To the Moon! Crypto Evangelist Brian Kelly’s Jaw-Dropping Bitcoin Price Prediction

Bitcoin price could find lunar footing with markets settling in the next bull cycle, according to crypto fund manager Brian Kelly. | Sourc:e: Shutterstock

Pay no attention to today’s pullback in the crypto markets. With the bitcoin price expanding as much as 30% in April so far to hover above the $5,000 level, it’s brought out the perma-bulls. Crypto fund manager Brian Kelly is among them.

Now that bitcoin is seemingly back from the abyss, he is no worse for the wear from the crypto winter. In fact, he’s returned with his boldest prediction yet — the bitcoin price will surpass its previous high of nearly $20,000.

But you’re going to have to wait for it. Kelly on CNBC suggests a new peak for the bitcoin price is a no-brainer, saying in response to a question about whether we’ll see record highs:

“Without question this next cycle. You’re talking probably a two-year cycle.”

There’s a method to his madness. Kelly points to the upcoming halving of the bitcoin supply, which is planned for 2020.

“The cycle for bitcoin is usually about a year before to a year after. So over this two-year period, you will likely get this big upswing — particularly if the institutions come in — and I think we surpass all-time highs.”

Bitcoin Price ‘Back in the Saddle’

Kelly’s of the camp that the bitcoin price most likely bottomed out at the $3,000 level at year-end 2018. Not only is the bitcoin price trading at November 2018 levels once again, but the fundamentals are intact. Keep in mind BTC doesn’t always trade rationally. But if it did, here’s the recipe for the when moon prediction:

- “active wallet growth up 26% since January”

- Transactions revisiting 2017 levels

- CME bitcoin futures “large open interest holders” at an all-time high

Predicting the bitcoin price is a tough business. You become the butt of many jokes.

‘Institutions at the Gate’

If anecdotal evidence is any indication, it’s when moon for the bitcoin price. Institutional interest in crypto is ramping up. Consider the turnout at the FO256 digital assets conference for sophisticated investors. The event, which was hosted by crypto investment management firm Arca, appears to be standing room only.

“Joy seeing Family Office/high-net-worth individuals taking notes, learning at FO256; talking to panelists and more,” tweeted Arca’s David Nage.

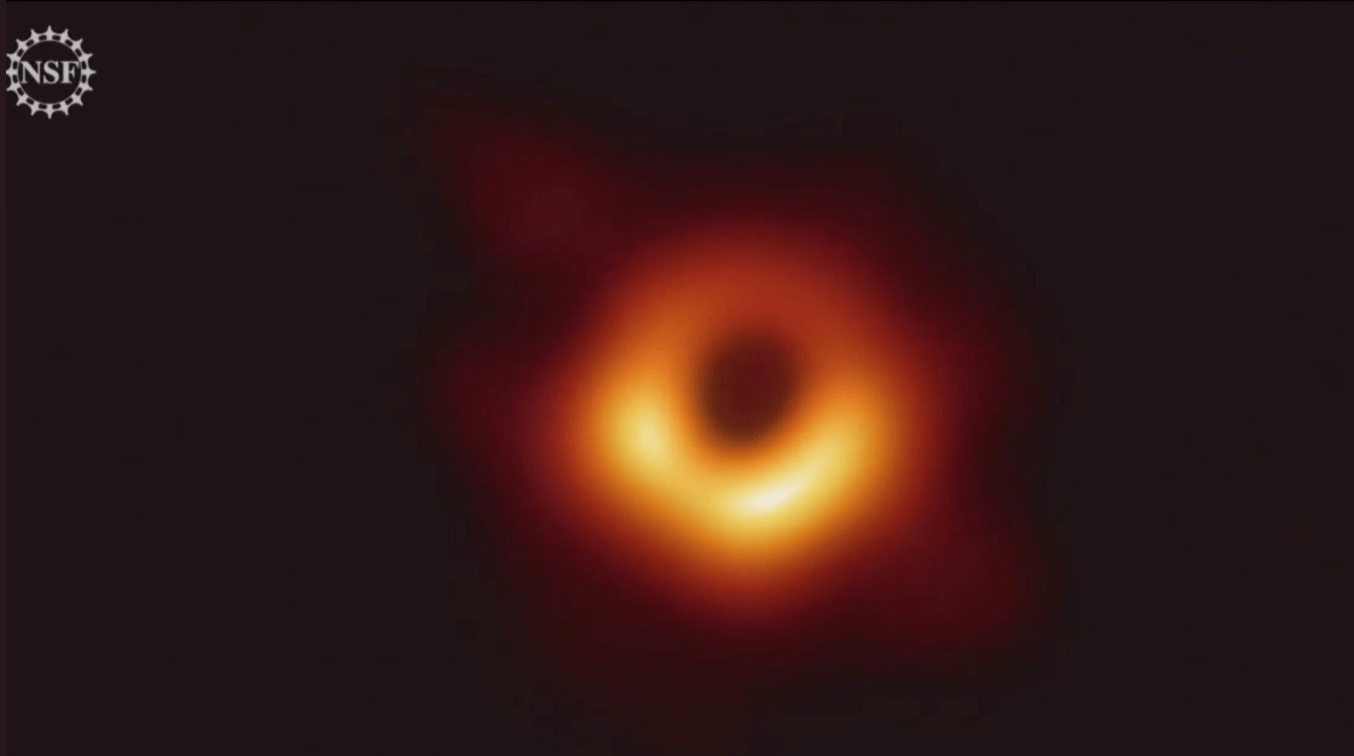

Bitcoin Price: Black Hole or to the Moon?

Skeptics still believe that the bitcoin price has fallen into the black hole.

Perma-bulls like Fundstrat’s Tom Lee, however, are impressed by bitcoin’s resilience. Lee told Bloomberg :

“An instrument that can go back to its 200-day and hold it is now back in a bull trend. So I think sentiment has to change because bitcoin is now in a bull market.”

Bitcoin whales, who are the early BTC investors, are back and they are putting dry powder to work in crypto. This is a sign that the bitcoin’s April rally is more than a blip, today’s declines notwithstanding, and has legs.