Prime Day Blowout Sees Bullish Amazon Stock Aiming to Deliver All-Time Highs

Amazon had a record breaking Prime Day, in the United States and globally. | Source: Shutterstock

Amazon just concluded its two-day global shopping event – Amazon Prime Day. The annual shopping holiday is exclusive to Amazon Prime members who have the privilege of taking advantage of Prime Day discounts. This year, the e-commerce giant is expected to rake in close to $6 billion in a span of the 48-hour event .

Investors are paying attention to the revenue generated by this event. The company’s stock is once again trading above $2,000 and it looks ready to take out the all-time high of $2,050.

Amazon.com, Inc. (AMZN) Painting a Large Continuation Pattern

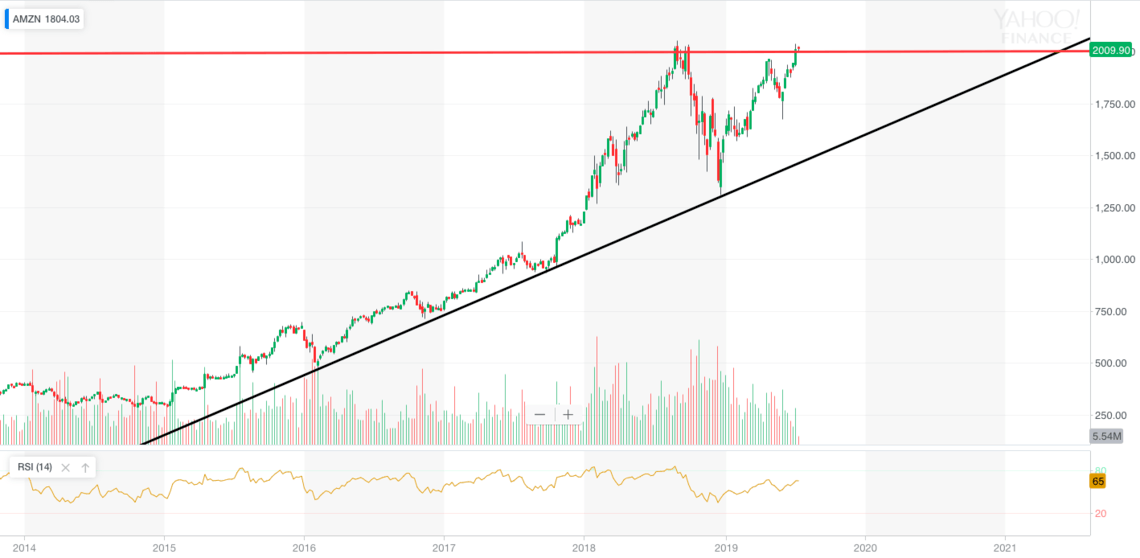

There’s no doubt that Amazon is one of the strongest Nasdaq stocks. The tech giant’s stock has been on a steep rise since January 2015. A quick look at the weekly chart reveals two reasons AMZN looks mega-bullish.

The first reason is that the equity has respected the uptrend line for more than five years. AMZN has touched the diagonal support four times and every single time, the stock has bounced. This points to an equity in a strong uptrend.

In addition to that, the stock is creating a large cup and handle pattern that’s visible in both the daily and weekly charts. This is a continuation pattern that suggests that Amazon will resume its uptrend once it breaks out of consolidation.

For a breakout to happen, AMZN must move above resistance of $2,025 with heavy volume. There’s little reason to suggest the security will have trouble breaching the resistance because taking out resistances and printing new highs is the new norm for most US equities. For instance, Starbucks, Walt Disney, and Adobe have all broken their respective resistance levels recently and are now setting fresh all-time highs almost every day.

A rising tide lifts all boats, so it is only a matter of time before Amazon blasts off to new highs. If it does, the minimum target based on the height of the pattern is $2,500.

Fundamentals Remain Strong

It appears that the stock’s technicals are not the only ones driving the vigorous uptrend. The company’s books reveal that its net income rose by over 17 percent from $3.03 billion in the last quarter of 2018 to $3.56 billion in the first quarter of 2019. The increase was primarily due to improvements in operating income and net income from continuing ops.

Further, the tech firm recently acquired an autonomous warehousing robotics company called Canvas Technology . The acquisition should increase efficiency in warehouses by cutting costs and boosting overall customer experience.

Bottom Line: Amazon Looks Strong in Both Technical and Fundamental Terms

Amazon is in a strong uptrend and it looks to blast higher as soon as it takes out $2,025. Robust fundamentals are also driving the price of the stock higher. Improvements in net income, as well as a key acquisition, can push shares into greater heights.

The e-commerce giant may be done dishing discounts on its shopping holiday but with technical and fundamental factors aligning, it’s looking good for those invested in the company’s shares.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.