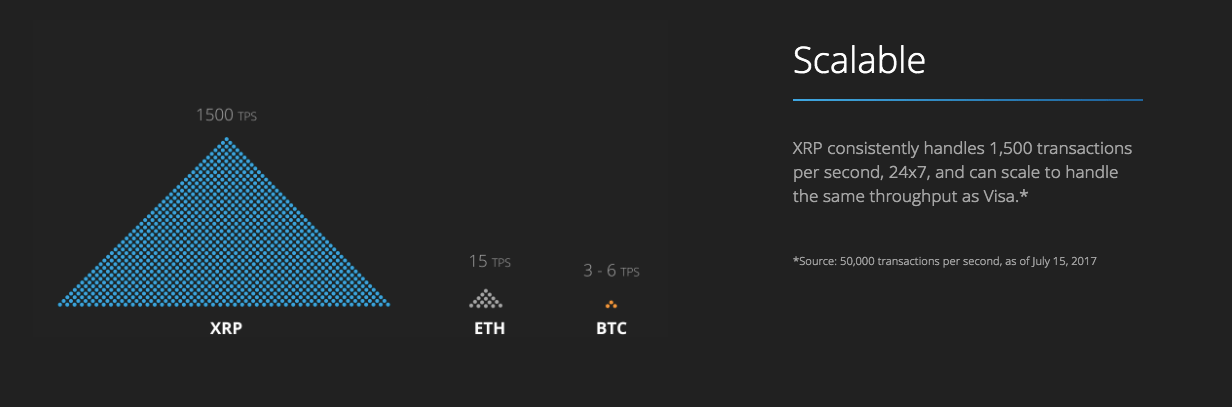

Another reason why corporations love Ripple is its scalability. XRP can handle 1,500 transactions per second and has the potential to match Visa’s same throughput of 50,000 TPS. On top of that, recipients can get their money in as little as four seconds.

To give you context on XRP’s efficiency, TechCrunch founder Michael Arrington sent $50 million and it took the network three seconds to settle payments. More importantly, the transaction cost 30 cents .

Why People in the Crypto Community Hate Ripple

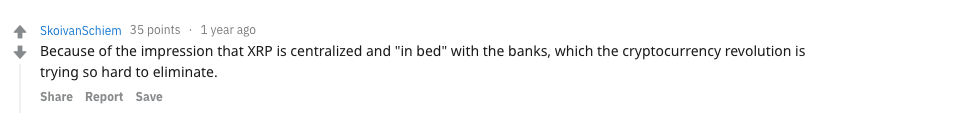

Most people hate XRP because they believe it is a banker’s cryptocurrency. By working with financial institutions, it deviates from Satoshi Nakamoto’s vision of a peer-to-peer currency that enables people to take control back from the banks.

On top of that, XRP is not a decentralized currency. One company operates and controls the network. Again, this goes against the whole idea of a decentralized cryptocurrency.

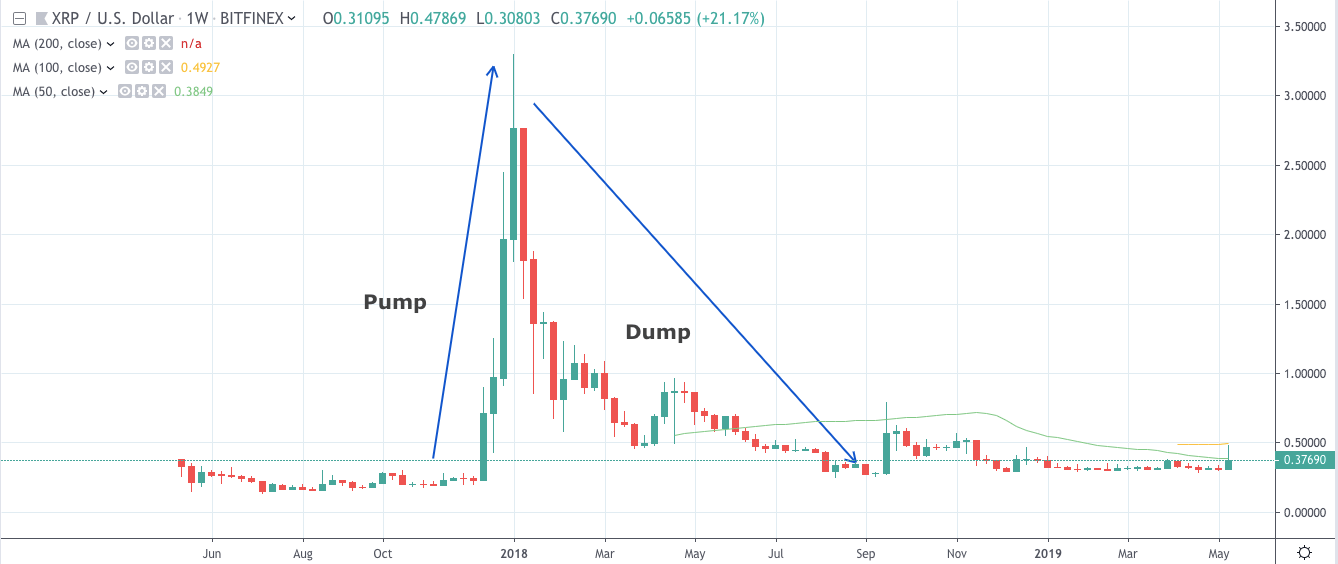

These are the obvious reasons why some people shun the altcoin. However, those in the know condemn the cryptocurrency for two reasons: it is pre-mined and Ripple controls 60% of XRP in existence . With this combination, they think that XRP is primed for pump-and-dump schemes. If you control supply, you determine the price.

Case in point: in the last bull run, Ripple traded around $0.24 on Dec. 11, 2017. The altcoin then surged to as high as $3.30 on Jan. 4, 2018. That’s an astronomical gain of 1,275% in less than a month. This created tremendous hype that lured many unwitting retail investors.

Unfortunately, the ensuing bear market was brutal. Ripple lost about 90% of its value from the peak. This left many in financial ruin. As a result, multiple lawsuits have been filed against the company. One disgruntled investor even asked Ripple for a $167.7 million payment for damages .

Bottom Line

XRP may be one of the better fundamentally sound cryptocurrencies, which is why financial institutions have embraced the altcoin. However, many detest the digital asset as it departs from Satoshi Nakamoto’s vision. Love it or hate it, there’s money to be made while investing in XRP.

The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.