Investors Rush and Crush to Buy $36 Million Ethereum-Based BAT ICO

Frenzy. One of the most anticipated token sale -about a web browser- sold out in 30 seconds. An investor paid $6,000 in transaction fees to jump the queue and be the very first. Another paid $2,000.

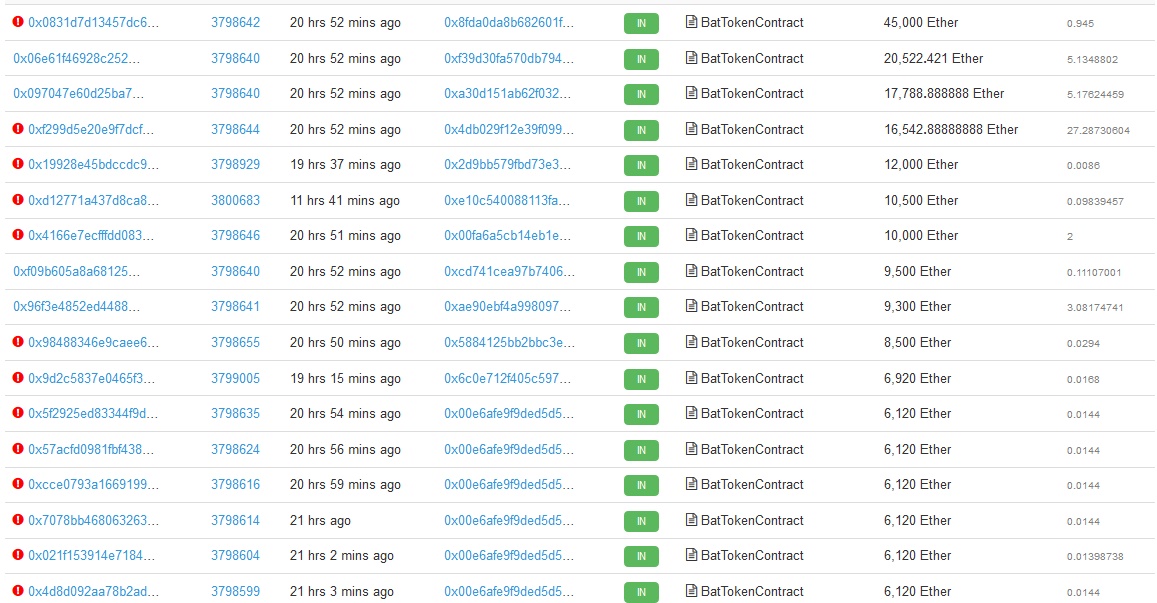

Seconds after the opening of the sale, millions poured in. Around $5 million is the highest sum invested, followed by around $4 million, with many more at $2 million and $1 million.

You simply had no chance of getting in. $65,000 in fees have been paid for transactions which did not go through because the cap had already been reached by that stage.

Bots. An army of them raced at block 3,798,640, crashing some nodes and wallets, kicking everyone else out of the network, with the event finished nearly as fast as Husain Bolt can run 100 meters.

Once that $36 million cap was reached, everyone else crashed against a wall, with their transactions rejected, but their fees kept by miners. That includes someone who sent $10 million, but their transaction was unable to get through, the network so returning their funds.

They, of course, are not happy for losing the bot race, so they took on to complain for any number of reasons, including how unfair it is they did not make it to the finishing line.

They’ll be able to once it starts trading, but they’re unhappy they could not buy at what probably will be the lowest price, the sale price, and that instead they will have to pay a premium either because their bot is rubbish or their fee was not $10,000.

How to make this process a bit more inclusive is a difficult question. Vitalik Buterin has suggested the opening price should start at infinity, say 1000 eth for 1 token, then gradually come down.

It’s a nice idea which hasn’t yet been fully tried, but the ecosystem is experimenting. Some think that experimentation should be halted and dinosaurs from the SEC – who probably don’t even know how emails work, maybe have some vague idea what a simple blockchain like bitcoin’s is, and probably no clue whatever what ethereum’s smart contracts are, let alone tokens – should step in.

The suggestion is usually made by jealous bitcoiners, who cry freedom when heroin is bought on silk road, then cry criminals when innovative projects are funded by the free people.

That said, the ecosystem does face some difficult questions and contribution to the debate by experts, including lawyers, IPO experts, and yes even the SEC, is always welcomed, as long as it is along the lines of how the process could be made fairer.

Because while tokens do have similarities with many other things, like cars had similarities to horses or birds to airplanes, they are also a very new and different invention which we haven’t really seen before.

Because they are code, code which may create new business models that could disrupt some industries, like advertising, as BAT aims to do by allowing individuals to opt-in towards seeing ads, get paid BATs in return, with some of it paid to publishers too, and the payment made by advertisers.

That is a potentially new “better than free” model, whereby not only are you given free content, but you are also rewarded for it. Of course, it might not work, but that’s the process of innovation – experimentation to see what does work.

That means our elders need to learn how to run first before they bring their hammer, because this space combines Silicon Valley’s mantra of move fast and break things with that of Alibaba’s – move fast and let regulators catch-up.

Featured image from Shutterstock.