NYU Prof: Bitcoin May Be “Dangerous Pricing Game”

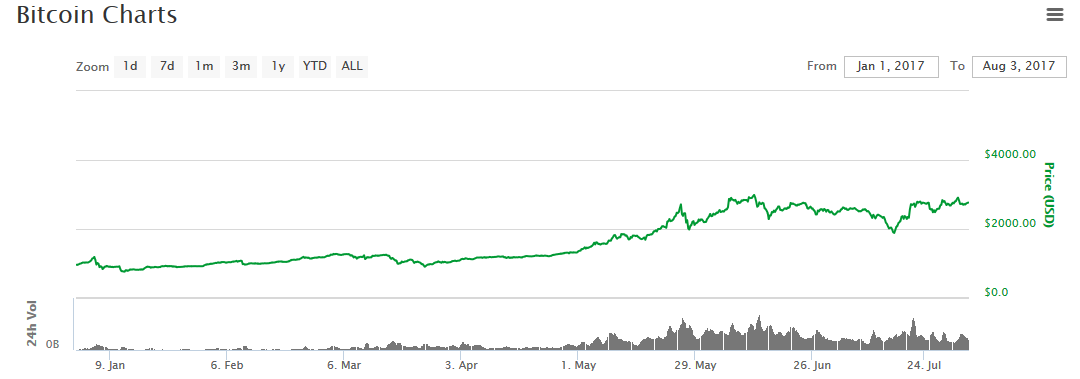

2017 has been a watershed year for bitcoin and cryptocurrency in general. The bitcoin price has soared to record levels, and initial coin offerings have raised more than $1 billion in funding.

Cryptocurrency proponents allege this rapid growth stems from increased recognition that this technology presents an almost limitless number of use cases. Critics compare bitcoin to the 17th-century Dutch tulip bubble and say that its value is derived entirely from speculation.

NYU finance professor Aswath Damodaran weighed in on the debate on his personal blog, Musing on Markets . Damodaran takes a more moderate tone than some of bitcoin’s more vehement critics, but he falls squarely in the skeptic camp, suggesting that bitcoin may just be a “dangerous pricing game.”

Bitcoin’s Weak Link

Damodaran comes to this conclusion by analyzing bitcoin’s usefulness as a currency. He states that a currency’s standing is measured by how well it serves as a unit of account, medium of exchange, and store of value. He says that cryptocurrency’s “weakest link” is “their failure to make deeper inroads as mediums of exchange or as stores of value.” Specifically, he indicts bitcoin for having little retailer acceptance, echoing Morgan Stanley’s recent claim that acceptance is “virtually zero.”

Damodaran says that bitcoin has yet to see wider transaction acceptance because of inertia (the public is slow to embrace change), price volatility, and competition from other cryptocurrencies. He says that price swings make bitcoin popular among traders but hamper its ability to gain acceptance as a unit of exchange. He blames developers and the community alike for promoting bitcoin as a way to get rich, although he does not give specific examples to confirm this claim.

Damodaran encourages people to honestly assess whether bitcoin’s usefulness as a currency justifies its record price levels or whether it is just a “dangerous pricing game with no good ending.”

If you believe that bitcoin will eventually get wide acceptance as a digital currency, you may be able to justify [bitcoin’s current price], especially because there is a hard cap on bitcoin, but if you don’t believe that bitcoin will ever acquire wide acceptance in transactions, it is time that you were honest with yourself and recognized that is just a lucrative, but dangerous, pricing game with no good ending.

Bitcoin Must Compromise on Privacy and Centralization

Nevertheless, Professor Damodaran is bullish on digital currency’s potential to compete with fiat national currency, with the caveat that he does not believe bitcoin or any other currently-existent coin will do so:

I believe that there will be one or more digital currencies competing with fiat currencies for transactions, sooner rather than later, but I am hard pressed to find a winner on the current list, right now, but that could change if the proponents and designers of one of the currencies starts thinking less about it as a speculative asset and more as a transaction medium, and acting accordingly. If that does not happen, we will have to wait for a fresh entrant and the most enduring part of this phase in markets may be the block chain and not the currencies themselves.

One reason he doubts bitcoin will succeed is that it is too committed to privacy and decentralization. For bitcoin or another digital currency to gain mainstream acceptance, he claims, it must make compromises in regard to user privacy and centralization:

I know that we live in an age where trust is a scarce resource and I argued that that the growth in crypto currencies can be attributed, at least partly, to this loss of trust. That said, to be effective as a currency, you do need to be able to trust in something and perhaps accept compromises on privacy and centralized authority (at least on some dimensions of the currency).

Many in the cryptocurrency community would undoubtedly consider that a devil’s bargain.

Featured image from Shutterstock.