Piper Jaffray’s Netflix Pitch Recklessly Ignores Several Basic Facts

Piper Jaffray's Netflix stock pitch recklessly ignores several basic facts about the challenges NFLX will face as the streaming wars heat up. | Source: REUTERS / Wolfgang Rattay

Ignore the threat of competition and buy Netflix stock. That was the questionable recommendation from Michael Olson, an analyst at Piper Jaffray.

In an interview with CNBC, Olson said that he expected the launch of Apple TV+ and Disney+ in November to have no material impact on Netflix.

Unfortunately, Olson’s NFLX elevator pitch ignores several basic facts about the streaming giant, as well as its growing number of competitors.

Netflix Stock’s Brutal Tailspin & Piper Jaffray’s Bullish Retort

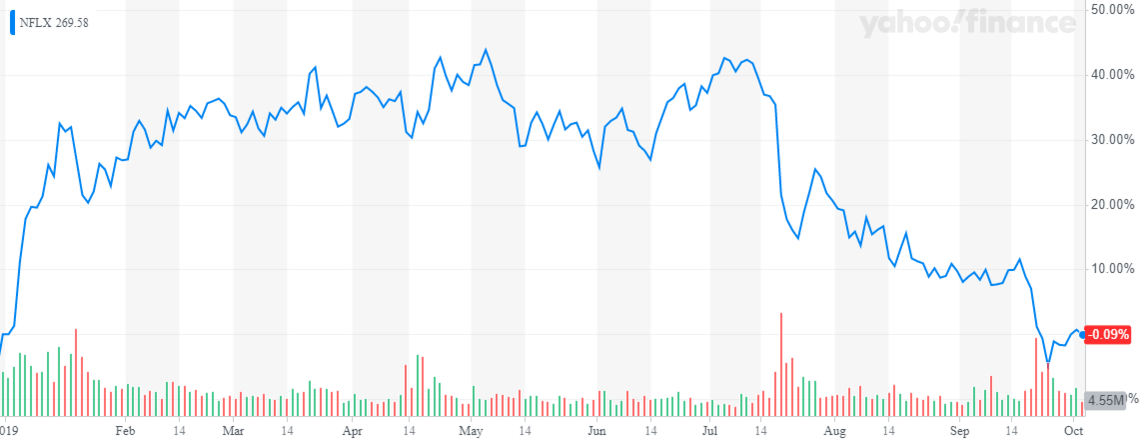

Netflix stock has been in a tailspin ever since it revealed a stunning subscriber loss when it reported earnings in July. Since then, the company’s market valuation has slumped by more than $41 billion.

Just this week, NFLX turned negative for the year, confirming that investors are worried about Netflix losing market share to Disney+, Apple TV+, HBO Max , and maybe even Peacock. Piper Jaffray’s Olson says they’re wrong.

Olson’s bull case for NFLX relies on research that suggests 72% of respondents would not trade out their Netflix subscriptions for Disney+.

However, that optimistic view ignores other important data, beginning with Netflix’s valuation.

Netflix Stock Is STILL Expensive

Even with the recent decline, NFLX shares are not cheap.

According to data from Yahoo Finance , investors are placing a 47x multiple on this year’s earnings.

This is a pricey valuation for a company that fails the “rule of 40” principle, which states that software companies should have a combined growth and profit margin rate of at least 40%.

With revenue growth of 26% and an EBITDA margin of 11%, Netflix underperforms at 37%.

NFLX’s Three Biggest Hurdles: Content, Content, & Content

It’s unquestionable that Netflix has achieved remarkable growth and transformed the media landscape. However, it’s not immune to the industry’s fundamental challenges, beginning with content.

Netflix is spending a fortune to produce content in-house, reportedly as much as $15 billion in 2019 alone. Unfortunately, a study conducted a year ago found that 80% of subscribers preferred licensed content.

Fan favorites like Friends and The Office continue to dominate viewing numbers, and the company will lose the license to both of those shows within the next several years.

No Clear Path to Long-Term Profitability

Another issue that Olson failed to mention was that Netflix has no clear path to sustained profitability.

As competition heats up, the company will need to spend more on content. Analysts see Netflix generating revenues of $20 billion and $24 billion in 2019 and 2020, respectively. In these years, the cost of content will likely be $15 billion and $17.8 billion. Therefore, revenue minus cost of content will be $5 billion and $6.8 billion. When you subtract the company’s remaining operating expenses, the profits will continue being negligible.

The bottom line is that for Netflix to justify this premium valuation, it needs to continue adding subscribers and hiking prices. However, as the most recent quarter showed, this strategy presents considerable risks. Subscriber growth could continue to slow, and competition could lead to ballooning content costs, all while the company finds itself locked in a price war.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.