Interview: BTC.com’s Alejandro de la Torre on Bitcoin, Crypto Mining, & Whether Satoshi is Female

Alejandro de la Torre is a busy man. His role as VP of Business Operations at BTC.com, Bitmain’s largest mining pool, involves managing the team, educating users, speaking with potential new customers, scouting out business opportunities, talking about BTC.com and Bitmain on the conference stage, and traveling — a lot.

Born in Venezuela and now living in Holland (with a multitude of miles in between), Alejandro spends most of his time on airplanes. In fact, right after our interview at Web Summit in Lisbon, he was jetting off to Tel Aviv, although not for work this time, but for a friend’s wedding, “we lost another one,” he sighs ruefully and shrugs his shoulders.

With his long hair slightly disheveled after battling high winds and heavy rains outside the arena, he leans back in his chair and smiles. “They closed the entrance, I didn’t think I was going to make it on time.”

Actually, he didn’t. In fact, we’d rescheduled the interview a couple of times already, but I wasn’t going to hold that against him. I’d ask him about Bitmain’s upcoming IPO instead.

“I can’t talk about that,” he states firmly.

Not even a little?

“No, sorry.”

The Outcome of Bitmain’s IPO is Anybody’s Guess

It was expected to be an off-limits topic. As the largest Bitcoin mining manufacturer, Bitmain has two pools, BTC.com and Antpool controlling around one-third of the Bitcoin hashrate.

It was the most profitable blockchain company at the start of the year, posting $1.1 billion in profit in Q1 2018 , although it took a big hit in Q2 and went on to record an estimated $400 million in losses according to BitMEX Research.

Still thought to be valued around $15 billion (depending on the week), Bitmain filed for its IPO on the Hong Kong Stock Exchange on September 26 — one that (if it happens) will set a record for the crypto industry. But latest developments in the market and fresh regulatory concerns out of Hong Kong are not painting a cheery picture.

According to the Nikkei Asian Review, Bitmain’s chances of getting listed on the Hong Kong Stock Exchange are dwindling since another major Bitcoin mining company, Canaan, just let its application lapse.

It seems that unrelenting market conditions and regulatory headwinds are disrupting crypto companies’ plans to go public. At least, that’s how it appears on the outside.

While the details of Canaan’s delayed IPO aren’t being disclosed, analysts explain that this usually happens when there’s regulatory uncertainty or unfavorable market conditions.

With bitcoin’s price hitting new yearly lows daily and hovering around $4,500 at the time of writing, it’s also possible that the company will have to adjust its valuation.

Moreover, “controversial” companies like bitcoin mining farms have an uphill struggle convincing regulators that their assets pose no risk to investors.

While Bitmain, Ebang, and Canaan are filing as chipmakers who just happen to serve other industries, such as blockchain and AI, it hasn’t gone unnoticed that the lion’s share of turnover comes from bitcoin mining.

But we can’t talk about that.

Alejandro’s Life Before Bitcoin [Which He Can Barely Remember]

What happens with the Bitmain IPO is really anyone’s guess right now. And whatever Alejandro’s opinion on the subject, he’s not sharing it with me. So, what can we talk about? I try to break the ice once again.

Tell me your story then. How did you get here, and what was your life like before Bitcoin?

A smile spreads across his face, I think I’m forgiven for the IPO question.

“I can hardly remember life before Bitcoin!” He laughs, “let’s see, I was an entrepreneur, and I was really into history and politics and what makes the world and society tick. So when I read the [Bitcoin] whitepaper in early 2013, I thought that was the answer I was searching for.

“It was an alternative financial system that basically gives humanity the opportunity to use this cryptocurrency however they want without anyone telling them what to do and what not to do. So, I thought this was a very important human discovery and achievement… So I bought a bunch of bitcoin and the price shot up!”

He laughs, before pausing, “But of course then it went straight back down. That’s why I don’t let these bear markets scare me anymore.”

However, this is the world of crypto where the situation can turn on a virtual dime. Since our chat, the markets are bleeding, and lately, we’re waking up to $25 billion losses in 24 hours. I wonder if Alejandro’s still not breaking a sweat. He continues:

“In early 2013 there was just a small amount of companies, so I started creating companies and the last one–I didn’t start it, but I came in very early on–that got acquired by Bitmain, and here we are.”

Do you feel like you’re exactly where you’re meant to be right now?

“Absolutely, yes, I do! Although there’s still a lot of work to be done. There are some challenges in this industry. Our main goal at BTC.com is to try to onboard more people. We need to really try to make it much easier to get more users.

