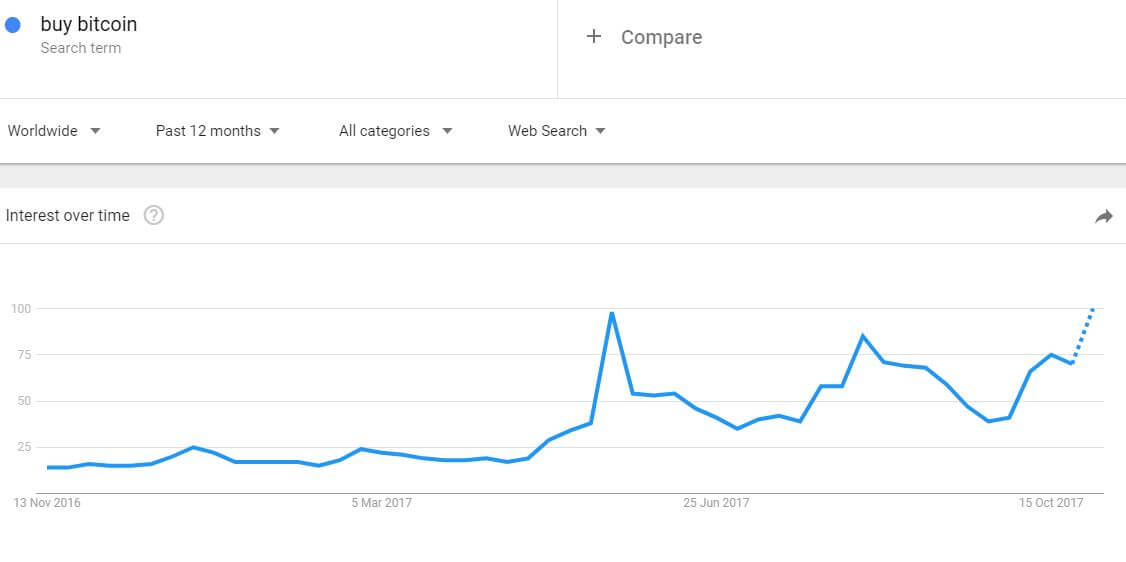

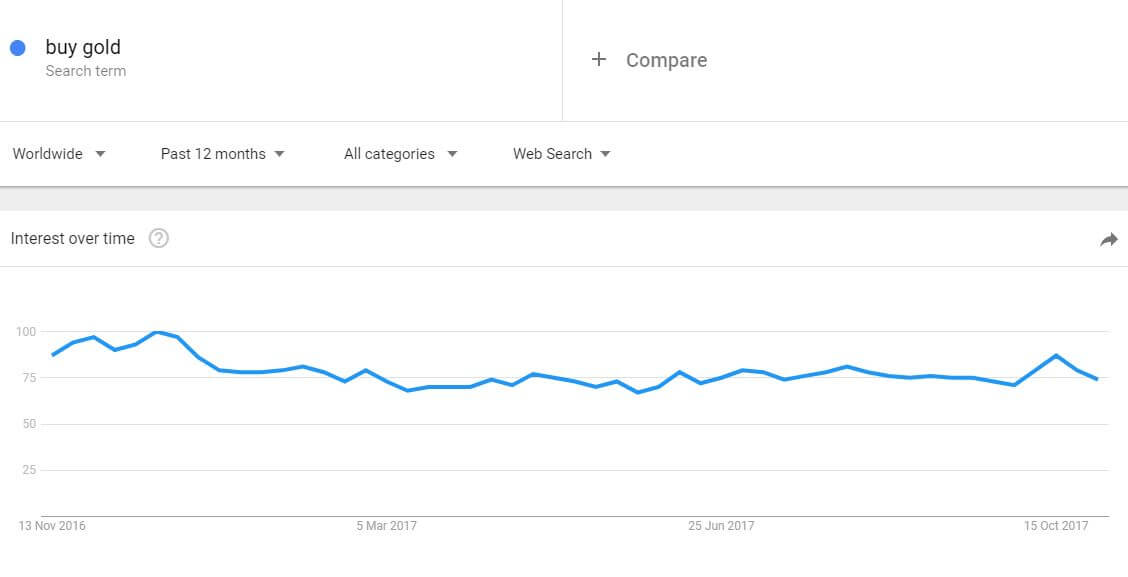

'Buy Bitcoin' Overtakes "Buy Gold" as Private Gold Trading Declines in October

Bitcoin's limited supply, its ease of use and a number of other factors make it a better asset than gold, according to Mark Yusko. Source: Shutterstock

Private investor gold trading fell by a third in October as Google searches to ‘buy bitcoin’ overtook yellow metal searches worldwide, according to BullionVault.

Adrian Ash, the director of research at BullionVault, the physical gold and silver market for private investors online, said that the amount of gold changing hands shrank by nearly one-third in October compared to the previous 12 months, down by 31.5 percent. Ash reports that gold buyers fell by 9.7 percent during October from the month before, whereas the number of sellers declined by 26.6 percent.

This saw the Gold Investor Index measure one tick higher from 54.5 in September to 54.6 in October, matching the sentiment index’s one-year average, said BullionVault.

Ash writes:

With the U.S. stock market setting fresh all-time highs day after day, it’s no surprise gold prices have retreated. Investment insurance is being discounted because equities seem invincible. Brexit isn’t worrying the FTSE, and Catalonia’s independence crisis has so far failed to dent Europe’s bull market.

Elsewhere, the rise of bitcoin is attracting new investors to the crypto market. As gold experiences a decline in trading, bitcoin is seeing a rise in the number of Google searches. According to BullionVault, Internet searches for ‘buy bitcoin’ are now overtaking ‘buy gold’ just as the digital currency overtook ‘buy silver’ in the New Year.

Ash states that investors are ‘being distracted by the noise around bitcoin and other cryptocurrencies,’ adding:

Altogether that’s made interest from new gold investors the weakest since the metal’s half-decade price lows of end-2015, just the U.K. referendum and Trump’s election shock helped gold enjoy its strongest annual rise in six years.

On a daily basis, in October, gold prices declined by 1.4 percent in Euros, 1.8 percent in Sterling Pound and 2.7 percent against the U.S dollar.

Even though gold trades recorded a decline in October, BullionVault client holdings grew by 208 kilograms, the first net growth in three months. Silver remained unchanged for the second consecutive month, at a record 689 tonnes. Despite this, though, the number of buyers declined more than sellers, down by 22.1 percent from September.

According to Ash, the sale of bullion coins and small bars to private investors has become ‘dismal.’

Yet, demand for bitcoin is continuing to increase with its value now worth over $7,000. Its user base is also increasing due to the fact that it can be used as a form of payment compared to gold. For many bitcoin is becoming a viable alternative to gold, silver and the fiat system.

Featured image from Shutterstock.