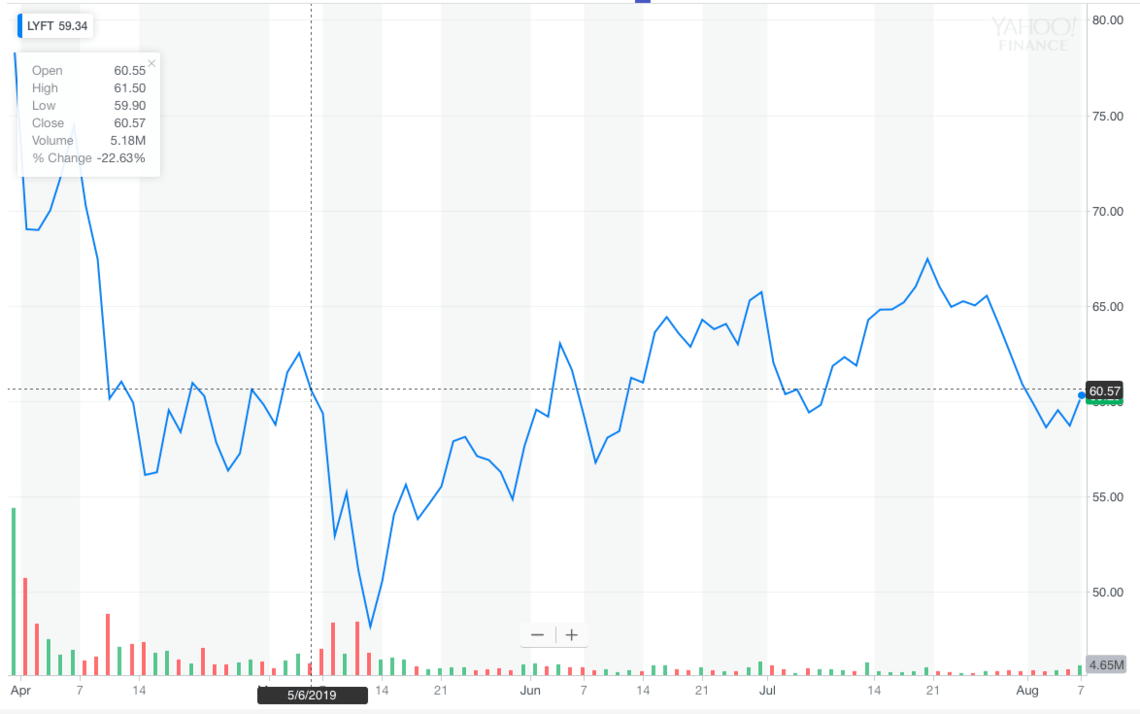

Lyft’s Loss Could Have Been Worse, Investors Throw the Stock a Lifeline

Lyft delivered second-quarter earnings which showed a smaller loss than expected, and investors are cheering the news by lifting the stock 5%. | Source: Shutterstock

Lyft delivered second-quarter earnings on Wednesday. Losses were still gigantic although a bit less than expected. The rest of the news was mostly bad but with a few bright points.

Let’s parse the most important numbers to see what Lyft is telling us and where the stock may go from here.

Good News

Lyft delivered revenue of $868 million versus $505 million in the second quarter of last year, an increase of 72 percent year-over-year.

Right off the bat, this is a bright point for the company. Seventy-two percent revenue growth for a company that continues to battle for market share is very impressive.

This good news is linked to another positive development. The number of active riders increased by more than 40%, from 15.45 million to 21.81 million. The fact that revenue growth exceeded rider growth tells us that these new passengers are using the rideshare service more than once.

Revenue per active rider increased by more than 20% from $32.67 to $39.77. It isn’t clear yet if this increase is due to an overall effect from price increases or if passengers are traveling further then they had in the past.

It’s likely a combination of both.

Bad News

Now for the bad news. Lyft’s adjusted net loss, which backs out a number of one-time charges and stock-based compensation expenses, was $197 million. That is a slight increase from the $177 million loss in the same quarter last year.

Tied into this number is cash flow, which is expressed as adjusted EBITDA. Lyft had a $204 million cash burn versus $191 million cash burn in the second quarter of 2018.

It’s actually a little bit better than that because once non-cash items are pulled out, the six-month cash burn is only $70 million.

This tells us that the company continues to lose money and burn cash. However, the cash burn is not horrific. From the look of the financial statements, the company’s cost of revenue doubled to $630 million, general and administrative expenses increased from $100 million to $267 million, and R&D increased $64 million to $310 million.

This tells us that the cost of running the company continues to rise as it expands, which is not unusual. It is notable that the company increased its R&D spending almost fivefold. That begs the question of exactly what it is that they are researching and developing.

Future Improvement

As for the future, Lyft raised guidance for both the third quarter and full year. Revenue is expected to be between $900 million and $915 million for the next quarter, with total annual revenue now expected to be about $3.5 billion, up about 6%.

Lyft also expects its annual revenue growth rate will now be 61%, up 52%.

The biggest change will be in adjusted EBITDA, which is now expected to be a loss between $850 million and $875 million. However, that is a substantial improvement from the expected $1.16 billion loss.

Of particular interest is that the company inferred that its venture-capital benefactors will stop subsidizing rides in the near future. That may put an end to the ride-share price wars. That, in turn, will mean higher prices for consumers. If that’s the case, and Uber also lifts prices, that actually brings yet more competition into the market in the form of taxicabs.

Taxicabs have been destroyed as rideshare has taken over. If taxicabs are no longer being undercut, their utilization rates should improve.

As far as Lyft’s stock, it’s up 5 percent after hours to $63.50 with a $17.5 billion market cap. Thus, it is trading at about 4.5x revenue.

That is still an extremely high valuation on a company that is losing money and burning cash.