“We’re always trying to find ways to make it very simple for people to use. I mean, once people use Bitcoin or Bitcoin Cash or Ethereum, they find out how easy it really is. It just sounds scary with all this technical language, but once you see the benefits of the technology, you’re in.

“I think the benefits of this technology sell themselves, but we need to find a way to make it easier for people to get in. So that’s what we are trying to do.”

What does that include?

“For example, anything from partnerships like, we’re the only Bitcoin app in the Huawei phones. That’s something I did a year ago. And just to make the app more fun and secure and easier to use.

“Also, BitPay is another way to enhance mass adoption of crypto, as a crypto merchant company that allows anyone to accept payment in crypto in a very easy way, with our wallet, you can easily send to any BitPay merchant. This furthers our goal of trying to get to the masses.”

And how is that going? Mass adoption feels like a long way off…

He ponders for a moment, before saying, “One of the things that is hurting mass adoption is scaling. We need to figure scaling out. This technology is still very new. Some people think that scaling through on-chain scaling (so increasing the block size) is the right way forward; others think that layer-2 solutions like Lightning and Rootstock (RSK) are the way forward, too. So we still don’t know, it’s a big unknown, a big experiment.

“We saw in late 2017 how many people came into Bitcoin, and Bitcoin fees got very, very high and I felt that really hurt adoption.

“Right now in the bear market, it’s a good time for all the companies and all the developers and all the guys in Bitcoin, Bitcoin Cash, and all coins to figure out how to effectively scale the system for when the next big push comes.”

And how far away is that solution?

“Well, the Lightning Network is already underway, but I think there’s still a couple of years before it can truly scale to be at a point where some people want it to be. I think Bitcoin Cash is ready to scale, and I would say that it’s the coin that is most ready to scale.”

What other cryptocurrencies do you mine?

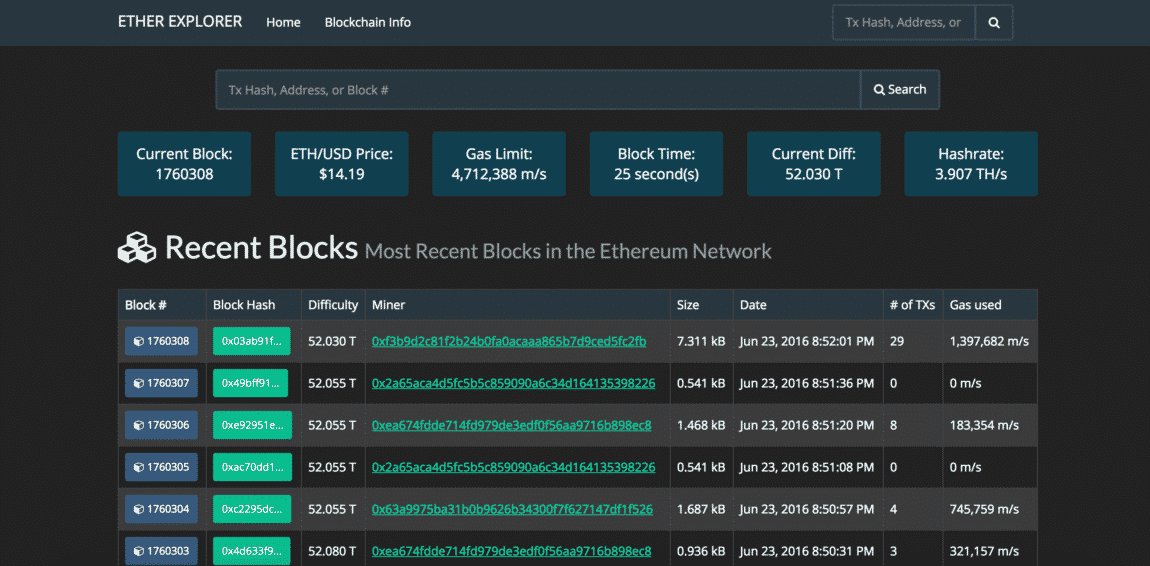

“We just started mining Ethereum and Ethereum Classic, and we just came out with Ethereum Block Explorer.”

Is that like Etherscan?

“Yeah, it’s like Etherscan, we’re doing the same thing as Etherscan, but we’ve had a block explorer for many years now, and I think we’re poised to take on Etherscan because they hold a lot of the traffic in Ethereum, but we’re poised to be better than them.”

Why mine Ethereum as well? Is this a maneuver to keep your portfolio diversified?

“It’s not so much that,” he explains. “We’re following our goal of creating an alternative financial system and help humanity with this technology. Ethereum has proven to be a good technology, a good coin. People use it, so we’re just providing more products. Plus, having a diversification of tools and products and solutions is much better than just having one. It’s a good thing for the industry; it’s a good thing for Ethereum.

