Obama’s Stock Market Skyrocketed 140%. What If Elizabeth Warren Did the Same?

FLORENCE, SC - OCTOBER 26: Democratic presidential candidate, Sen. Elizabeth Warren (D-MA) is often accused of being anti-Wall Street | Source: Sean Rayford/Getty Images/AFP

Turn on CNBC or Bloomberg TV and you’ll hear at least one Wall Street analyst screaming about the danger of an Elizabeth Warren White House on the stock market.

Billionaire investor Leon Cooperman joked that “they won’t open the stock market if Elizabeth Warren is the next president ” and accused her of “sh*ting on the American dream.” Hedge fund managers Paul Tudor Jones and Steve Cohen both predicted a stock market drop between 10-25% if she was elected . Mark Mobius agreed that a 25% drop was possible .

But what if they’re wrong?

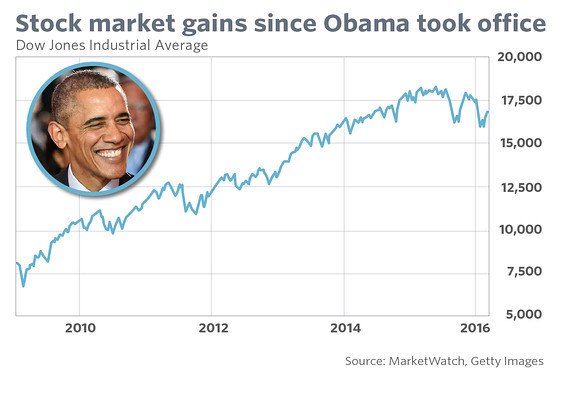

David Zervos, chief strategist at Jefferies thinks the Warren scaremongering is overplayed . He compared her agenda to Barack Obama, who oversaw a 140% stock market run during his White House tenure.

“[Warren is] not that different to Obama. If you put the two of them side by side in 2007, they had very similar agendas: healthcare, regulation, financial, energy, environment. And from 2009 going forward, when Obama took office, we never looked back. The stock market just rallied.”

Elizabeth Warren: a threat to the stock market?

Warren has emerged as the clear leader in a stacked field of Democrat presidential candidates . Overtaking Biden in polls and betting markets, she will likely take on Trump in the 2020 election.

But her policies have Wall Street nervous. Money managers point to her proposed “wealth tax” as well as strict attitude towards banks, tech companies, and energy companies as reasons to be bearish.

Even Zervos admits there would a sweeping change in market expectations:

“She would change returns on capital expectations, earnings expectations, regulation would go up, taxes would go up.”

But he ultimately believes a Warren stock market would rise because the Federal Reserve would rally behind her, like it did Obama.

“I think people forget if we were to go down, how likely would this Fed be to backstop Elizabeth Warren? And I think the answer is very likely. This is a Fed that is not particularly friendly with this administration. The guts of the Fed is probably much more excited about an Elizabeth Warren than a Donald Trump.”

Warren: not the socialist you think?

Zervos also argues that Warren is more of a controlled capitalist than a socialist, especially when compared to rival Bernie Sanders or left wing UK figure Jeremy Corbyn.

“I think she has a slightly more conservative bent [than other Democrats].”

In other words, a Warren White House might be a blessing for investors compared to a Sanders administration.

Remember: investors doubted Trump, too

Ultimately, it’s a fool’s errand predicting the stock market reaction ahead of an election.

Remember these headlines and quotes from back in 2016?

- A Huge Hedge Fund Says Stocks Will Crash if Donald Trump Wins

- “In all likelihood, a Trump victory would lead to a swift, knee-jerk sell-off.”

- “Strategists agree there would be a sell-off with a Trump win”

So, let’s take these dramatic Elizabeth Warren 25% sell-off predictions with a grain of salt. We’ve been here before.