JPMorgan’s Advice for Navigating Wild Stock Market Swings: BTFD

Two top JPMorgan analysts are encouraging investors to buy the dip whenever the stock market tumbles, saying any Dow plunges are temporary. | Source: REUTERS / Lucas Jackson

Two top JPMorgan analysts are encouraging investors to keep calm during any forthcoming stock market downturns and to buy when the Dow Jones tumbles. Why? Because they say the dips are temporary and the stock market will eventually recover any of its lost gains.

JPMorgan: Stock market will regain previous highs

JPMorgan quant guru Marko Kolanovic and chief U.S. equity strategist, Dubravko Lakos-Bujas, urge investors to BTFD (Buy The F***en Dip) and not squander a great opportunity.

Kolanovic and Lakos-Bujas made the assertions in an Aug. 8 investor note, as reported by CNBC .

“We do think that after a short period of stabilization, markets will likely regain previous highs. And hence, we see this sell-off as a medium-term buying opportunity.”

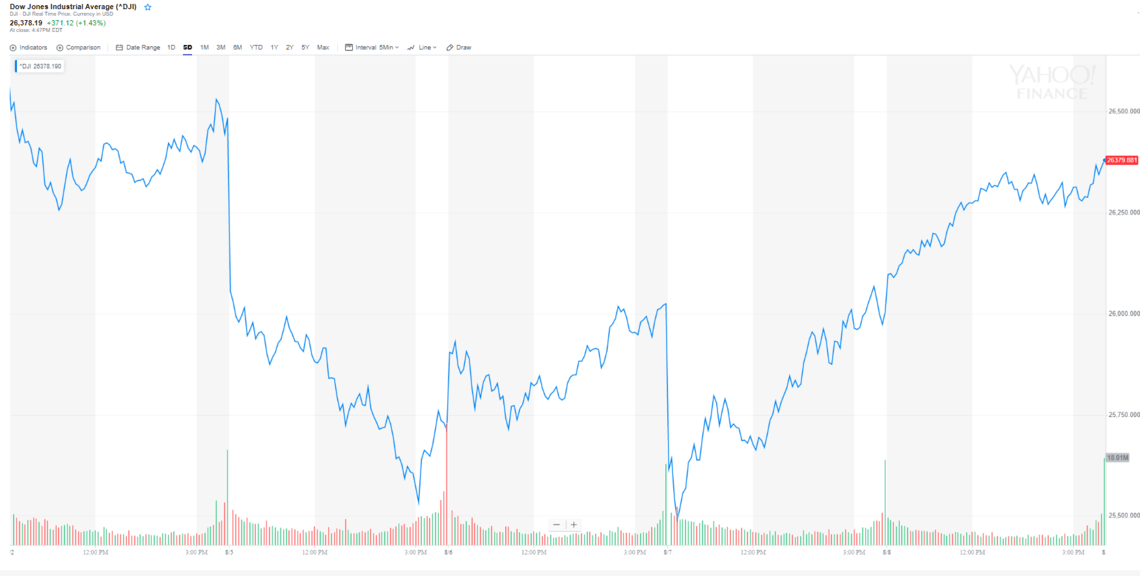

As CCN.com reported, the U.S. stock market experienced several erratic swings this week amid the escalating U.S.-China trade war.

Since tumbling 890 points on Aug. 5 after China devalued the yuan to near-historic lows, the Dow has made an uneasy but steady recovery.

Analysts see limit to U.S.-China trade tensions

Kolanovic and Lakos-Bujas expect trade tensions between the United States and China to continue. However, they don’t expect “further uncontrolled escalation.” Why? Because they believe that President Donald Trump doesn’t want a trade war-induced recession, which could hurt his chances of re-election.

Moreover, the JPMorgan duo believes that the stock market will go higher because of these contributing factors:

- Wage growth

- Better-than-expected corporate earnings

- Quantitative easing from global central banks

While Kolanovic and Lakos-Bujas say the current macro environment is “far from perfect, macro fundamentals likely justify higher equity prices.”

According to FactSet , 76% of S&P 500 companies reported a positive EPS surprise for the second quarter. This translates into a bullish market outlook.

“With central banks globally in easing mode, cash is becoming less rewarding, leaving equities as potentially the only alternative with an attractive yield and long-term growth potential.”

Top economist: Recession fears are overblown

Wall Street was roiled by astonishing stock-market turbulence this week. However, top economists telegraphed last year that the Dow Jones would experience this kind of ferocious instability in 2019.

As CCN.com reported, Mohamed El-Erian — the chief economic adviser at Allianz SE — warned back in December 2018 that the stock market would endure wild swings in 2019 because of financial uncertainty in Europe and China.

In fact, El-Erian said that 1,000-point swings in the Dow would be the new normal this year.

“Don’t be surprised if you see these 1,000-point swings in the Dow Jones. That is our new reality for a while.”

However, El-Erian said that despite the stock market volatility, the U.S. economy will remain strong and will continue to grow at a robust rate of 2.5% to 3%, while wages will continue to rise 3% or more.

El-Erian added that the U.S. economy will slow down a bit this year as Europe and China experience decelerations. However, he said the fears of an imminent U.S. recession are overblown. Barring catastrophic circumstances, “[a recession] is certainly not becoming a reality,” El-Erian said.