“We all have to work together, we’re still in very early days when you think about users–I think Facebook has 2.2 billion–we’re talking about 50 million right now,” he bursts out laughing… “We’ve got a long way to go.”

Let’s touch on Proof of Work versus Proof of Stake? Are you concerned about Ethereum moving to Proof of Stake at all?

He pauses for a long time and furrows his brow before replying, “no.” It wasn’t as decisive a no as the answer to my IPO question, though. You know those “nos” that almost sound a little like a “yes” when the short monosyllabic sound is stretched out just a little longer than usual?

“It’s not a concern,” he insists. “I think it’s a very interesting time to look at what would happen if such a big mining pool based on Proof of Work transitioned to Proof of Stake. It’s going to be very interesting to see how it develops.

“I mean, there have been small coins that have transitioned, but we’re talking about thousands, not millions here so it’s a very interesting development and I think the Ethereum guys can pull it off.

“As for the mining pool, our tech guys are working very, very hard to pull off some kind of hybrid mining pool for Proof of Stake. So it’s something we’re already preparing ourselves for. It’s a good thing, let’s see what happens,” he says again as if trying to convince himself before coming out with what I was expecting to hear:

“Although, I believe the Proof of Work model is a very good model. It’s been proven, and security has been proven, so I staunchly believe in Proof of Work. But that doesn’t mean we can’t see what happens with Proof of Stake.”

And what about the environmental impact with Proof of Work?

“Well, I have a couple of things to say on that subject. First of all, mining pools are in places where energy is clean, and they’re creating jobs. And in the second place, you have to look at it as a very important technology that will help us people have an alternative to banks and help us grow and be financially secure.

“If you look at Bitcoin like I do then the energy usage is just fine. This decentralized system that’s not controlled by anyone, yeah it runs on electricity, so sorry. But the existing financial network also runs on electricity. All the benefits outweigh that.”

A lot of people say that China holds too much of the hash power and that mining should not be centralized. What do you think about that?

“The miners look for cheap energy right? And it just happened to be that the Chinese government built a lot of hydroelectric power plants because they envisioned huge cities, and most of them didn’t come to fruition. So now there are these hydroelectric dams in the middle of northern China that were supposed to power a city of a million people and the energy is just being shot into the ground.”

So it was going to waste?

“Yes. So the local people, they want to create jobs, and a mining farm is a very good way to create jobs for the local town and also transfer that otherwise surplus energy into something that makes money. So that’s what happened in China.

“But now a lot of the mining is done in places that are cold, that have surplus energy, so it’s no longer how it used to be back in the day, it’s changed, the environment has changed, the industry has changed. There’s a lot of mining in Norway, Siberia, in Iceland, in Canada, in the United States.”

So a cold climate is key — but not a regulatory one. Is that why we’re seeing more mining outside of China?

“That plays a role as well.”

Tell us about the work you’re doing with RSK…

“Sure, we’re going to be integrating Rootstock (RSK). It’s very interesting technology it allows for smart contracts on Bitcoin, and it’s as we saw with Ethereum, it’s very popular, everyone likes them, so it’s very good to have that technology on Bitcoin.

We’re very happy to provide merged mining with Rootstock, so if you’re a miner in our mining pool, you can mine Rootstock at the same time. What that does is it adds the security of the Bitcoin blockchain network, or our pool, onto RSK. Now [that] Rootstock has BTC.com it provides them with much more security.”

More miners, more numbers, more security?

“Yes.”

OK, so my final question then, this is a little OT. Who is Satoshi Nakamoto?

He laughs.

Do you have any theories at all?

“I do,” he says decisively. “My theory is that it doesn’t matter because if there was a face behind Bitcoin a lot of people would focus on it. Like Vitalik Buterin, he is Ethereum. But with Bitcoin, people can focus on the technology and user adoption, and products and services and not on the person.”

He pauses and looks at me earnestly for a moment, then a hint of a glint flashes in his eyes. “If I had to choose, though, I would say it’s probably a woman.”

You’re not just saying that because you’re talking to a woman?

He leans back in his chair and roars with laughter when I call him out on what he’s just said. “No, no,” he tries to assure me, “That’s what I always say!” Whether or not he believes that is another matter.

In an industry where women make up a sliver of the numbers, I suppose it’s possible that Satoshi is female. It’s also possible that Bitcoin will hit $1 million by 2020, and perhaps it’s more plausible than Satoshi being Craig Wright.

In this crazy crypto world of epic gains and losses, jam-packed with the largest collection of Side-show-Bobs and off-the-wall characters imaginable, all bets are pretty much off.

Featured Image from Shutterstock