Lyft IPO: Beating Uber to the Punch Absolutely Crucial to Fuel Growth

Lyft chose to conceal an important statistic to "avoid investor confusion." Meanwhile, the stock is down more than 25% since its IPO. | Source: AP Photo/Gene J. Puskar

Lyft, the ride-hailing giant based in the U.S., has officially filed its S-1 IPO registration and is set to be listed on the NASDAQ by April, before Uber.

Early reports suggest Lyft is expected to secure over $100 million from the IPO and is forecasting a valuation of around $20 to $25 billion.

Overvalued? Lyft Records $911 Million Net Loss in 2018

In its S-1 filing , Lyft disclosed that the company recorded a net loss of $911 million in 2018, up by more than $200 million since 2016.

Although the company has generated substantial losses in the past three years, it has translated to significant growth in revenue and ride bookings.

Since 2016, within a 2-year span, the revenue of Lyft has increased from $343.3 million to $2.2 billion, by more than 540 percent.

The bookings on the Lyft app surged from $1.9 billion to $8.1 billion in the same time frame, by 326 percent.

The rapid rise in the number of bookings on the platform made possible by the company’s scalability-first mindset allowed Lyft to secure 39 percent of the ridesharing market in the U.S.

Lyft said :

“Together, these investments have enabled us to create a powerful multimodal platform and scaled user network that has resulted in the rapid growth of our business. Our U.S. ridesharing market share was 39% in December 2018, up from 22% in December 2016.”

Several analysts have said that the strong figures and the relatively large market share Lyft has over the U.S. ride-sharing market could enable Lyft to appeal to investors as a fast-growing competitor against the dominant Uber.

Speaking on Yahoo Finance, Jay Ritter, University of Florida Cordell Professor of Finance, said that the IPO of Lyft before Uber could provide the company with more visibility that may allow the firm to achieve a bigger valuation from the IPO.

Ritter said :

“I think it’s going to give more visibility to the company. Uber’s got a bigger market share in the United States but Lyft’s market share has been growing and additional publicity for Lyft is going to help it.”

“It’s very well positioned to go public. Both companies have been hemorrhaging money and they’ve been focused on growth rather than short-term profitability.”

The professor further emphasized that Lyft has been able to gain market share at a rate that exceeded analyst expectations because it had not suffered controversies and scandals like Uber.

“One of the reasons they’ve been gaining market share is because they haven’t had all the controversies that have been associated with Uber,” Ritter added.

In 2017, Uber reportedly suffered scandals and blunders regarding sexual harassment claims, poor treatment of drivers, and questionable executive conduct.

Around a similar period, the growth of Lyft increased at an exponential rate, as noted in the company’s S-1 document:

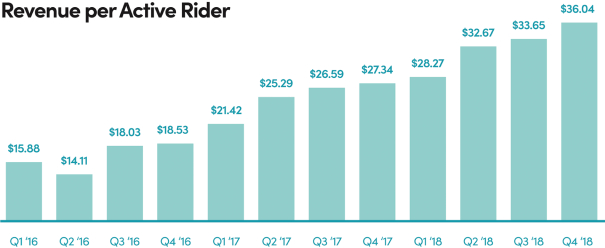

“The growth rate in Revenue per Active Rider increased significantly in the first and second quarters of 2017 as our brand and values continued to resonate with riders and they increased their usage of Lyft instead of competing offerings.”

Lyft expects investors will focus on the rapid expansion of the company’s revenue, bookings, and market share rather than its operating losses.

Lyft IPO Filing Identifies More Growth Catalysts

In its IPO filing, Lyft identified additional modes of transportations such as scooters and bikes as an important future market for the company.

The firm is eyeing subscription services as the demand for new rides such as scooters continues to increase in the future, which could excite some investors in the entrance of a relatively new and untested market.

“We expect the number of Rides to continue increasing as the number of Active Riders increases, we expand our network of shared bikes and scooters and we develop new offerings, such as subscriptions.”