How Tesla’s 7% Stock Drop Shows Dow Jones Isn’t in the Clear

The stock price of Tesla has dropped by 7.14 percent in pre-market following the release of CEO Elon Musk’s letter. The struggle of the car marker demonstrates the lack of fundamentals in the U.S. stock market which may lead to the decline of the Dow Jones.

Over the past week, several analysts including Morgan Stanley strategist Mike Wilson and Gluskin Sheff chief economist David Rosenberg said that fundamentals are missing in the U.S. stock market and as such, at least in the short-term, it still remains vulnerable.

Abrupt Workforce Cut of Tesla

On January 18, Elon Musk revealed in a letter sent to the company’s employees that approximately seven percent of the firm’s workforce will be let go to fund the increased production rate of the Model 3.

The letter of Musk read:

As a result of the above, we unfortunately have no choice but to reduce full-time employee headcount by approximately 7% (we grew by 30% last year, which is more than we can support) and retain only the most critical temps and contractors. Tesla will need to make these cuts while increasing the Model 3 production rate and making many manufacturing engineering improvements in the coming months.

He strongly emphasized that the cut was necessary in order to maintain the price of the Model 3 at $35,000. The demand for the Model 3 has increased significantly throughout the past year across all international markets and the company has been pressure to expand its production.

While Tesla provides long-term cost-effective alternatives to traditional vehicles that rely on fossil fuels through the establishment of superchargers, Musk noted that the initial pricing of the models also needs to be competitive in the global automobile sector.

Why Analysts Couldn’t Give an All Clear For Dow Jones

Previously, CCN.com reported that many major U.S. conglomerates in the likes of American Express and McDonald’s have not released their earnings reports.

Mike Wilson, a strategist at Morgan Stanley, explained that the magnitude of the revision of earnings by large corporations in the U.S. market shocked many investors and that until the earnings reports of most companies are released, an all-clear cannot be declared for the Dow Jones and other indexes.

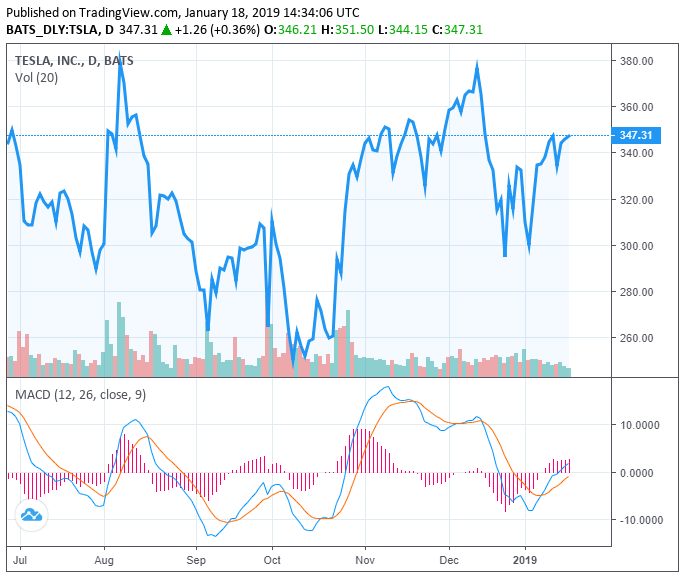

Similar to Morgan Stanley, while Tesla recorded a profit of 4 percent, its profit in the fourth quarter of 2018 was lower than its previous quarter, possibly due to the trade war between China and the U.S.

“In Q4, preliminary, unaudited results indicate that we again made a GAAP [generally accepted accounting principles] profit, but less than Q3. This quarter, as with Q3, shipment of higher priced Model 3 variants (this time to Europe and Asia) will hopefully allow us, with great difficulty, effort and some luck, to target a tiny profit,” said Musk.

China has suspended tariffs on U.S. car imports until March 1 and the two countries are making progress in achieving a comprehensive deal. But, in an event in which a deal is not achieved and tariffs on cars are reinstated, Tesla will be forced to sell most of its models in the $90,000 to $100,000 range once again.

The uncertainties in the market and the low profits of large companies may leave the Dow Jones vulnerable to a short-term correction in early 2019.