Newsflash: Tesla Shares Nosedive After Major Analyst’s Consensus Turns to ‘Sell’

If Tesla raises even more capital and fails to deliver, Elon Musk will face serious investor blowback. | Source: REUTERS/Bobby Yip/File Photo

By CCN.com: Elon Musk and Tesla’s poor start to 2019 looks like it’s set to get worse. After news of a $1 billion debt balance and cost-cutting layoffs, analysts are adding to Tesla’s trauma.

Tesla shares ended yesterday 1.11% down. Premarket moves showed a further fall for Tesla of over 2% as RBC downgrades the stock to “underperform.”

RBC Says Tesla Will “Underperform” and a Third of Tesla Stock Price is an “Elon Premium”

RBC Capital says Tesla shareholders could be blinded by CEO Elon Musk’s ambitions. Analyst Joseph Spak says:

It’s not that we don’t believe Tesla can grow over time, our model shows solid LT growth. But the current valuation already considers overly lofty expectations.

Spak calculated earnings over the next few years based on Tesla Model 3 sales. The result falls shy of a value that would deliver profits to please shareholders:

Let’s assume 1mm [Model 3] units @$55k ASP, 12 percent EBIT margins, no interest/equity raise all by 2025. This is undoubtedly solid earnings, but at a more ‘mature’ 15x P/E, the discounted back value is ~$195, meaning even in an optimistic case at least 1/3rd of today’s price is an ‘Elon premium.’

Tesla has just been given permission to sell the Model 3 in Europe.

The analyst believes Tesla is finally giving more clarity to investors “which is a long-term positive, but means downward pressure to growth expectations – which in our view are too high to justify current levels, let alone to add to positions.”

Tesla Dream Turns to Reality as the Rubber Hits the Road

Spak says:

For years, Tesla sold the dream of transportation disruption and fantastic growth.

Now it seems reality is hitting both Tesla and its shareholders. Spak says Tesla seems to be more “tactful” with its messaging. CEO Musk has recently said Tesla would achieve a “tiny profit” in the fourth quarter of 2018.

Conventional automakers are pushing their electric vehicle efforts. They have decades of experience in delivering global, volume, car sales. Spak identifies the challenge for the comparatively infant innovator Tesla:

The rubber appears to be hitting the road as the realities of Tesla becoming a volume player, the challenges to scale and deliver high volume at high ASPs/margins are coming to a head.

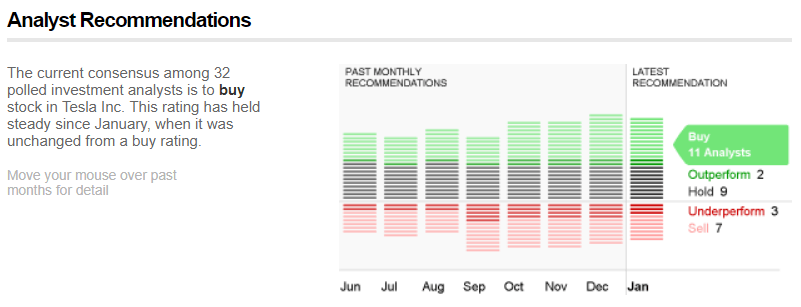

With RBC’s “underperform” rating TipRanks.com now says nine analysts give Tesla stock a “sell” rating. Eight analysts still say “buy” and seven are advising a “hold” on the stock. Though in comparison TipRanks.com says Apple has zero “sell” ratings.

According to CNN , out of 32 analysts polled 11 set a “buy” rating and two an “outperform.” On the flip side seven give a “sell” rating and three an “underperform.” Nine give Tesla stock a “hold” rating.

