Netflix Shares Drop After Wall Street Gets It Wrong

Netflix shares took a nose dive after Q2 guidance failed to impress. | Source: Shutterstock

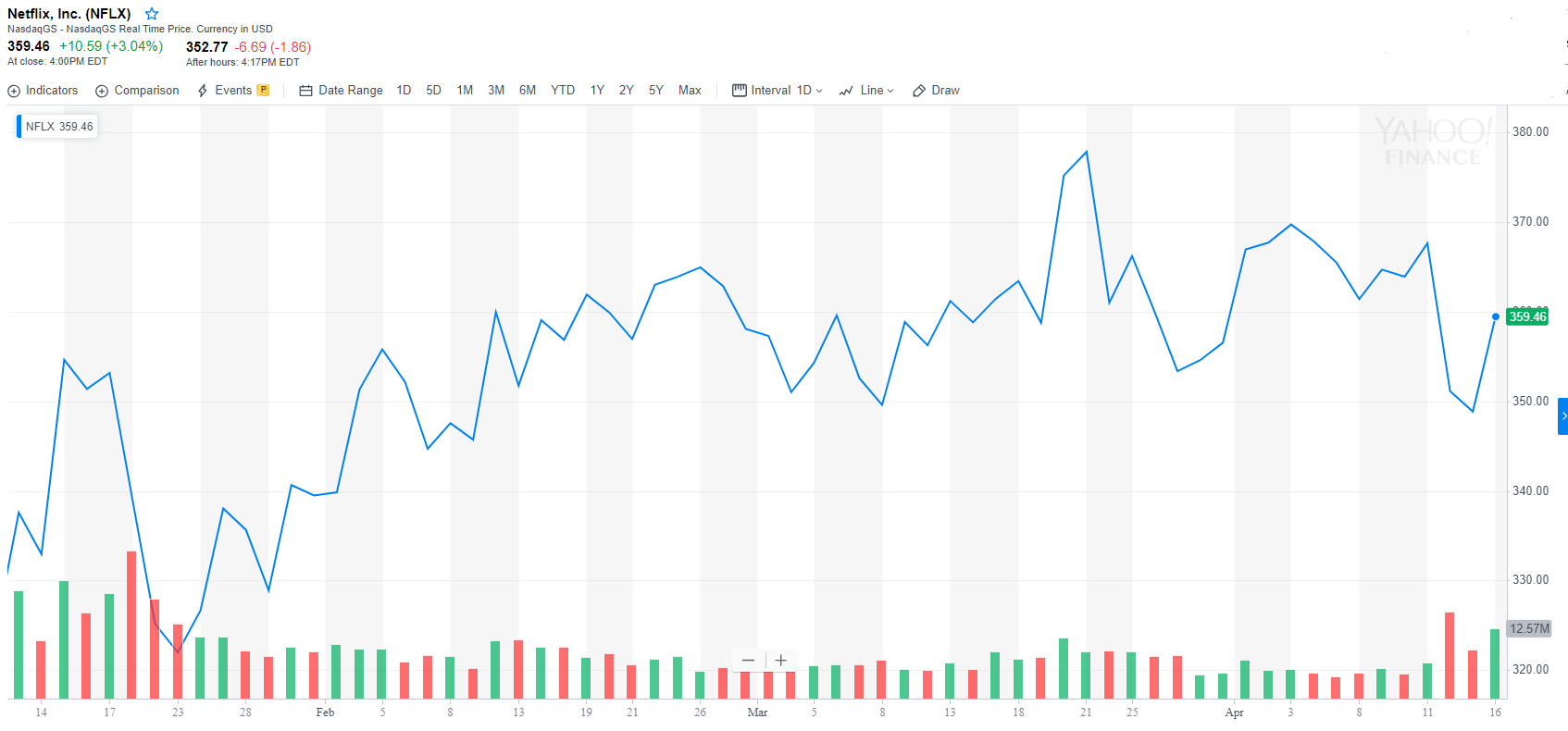

By CCN.com: It’s been a whipsaw day for Netflix investors, one that has taken a turn for the worse. After rising more than 4% earlier in the day, Netflix shares turned negative in after-hours trading. The streaming content-giant just unveiled its Q1 earnings, and Wall Street didn’t like what it saw. While Q1 performance surpassed expectations, it was the closely watched future outlook that spooked investors.

Prior to the earnings report, which was announced after the closing bell, Netflix shares were on a roll, rising to $361. Wall Street analysts fueled the rally with bullish ratings and price predictions, something that came back to haunt them hours later. While Netflix managed to surpass consensus estimates on earnings per share, revenue, and paid subscribers added domestically and internationally, future guidance was weak. The company is predicting Q2 EPS of $0.55 versus Wall Street estimates of $0.99, CNBC reports .

Wall Street Misses the Mark

Before earnings, Deutsche Bank’s Bryan Kraft reportedly bolstered his rating on the stock to buy from hold. He based the upgrade on the anticipated outlook for subscriber growth in 2019 and 2020, suggesting that Wall Street’s forecast was overly modest. BMO, another analyst firm, reportedly lifted its price target on Netflix’s stock to $400 from $360 and attached an outperform rating. Not to be outdone, Bank of America was on the same bandwagon, reportedly advising investors to “buy the dips” in Netflix shares. With NFLX shares currently trading at $359, here’s your chance. Today’s price movement comes after the stock barely budged over the past three months.

Mashable’s Michael Nunez told TD Ameritrade Network that the metrics to watch for Netflix will be international sign-ups as well as the amount the company doles out for original content and licensing deals. It was next quarter’s bottom line, however, that stole the thunder.

Netflix and the Streaming Wars

Competition for streaming content has been heating up. Disney launched and competitively priced its own version of a content streaming service ($6.99 per month) that will go head-to-head with Netflix. Disney takes a more family-friendly approach compared to its rival. For instance, Netflix is behind teen show Insatiable, which has been criticized for its fat-shaming tone. It’s possible that Netflix will start leaning more in Disney’s direction with G rated content. Netflix CEO Reed Hastings is already pursuing film and a place for the company’s content at the Academy Awards. Meanwhile, Apple and NBC also recently revealed that they are entering the streaming fray.