Enjoy This Stock Market Rally While It Lasts

This stock market rally has delivered mouth-watering returns. According to JP Morgan, bulls should enjoy it while it lasts - which won't be much longer. | Source: Shutterstock

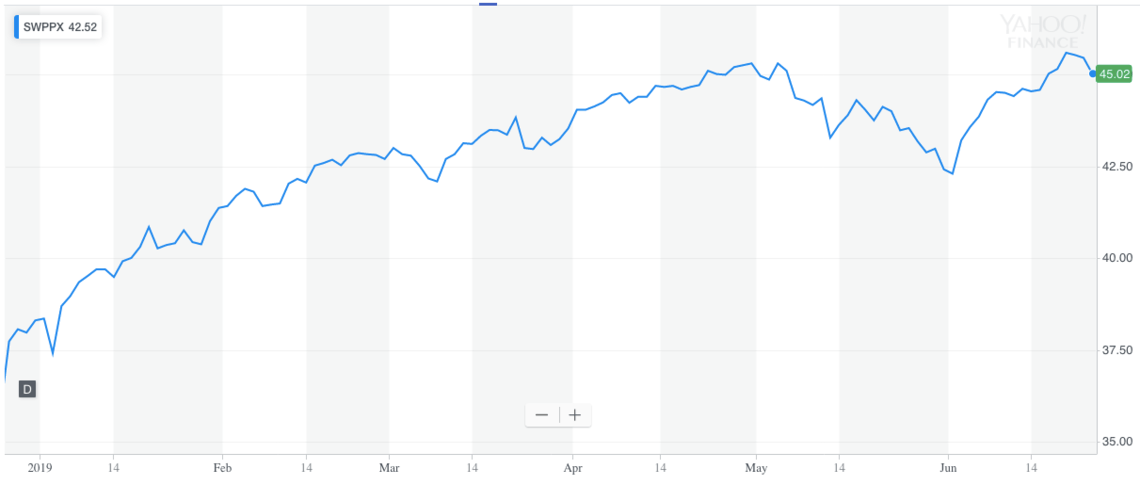

The S&P 500 is charting its best first half of the year in over a decade. Meanwhile, the Dow Jones Industrial Average is having its best June since 1938 amid a triumphant year for stock market bulls.

But the fundamentals underlying these benchmark movements are troubling. The stock market is looking wobbly to JP Morgan chart analyst Jason Hunter.

It may be that this rally is all frosting and no cake.

JP Morgan Analyst: Stock Market Rally Won’t Last Under Current Conditions

The biggest gains in the stock market belong to defensive equities classes like utilities and consumer staples. These recession-proof assets tend to be more resilient to market cycles.

Cyclical stocks that correlate with economic growth (like technology and consumer discretionary companies) are lagging the broader stock market benchmarks.

In a Wednesday note to investors, Hunter said :

“We do not believe the divergence between Cyclicals and Defensives can persist if the S&P 500 Index is set to extend the rally through the summer. In our view, either cyclical markets need to start outperforming and take the leadership role in a rally, or the broad equity market is vulnerable to a material setback.”

That’s a bet Bank of America is ready to make. The bank’s head of United States equity strategy, Savita Subramanian, has raised consumer discretionary stocks to overweight from underweight while shifting utilities stocks to underweight from overweight.

Headlines Are Spooling Up The S&P 500

As Hunter pointed out on CNBC’s Fast Money earlier this month:

“Most important–– this has been a very headline-driven market over the past several months. We have G20 coming up, the trade stories…”

The stock market benchmarks are in a precarious position when the prices of equities are driven by the news cycle. The center of gravity for corporate valuations is too top heavy when the stock market gets pushed around so easily on rumor, speculation, and innuendo.

The main headlines churning stock markets in 2019 have been the U.S.-China trade negotiations and the Federal Reserve’s dovish turn.

The former is speculation, and investors have no way of knowing where the U.S.-China trade chips will fall. The latter is price inflation – driven by a potentially artificial expansion of liquidity.

That excess liquidity could also run away from the stock market and into global macro hedges, as we see capital flowing to alternative assets like gold and bitcoin.