PayPal’s $500 Million Uber Bet Has Already Lost $190 Million. It Could Get Worse

Uber's stock is at an all-time low since its IPO earlier this year.. REUTERS/Brendan McDermid

- PayPal got in late having bought over 10 million shares of Uber at $45

- Some analysts are expecting a ‘horror show’ after the stock lock-up period expires.

- Uber’s stock hit a record low on Tuesday a day ahead of the expiry of the lock-up period

Payments firm PayPal (NASDAQ: PYPL) was one of the biggest investors in Uber Technologies (NYSE: UBER) ahead of the IPO. In its prospectus, Uber noted that PayPal had agreed to buy 11,111,112 of its common stock at a price of $45 per share. This cost PayPal slightly over half a billion dollars.

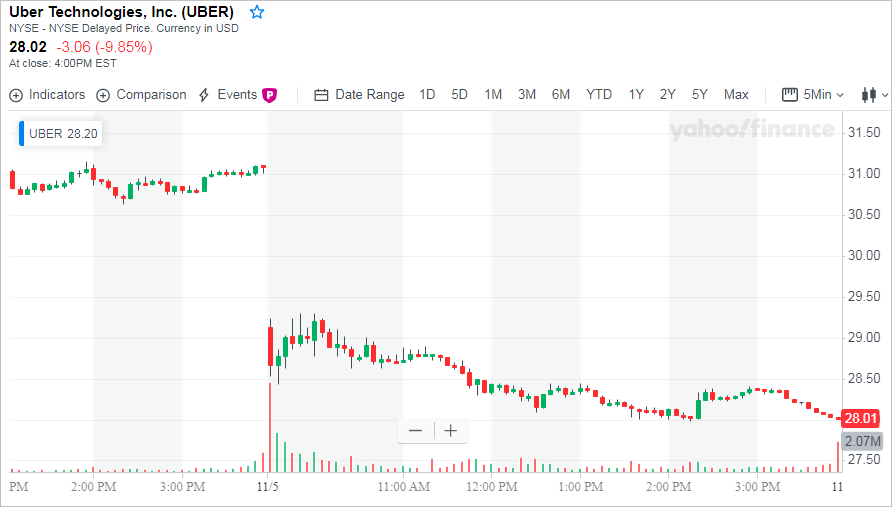

After Uber plunged by nearly 10% Tuesday to $28.02 per share following a quarterly loss of over one billion dollars, PayPal’s stake in the ride-hailing firm is now worth $311,333,358. This translates to paper losses of approximately $188,888,904.

The Tuesday plunge also marked a new record low for the stock. The previous low was $28.31 registered in early October.

Will PayPal’s investment ride get bumpier?

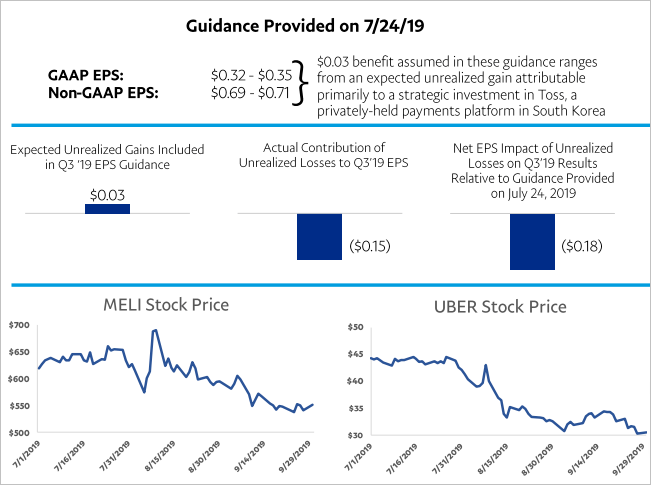

In the third-quarter earnings call with analysts, PayPal CFO John Rainey noted that strategic investments in Uber investment (and ecommerce giant MercadoLibre) had ‘created more earnings volatility. Notably, the Q3 results released last month showed that the strategic investments had caused PayPal unrealized losses of $0.18 per share during the quarter.

At the time, Uber’s stock had declined the most – 34% compared to MercadoLibre’s 10% fall.

Now the pain is likely to get worse for PayPal as the six-month lock-up period expires today (November 6th). A flood of shares from employees, founders and venture capitalists could hit the market pressuring the stock even further.

By some estimates close to 40% of the company’s stock that was not eligible for trading before the expiry of the lock-up period could now come into play. With Tuesday’s plunge having reduced Uber’s market cap to approximately $47.63 billion, this translates to stock worth approximately $19 billion becoming available.

Wedbrush analysts have already warned that the expiry of the lock-up period could result in a ‘horror show’ due to ‘an avalanche of selling’.

How low can Uber go?

While it is impossible to tell if and by how much Uber will fall, how other tech stocks have fared could provide a pointer. In the social media niche, Twitter fell 18% on the day of its lock-up expiration while Facebook fell 4%. Zillow and Groupon on the other hand fell 13% and 8% respectively.

Assuming a decline is guaranteed, Uber will probably be hoping to copy Lyft. When its rival’s lock-up period expired in August, the stock fell by just 1.5% . A double-digit decline, on the other hand, would be panic-inducing.

Perhaps worried that its investment in Uber might take ages breaking above the IPO price, PayPal last month disclosed that it will exclude the unrealized losses in such ventures in its quarterly reports beginning next year:

“Starting in 2020, we will update our non-GAAP methodology to exclude the impact of these gains and losses on our strategic investments as we believe this will provide a better understanding of our operating performance and a more meaningful comparison of our results between periods.”