Jamie Dimon Defends Trump’s Tariff War as Stock Market Bleeds

Liberal JPMorgan CEO Jamie Dimon surprisingly defended Trump's hardline trade war tactics, even as they continue to make the stock market bleed. | Source: REUTERS / Mike Blake

By CCN.com: Jamie Dimon has been in the news with a number of surprising opinions lately, but his latest interview could perhaps be the most maverick. Speaking to Poppy Harlow on CCN.com Business , the JPMorgan CEO revealed that – contrary to the stock market’s horrified consensus over Donald Trump’s aggressive posturing on trade tariffs with China – the president’s policy is actually working.

Earlier in the year, Dimon spoke out against the U.S. government shutdown – warning that it could slash economic growth to zero – as well as Trump’s tax cuts, which in his opinion have done nothing for ordinary American workers. Cutting a distinctly liberal tone on the topic, one would think that Dimon was a full-on anti-Trumper, but in this interview, he made it clear that his thoughts on Trump’s economic policy are decidedly non-binary.

In particular, he made it clear that he does not see the short term reaction of the stock market as a reliable judge of a situation.

Stock Market Reaction is ‘Expected, But Not Disastrous”

In Jamie Dimon’s opinion, while the stock market’s much-reported reaction to Trump’s tariff threats are not good for anyone, it does not necessarily mean that an economic apocalypse is at hand if the said tariffs are indeed imposed. He believes that while imposing such tariffs may have a negative impact on the market, America will be fine in the long run and the dreaded specter of a trade war will probably never actually happen.

Speaking further on this point he said:

“Tariffs increase the odds of a trade war, that’s all. I think if you had tariffs, you would see reactions in the marketplace that are not what either side wants.”

Soothing as they are, Dimon’s words will come as scant consolation to investors who were caught cold by Trump’s Sunday tweets, which single-handedly threw the stock market into a storm of volatility.

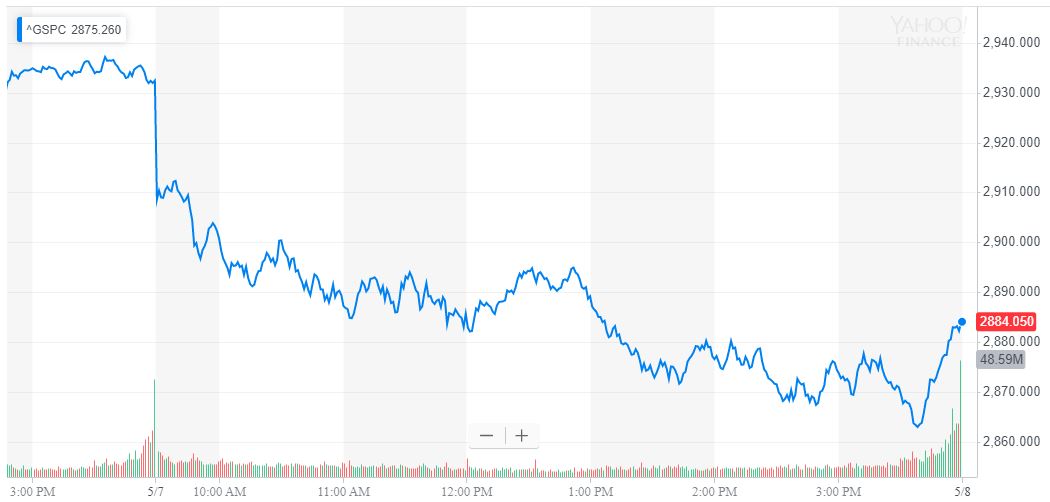

On Tuesday, the Dow Jones Industrial Average crashed by 473 points or 1.79%, only slightly better than the Nasdaq’s 1.96% collapse. The S&P 500 fared best among Wall Street’s major indices, losing 1.65% to careen below 2,900.

Jamie Dimon: Chinese Negotiations Justify Trump’s Shock Tactics

While the market continues to suffer in the wake of Trump’s Twitter-fueled scorched-earth tactics, Dimon believes that everyone is actually missing the bigger point about the president’s hardline strategy. In his opinion, America needs to re-balance its economic relationship with China.

“There are serious issues around trade. We want the issues seriously looked at and resolved. On the other hand, a trade war wouldn’t be a good thing and I do believe that both the U.S. administration and China are trying to get to a proper deal.”

Regardless of whatever collateral damage the president’s aggressive tactics cause to the stock market, Dimon says that Trump is actually succeeding where no one before him has – getting China to even negotiate.

Regardless of opinions like that of former White House economic adviser Gary Cohn who memorably stated earlier this year that “Tariffs don’t work,” Dimon believes that there is a method to Trump’s madness.

In his view, Trump’s aim is not actually to use tariffs as an economic instrument, but actually to use the threat of tariffs to force China into a negotiating position that it has not had until now. He said:

“I agree with [Gary Cohn]. [Tariffs] don’t work technically, because they cause all these various things, but I think if the president were here, he would say, ‘They worked. I got them to the table, and no one else did.’ So as a negotiating strategy, it might have worked, yes.”