Mammoth Dow Jones Rally Should Follow End to US-China Trade War

Fundstrat predicts that sunny skies lay ahead for the bitcoin price. | Source: Shutterstock

According to an exclusive Reuters report , the U.S. and China are moving rapidly to establish a comprehensive trade deal, a move that could fuel the rally of the Dow Jones to continue on across the upcoming months.

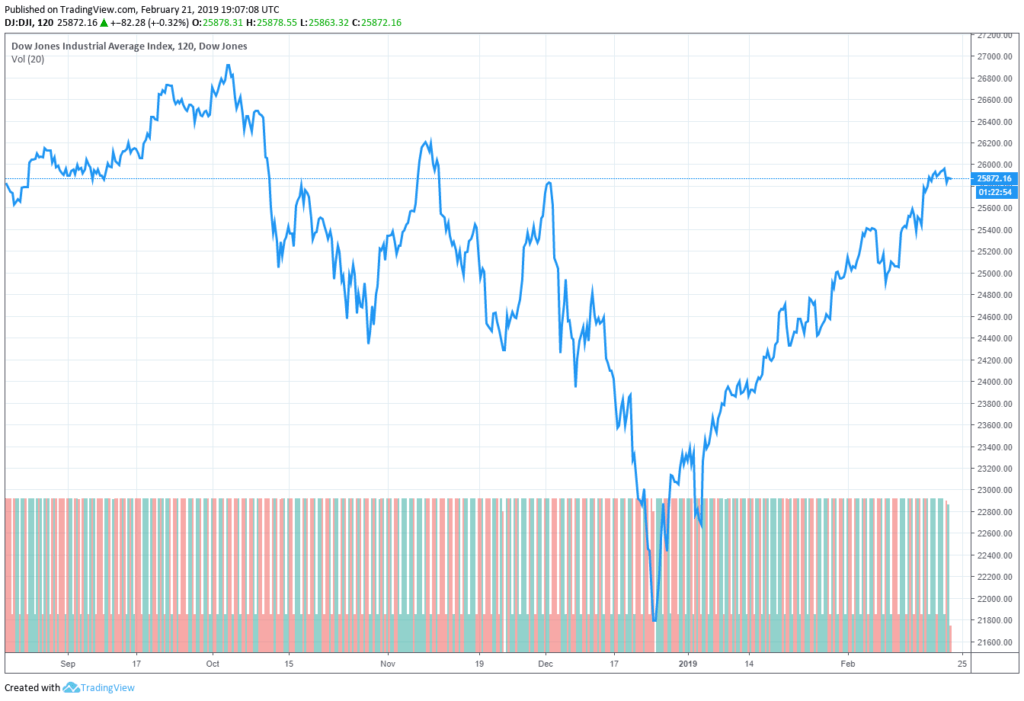

New Trade Deal Bodes Well for the Ongoing Dow Recovery

Sources close to the negotiation told Reuters that the trade talks have seen most progress in recent weeks despite the heavy demands outlined by President Donald Trump.

The core issues the Trump administration has laid out for the Chinese government to address pertain to the structure of the economy of China.

Hence, creating a full-scale accord could fundamentally change the way corporate China functions, which most likely has held back the Chinese authorities in the discussions.

“Negotiators are drawing up six memorandums of understanding on structural issues: forced technology transfer and cyber theft, intellectual property rights, services, currency, agriculture and non-tariff barriers to trade, according to two sources familiar with the progress of the talks,” the report read .

Crucial For the Dow Jones

Currently, fundamentals in the U.S. market are at their strongest points. The unemployment rate of the U.S. is at a 50-year low, household balance sheets are at record highs, and key sectors like oil have recovered following a poor half in 2018.

However, as Art Hogan, chief market strategist at National Alliance said, the trade war between the U.S. and China is preventing the Dow Jones and the rest of the U.S. market from demonstrating a strong recovery.

Once a trade deal is established, analysts expect most of the pressure on the U.S. stock market to be alleviated, possibly triggering a new rally for the Dow Jones.

“That’s confirmation of what we’re concerned about. The last thing we need is have actual data confirming our greatest fears. Now, is some of that tied to trade talks with China and could some of that dissipate if we have a deal done? Absolutely, but it’s impossible to untangle those two things right now. That’s our reality,” Hogan said.

Already, insiders in the Chinese government reportedly stated that the U.S. and China have come to a consensus to eliminate discrepancies in trade through MOUs that cover complex issues.

The only core issues that remain are said to be the U.S. government’s concerns on the industrial policies of China, which both countries have been fiercely unwilling to compromise on.

Ultimately, economists including Bill Lee, a Milken Institute executive, said that China is more desperate and urgent to land a deal than the U.S. due to the growing number of defaults in the country.

If the slowdown in the domestic market of China pushes the trade talks forward, the probability of a comprehensive trade deal in the near-term rises, massively boosting the prospect of the Dow Jones throughout the next quarter.

Lee explained:

“If we had a traditional slowdown in China, China would have unquestionably pumped up credit and shot out their housing market and try to revive domestic demand that way. Right now, you see how reluctant they are to do so because they [have] already gone on a campaign of reassuring the world we are having a policy in place that put a lid on the rising leverage.”

“That is the big constraint the Chinese are facing now and that’s why I think they are so desperately looking to make a deal with Trump.”

How the Stock Market Could React

While the sentiment around a potential trade deal has improved, the outcome of the trade talks still remains uncertain.

The establishment of a full-scale trade deal even after the March 1 deadline could fuel a rapid movement in the U.S. stock market and the Dow Jones, re-establishing momentum in the markets.

Featured Image from Shutterstock