Amazing! Nasdaq to Add XRP Liquid Index, Crypto Bulls Rush In

The Nasdaq is taking the plunge with an XRP-based index. | Source: Shutterstock

By CCN.com: Nasdaq exchange is adding Brave New Coin’s XRP Liquid Index tomorrow, sending crypto traders into a bull frenzy.

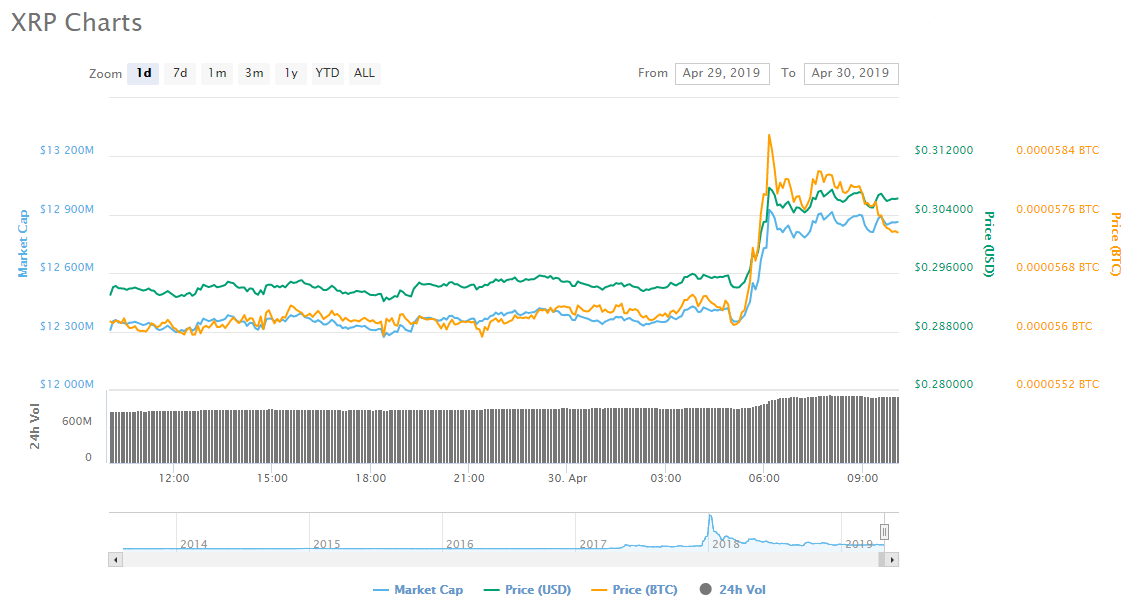

Within an hour of the announcement, XRP had surged by about 4%.

The announcement comes within months of Nasdaq adding Brave New Coin’s (BNC’s) Bitcoin and Ethereum Liquidity Indexes – BLX and ELX. They are all part of the Nasdaq Global Index Data Service.

The launch of crypto indices is clearly significant because it plays right into the mass adoption of cryptocurrencies. Institutional traders who may have been on the sidelines are being drawn into the space with the launch of each index.

Also, the launch of the indices could lead to regulatory approval for crypto-based derivatives in the market, as CCN.com previously reported.

More Ways to Track

The BNC XRP index addition will allow users to track the price of XRP “with far greater transparency than before,” Nasdaq boasts. With a market cap of roughly $12 billion, XRP is currently the third-largest crypto asset behind bitcoin and Ethereum.

According to the Nasdaq press release :

“The XRP Liquid Index (XRPLX) to meet the marketplace requirement for a single, reliable and fair USD price for XRP — based on live real-world trading activity. The index is designed to report a market price at which liquidity could enter or exit an XRP position.”

Spot On

The XRP Liquid Index has several features that make it ideal for settlements and accurate spot pricing. This includes 30-second intraday pricing, end-of-day OHLCV, and time and volume-weighted-averages, according to Nasdaq.

Like its bitcoin and Ethereum indexes, the XRP Index will provide a real-time spot or reference rate for the price derived from the most liquid parts of the global market. XRPLX could serve as the base price of XRP for regulated investment vehicles in the long term. The same holds true for BLX and ELX.

Nasdaq indices are not concentrated in a small group of exchanges or over-the-counter (OTC) exchanges. Rather, the indices take into consideration all platforms processing cryptocurrency trades and find a reliable spot price.

Right now, the exchanges for the XRPLX include Bitfinex, Bitstamp, Poloniex, and Kraken. Nasdaq says it plans to add Coinbase in the future.

Floodgates Opened?

Traditional trading players like Nasdaq have long been considered key to the mass adoption of crypto. The exchange doesn’t want to get left behind in the space that is growing despite challenges.

The Nasdaq news comes on the heels of Ripple revealing a 54% sales-spike with institutions buying XRP. It released its Q1 2019 XRP markets report last week showing it sold $169.42 million in XRP from January to March. Institutional sales accounted for $61.93 million, more than one-third of all its sales.