Hong Kong Protesters Get Creative to Flout Anti-Mask Ban

Hong Kong protesters are finding creative ways to circumvent a local ban against face masks. | Image: AP Photo/Vincent Yu

Protesters are finding innovative ways to circumvent the oppressive anti-mask ban which came into effect in Hong Kong on Friday.

The emergency law is unprecedented in the city’s China-led history as chief executive Carrie Lam looks for every available tool to quell the unrest.

Locals are gathering on social media to post workarounds to the ban, including this clever protest hairstyle tutorial on Twitter:

Two people were arrested on Monday morning and charged with illegal mask-wearing. AFP reports that supporters subsequently flooded the courtroom and covered their faces in defiance of the blanket law.

Meanwhile, government officials are considering even harsher restrictions, such as internet censorship. The protests are now entering their seventh consecutive month.

Privacy Remains a Key Focal Point for Protesters

Reports surfaced on Sunday that some protesters were using high-tech facial projectors to fool police across the city. That claim, however, has since been debunked.

The wearable projectors are, in any event, a legitimate concept by artist Jing-Cai Liu, who designed them specifically with privacy in mind.

Facial recognition payments are already a thing in China and Hong Kong’s more liberal populace is pushing back against a 1984-style mass surveillance that Chinese authorities are pursuing.

Investors Losing Confidence in Hong Kong Markets?

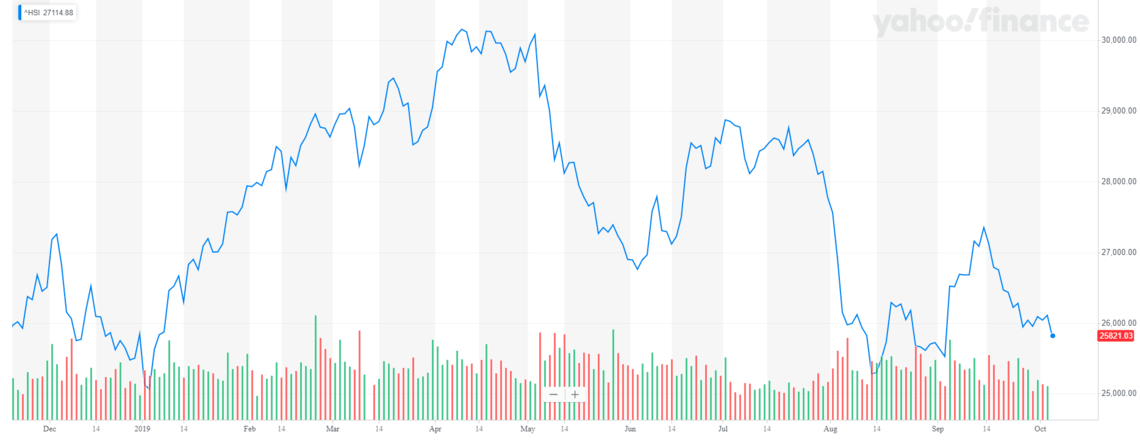

Hong Kong’s Hang Seng Index has significantly under-performed in 2019. The HSI is up a measly 3% after a stellar start to the year.

It currently trades around HK$25,821 and is rapidly approaching the lows of January.

Despite its poor performance, investment banks Credit Suisse and UBS claim there is little evidence that money is actually fleeing the city.

U.S. indices, by comparison, continue to be the best house in a bad neighborhood. The Dow Jones has rallied some 15% since the beginning of the year even as JP Morgan rings the stock market gloom alarm.