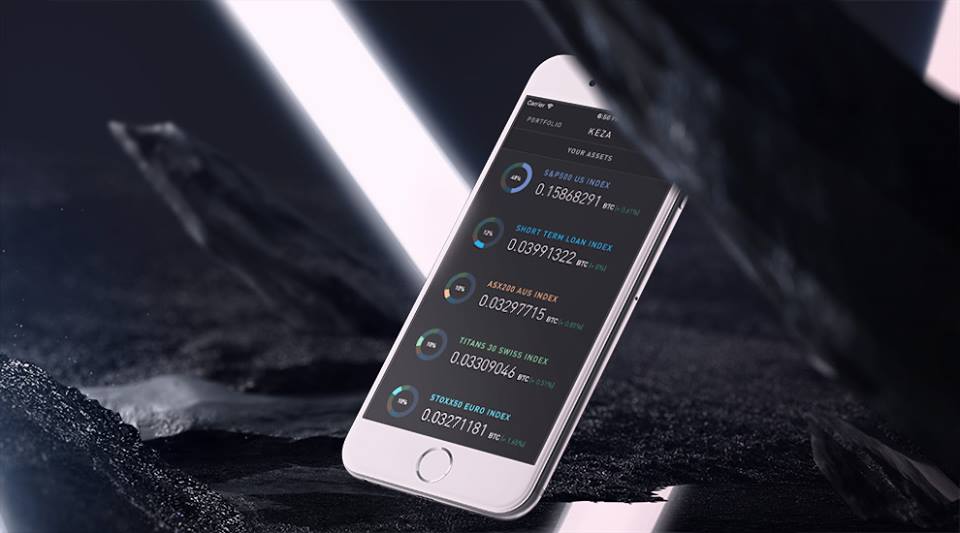

Keza App Allows Users To Invest Bitcoin In Stocks And Fixed Income Portfolios

Keza , a New York-based startup, launched an iOS app that allows users to invest bitcoin in stocks and fixed incomes, according to Nasdaq. There are moderate, conservative and aggressive portfolios. The company has raised $357,000 and is backed by Digital Currency Group and Jason Calacanis of HOF Capital.

The riskier the portfolio, the greater the exposure to volatile assets like foreign stocks. Once a user picks a portfolio, they can deposit bitcoin and track investments over time. There is a 1% maintenance fee, according to the Keza website.

Stefan Britton and Simon Burns, company founders, came up with the idea after looking for options to invest bitcoin.

Duo Uncovers A Financial Need

“My co-founder and I had been reviewing all of the options to invest our bitcoin and kept looking for a product that just didn’t seem to exist,” Burns said. “We started coding and putting together an MVP, that MVP got us into Boost.VC and developed our vision for the company.” (BoostVC is a technology startup accelerator program that accepts startups in groups called “tribes” has announced that it will be going 100% Bitcoin for the foreseeable future.)

The pair decided to launch the app after beta tests and conversations with mobile phone users in emerging markets indicated a lack of access to modern financial services and investment options.

There are no deposit minimums. The app will allow investment in emerging markets currently restricted to investors who can reach a $1 million minimum.

Burns, in response to questions on ProductHunt.com , said most users will likely be from emerging markets. Investors in emerging markets lack access to high caliber investments and have moved into bitcoin to use banking services like cross-border payments and remittance services.

The company on its website noted the portfolios are invested across global markets and different assets to ensure long-term returns across all market conditions.

BTC-Denominated Indices

Burns said the investments are made in bitcoin-denominated indices.

“So on a day the SP500 goes up 2 percent, your allocation to the SP500 goes up 2 percent in Bitcoin terms (i.e. 1BTC becomes 1.02BTC). We’re aiming to launch fiat products in the medium term,” he told ProductHunt.com.

The iOS beta app is available for users outside the U.S. only. Users who want an early access can sign up on the Keza website.

Featured image from Facebook/Keza.