Morgan Stanley Analyst Cries Wolf, Predicts Prolonged Dow Earnings Hell

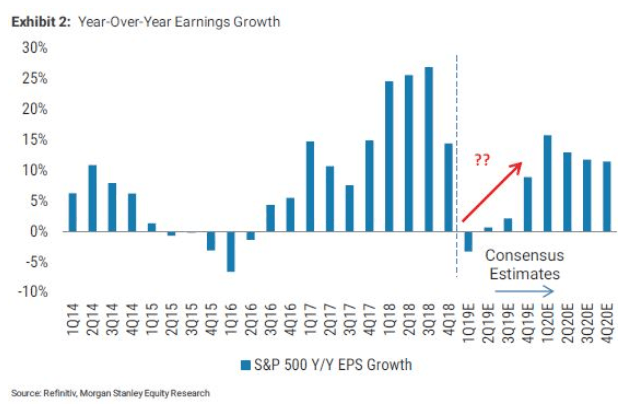

Morgan Stanley analysts must have gotten up on the wrong side of the bed. They have issued a doom-and-gloom report about corporate earnings, choosing to focus on the glass half empty while other forecasters manage to see it half full. The Wall Street firm is predicting an “earnings recession,” which translates into at least two straight quarters of hell for stocks and the Dow Jones Industrial Average.

While most analysts expect that Q1 results will be excruciating, they can also see a light at the end of the tunnel. The consensus view is that earnings growth will return in Q2, green shoots of which have already begun to emerge. Morgan Stanley Analyst Michael Wilson, however, is much more negative. His report is cited in CNBC :

“This is where the rubber will meet the road for stocks. We’re comfortable saying that the stock market is well aware of the weaker earnings growth expected this quarter. However, the real question at this point is what the second half of the year will look like.”

Analyst Cries Wolf

If you’re an investor, the last thing you want to hear is that the Dow or S&P 500 indexes are stuck in the doldrums for the foreseeable future. Unfortunately, that’s what the Morgan Stanley report is saying. While Wilson seems fine to believe that market conditions are worse than anticipated, he fails to extend that same courtesy to the possibility that things are improving.

The R word has been tossed around quite a bit of late in light of the global economic slowdown. While the glass-half-full economists maintain that the likelihood of contraction actually happening is slim to none, an earnings recession would be similarly damaging to sentiment. Investors have already priced Q1’s woes into stock prices, and estimates have been adjusted to reflect lowered expectations. Wilson is making no provisions for upside surprises, which, if he’s right, is not good news for the Dow, S&P 500, or the Nasdaq.

“[A] lowered bar into the quarter does not mean the likelihood of a beat is greater. The forecasts for 1Q19 have been lowered substantially and we do not think we are going to see a beat big enough to lift index growth into positive territory.”

Fortunately for investors, Wilson has cried wolf before .

Earnings Recession Fears Are ‘Overblown’

Other Wall Street firms have considered the possibility of an earnings recession but have come to better conclusions. Credit Suisse reportedly believes that the earnings recession will be averted, while Bank of America Merrill Lynch is forecasting profit growth in Q2.

Canaccord’s Tony Dwyer believes that the worries stemming from earnings recession are”overblown,” he told CNBC. Corporate America hasn’t suffered a negative earnings quarter since 2016. Nonetheless, Dwyer points out that at the time, both profits and revenues suffered. This time, companies are expected to report rising revenues despite profit declines.

The banks kick off Q1 earnings season on Friday.