Netflix to Hit 270 Million Subscribers in 6 Years Despite Disney and Apple: Analyst

Despite predictions to the contrary, Netflix still has a very bright future, analyst says. | Source: Shutterstock

Netflix (NFLX) is down by over 31 percent from the all-time high of $423.21. From a strictly technical perspective, the stock has already entered bear territory. Even the mainstream media is starting to doubt the company’s ability to sustain its growth.

Forbes published an article in July stating that based on profit estimates and the average industry valuation, the fair value of Netflix stands at $120. Investors may seriously start considering the projection of the business magazine.

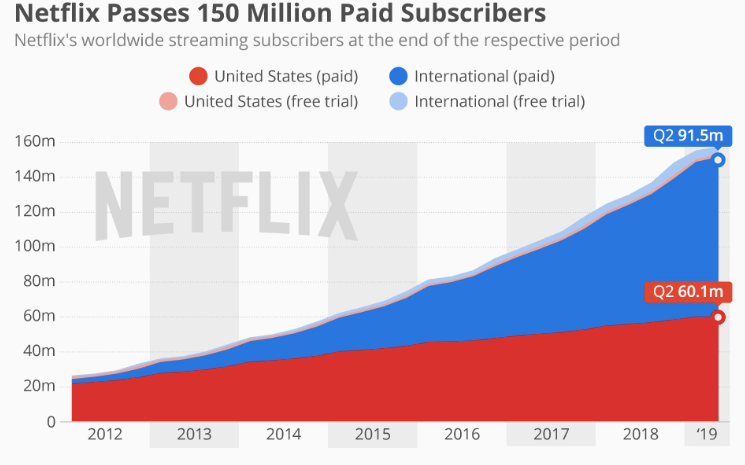

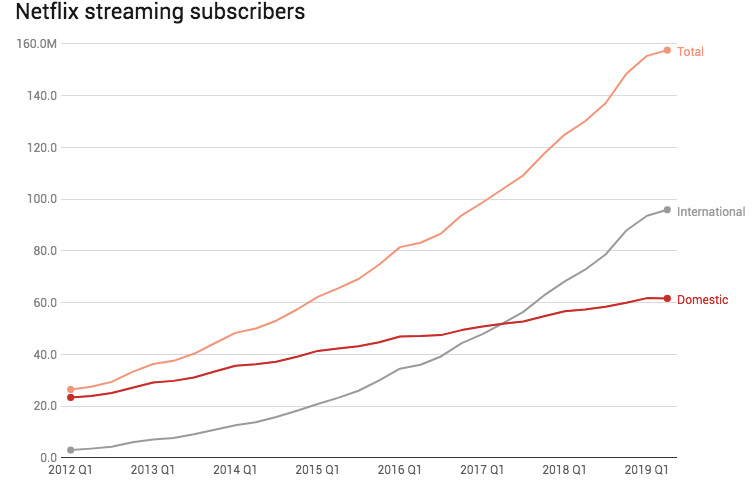

The streaming company lost 130,000 subscribers in the U.S. in Q2 after eight years of unstoppable growth.

More importantly, other companies such as Apple (AAPL) and Disney (DIS) are entering the on-demand streaming service area. These media giants are after Netflix’s subscribers. Experts predict that the streaming wars will be in full display in November as Apple and Disney both launch their streaming services in the same month.

It appears that the future looks grim for Netflix. However, a research analyst of a market-leading consulting business believes that the streaming titan will continue to dominate the space.

Disney and Apple to ‘Erode Netflix Market Shares Everywhere’

The next five to six years will be a challenging time for the streaming giant. The company will now face competition from other media companies such as Disney and Apple.

According to Morgan Stanley analyst Benjamin Swinburne , Disney is likely to acquire over 130 million subscribers worldwide by 2024. The analyst also believes that the media company would have 13 million subscribers by the end of 2020.

Estimates for Apple’s TV+ service is not far behind. Analysts at Wedbush believe that the tech company would have 100 million subscribers in three to five years. In its research report, Wedbush noted that the

company’s installed base and unmatched brand loyalty

would make the medium-term goal realistic.

In addition, Tony Gunnarsson, the principal analyst at the research consulting firm Ovum, believes that Netflix will go head-on against tough competitors.

The head researcher spoke with CCN.com and said,

Looking back at the 2010s, it’s clear that Netflix did not really face much real competition as it was able to build its huge global business almost unchallenged. In the 2020s, however, this won’t be the case as every media company in the world will be lined up to take on Netflix, and the might of giants like Disney and Apple will for sure erode Netflix market shares everywhere.

Netflix Finds Salvation in the International Stage

While the growth of Netflix in the U.S. is showing signs of weakness and other media companies are out for blood, the streaming company is establishing a strong foothold in other countries. In the first quarter of 2019, Vox reported that the tech company added 7.86 million subscribers. That’s a growth of over 30 percent from the nearly 6 million subscribers it added in the same quarter last year.

Also, Mr. Gunnarsson acknowledges this trend. The research analyst told CCN.com:

Netflix will be in growth until at least 2025. In that year, Ovum believes Netflix will have increased its total global subscriber base to about 270 million, driven by international markets particularly its cheaper subscription tiers in huge scale markets such as India.

Netflix’s CEO Reed Hastings validates this sentiment. In a speech at the Economic Times Global Business Summit in New Delhi, the top honcho said,

Given the consumer base, the next 100 million [subscribers] for us is coming from India.

Currently, Netflix has over 150 million subscribers. If the assumptions from the researchers and analysts above are accurate, then the streaming giant has a massive upside of over 44 percent in terms of subscriber growth in the next six years.