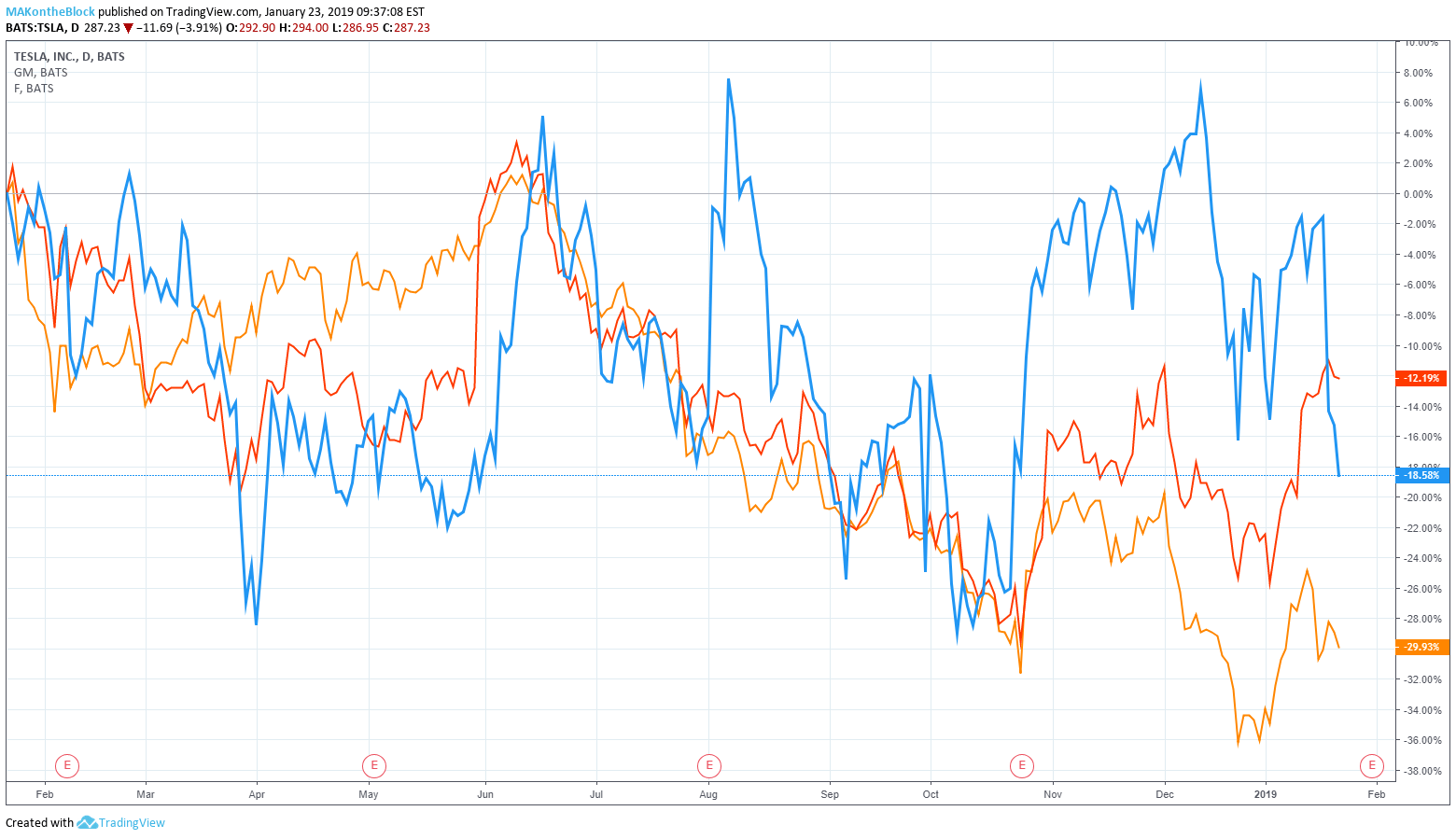

As the market opens Tesla’s share price has fallen rapidly, at the time of writing by 4%. In comparison, General Motors shares are up 0.03% and Ford stock is down just over 1%.

General Motors recently revealed plans to use its luxury Cadillac brand to compete with Tesla and its shares leaped earlier in January as the iconic brand upped its profits guidance for 2019.

Price Charts from TradingView .