‘Insane’ Bitcoin Momentum Goes Overdrive as ‘Real Volume’ Hits $1.5 Billion

Bitcoin price is having a flourish, boosted by soaring trading volumes, as halftime approaches for 2019. | Source: Shutterstock

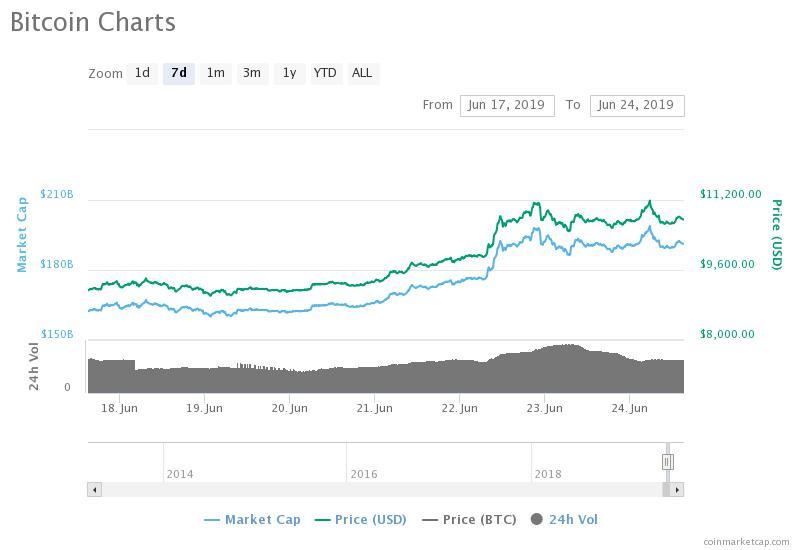

By CCN.com: Bitcoin price has increased by 16 percent in the past week against the U.S. dollar following its initial breakout of the $10,000 mark on June 21.

Luke Martin, a crypto trader, has said that the momentum of the dominant crypto asset is “insane,” indicating that minor corrections are being absorbed by the market at a fast pace and that the short term trend of the asset remains strong.

How far can bitcoin go?

Earlier this month, the “real 10” volume of bitcoin which refers to the daily spot volume of exchanges with more than $1 million in verifiable daily volume as found by Bitwise Asset Management, hovered at around $500 million.

In the last several days, the real 10 volume of the asset has spiked to over $1.5 billion, peaking at $2 billion.

The real 10 volume does not include BitMEX, which processed more than $10 billion in trades on its peak days throughout June.

“And, when you remove fake volume, CME and CBOE futures volume is significant ($91M), especially compared to the real spot volume (35% for Feb 2019). This is good news because it means CME— a regulated, surveilled market— is of material size, which [is] important for an ETF,” said Bitwise.

Based on the substantial increase in volume since March, with the CME bitcoin futures market recording a daily volume of $1 billion at its peak in May, recording a nearly 11-fold increase since March, traders expect the momentum of bitcoin to be sustained in the upcoming months.

“BTC momentum is insane right now. After reaching 11.2k yesterday price dipped sharply almost 10%. It hasn’t even been 24 hours and the dip has already vanished. Price $100 away from yearly highs. Again,” Martin said.

Since December 2018, the bitcoin price has risen from $3,150 to $11,200, recording a 250 percent gain against the U.S. dollar.

Global markets analyst Alex Krüger said that if the bitcoin price initiates another 250 percent gain in the medium to long term, it may result in the asset surpassing $38,500.

“BTC increased 250% between the December lows and now. Another 250% increase would take price to $38.5K. (Past performance not indicative of future results),” he said.

Similarly, Fundstrat co-founder Thomas Lee said that when bitcoin moves past its FOMO level, which in the case of its most recent rally is considered to be $10,000, it has tended to record gains in the range of 200 to 400 percent.

“In most markets, a ‘new high’ is needed to confirm a breakout But with bitcoin, when it trades at a price seen only 3% of its history, this has confirmed a new high imminent. This makes crypto different. This ‘3%’ is $10,000. FOMO = $10,000 Currently $250 away from FOMO,” Lee said on June 20 before bitcoin hit $10,000.

Will alternative crypto assets follow?

Sme traders anticipate that as bitcoin stabilizes above $10,000, investors would target high-risk options in alternative crypto assets or other major crypto assets, resulting in the inflow of capital to the rest of the crypto market.

For now, due to the parabolic trend of bitcoin, most traders expect bitcoin to sustain its momentum and regulated markets like the CME bitcoin futures market and GBTC to further fuel its upside movement.

“The next alt season is going to melt faces. But we’re at the mercy of #Bitcoin. When $BTC says it’s time, it will happen. Very soon,” one trader said.

Click here for a real-time bitcoin price chart.