Peloton Thinks It’s the Next Apple – It’s Actually the Next GoPro

Peloton desperately wants to be the fitness industry's Apple. Unfortunately, it's actually far more likely to turn out like GoPro. | Source: AP Photo / Mark Lennihan

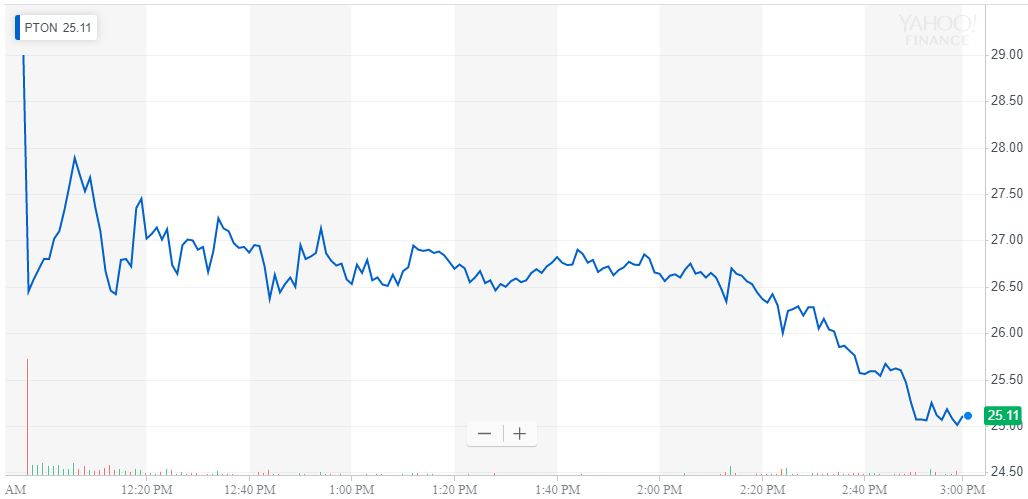

Peloton Interactive went public today, and its stock quickly plunged below its $29 IPO price in the third-worst unicorn debut since 2008.

The IPO comes a week after fellow unicorn WeWork abandoned its listing process. It also comes a year after the company raised $550 million at a $4.5 billion valuation.

Peloton: the fitness industry’s Apple?

Similarities between the two firms have led bullish analysts to dub Peloton the “Apple of the fitness industry .”

First, both companies target the market’s upper tier. Apple has made billions of dollars every year by selling phones at premiums over its competitors. Peloton sells bikes and treadmills that cost more than $2,000 and $4,000, respectively. This is a hefty premium considering that treadmills are readily available for less than $1,000 at most fitness retailers.

Another similarity is that both companies want to sell an ecosystem, not just individual products. Apple’s ecosystem includes computers, smartwatches, iPads, Apple Music, and Apple TV. Peloton is creating a fitness ecosystem that includes hardware, software, and even apparel.

Further, the two companies have a devoted following. Apple fans have been known to queue for hours after a new iPhone goes on sale. Meanwhile, Peloton has managed to create a cult-like customer base. Indeed, the company has sold its overpriced devices to more than half-a-million customers. It also has 1.4 million registered users, many of whom pay between $20 and $40 per month to stream fitness classes.

Therefore, it makes sense to say that Peloton wants to be the Apple of the fitness industry, and its dramatic revenue growth arguably suggests that it’s well on its way.

GoPro is the best comparison to Peloton

Unfortunately for Peloton, it won’t be the next Apple. And unfortunately for Peloton investors, it could be the next GoPro.

It’s easy to forget that GoPro’s valuation surged as high as $12 billion following its 2014 IPO. It’s also easy to forget that it appeared justified at the time.

Like Peloton, GoPro had a cult-like following. In 2013, the company sold more than 3.8 million HD cameras, continuing a trend of significant growth. GoPro bought into the ecosystem strategy, even creating a subscription service called GoPro Plus that started at $4.95 a month.

The few people who announced that they were short the stock were rebuffed by both investors and analysts. However, investors should have listened. GoPro sales declined, subscriber numbers waned, and within a little over a year, shares had fallen below their IPO price.

Today, GoPro is worth just $720 million.

Here’s why Peloton investors should be concerned.

The two unicorns had similar revenue statistics leading up to their public listings. In the three years before its IPO, GoPro had $234 million, $526 million, and $985 million in revenue. Peloton brought in $218 million, $435 million, and $915 million. During its IPO, investors valued GoPro at $2.95 billion. Today, they valued Peloton at $8.1 billion.

Peloton also faces similar threats, beginning with an unrealistic customer target. In its filing, Peloton said that it was targeting the 45 million people in the United States, along with another 22 million people globally.

These numbers are suspicious. Consider that there are only 62 million gym members in the US. This means that Peloton believes that it can convince 72% of them to buy the bikes and treadmills, or else convince a massive number of couch potatoes to begin working out. It also expects 12 million of them to subscribe to its fitness streaming service.

Why Peloton’s challenge is even greater than GoPro’s

In one sense, Peloton faces an even more significant threat than GoPro since most people don’t regularly upgrade fitness bikes and treadmills. This means that Peloton will need to rely on its digital subscriber base. Again, this will not be possible because of how fast many people give up on exercising. One study found that 90% of new gym members quit within three months .

Peloton also faces competition from established names like NordicTrack, Pro-form, and Echelon , putting the company at risk of being a victim of its own success. As the connected fitness industry continues to grow, so will the range of options. Many customers will inevitably turn to cheaper devices, putting pressure on Peloton’s margins.

Maybe that’s why PTON is down nearly 14% in its first day of trading.