High-Rolling US Consumers Rescue Dow from Trade Hurricane

Forget the noise, U.S. consumer spending is pushing the Dow and other indices higher. | Source: Shutterstock

U.S. consumers are, more than ever, the envy of the world. While the global economy grapples with slow growth, U.S. consumer spending has prevented it from teetering on the cusp of collapse and may have single-handedly saved the Dow Jones Industrial Average in the process.

Forget the FUD: Consumers are Pushing the Stock Market Higher

Indeed, U.S. consumers are a force to be reckoned with, contributing the greatest share of the world’s GDP last year, at 18%. American shoppers alone did more for the expansion of the global economy than the whole of China’s GDP, which was a close second at 16%. There’s a way to play it, and it’s in consumer stocks.

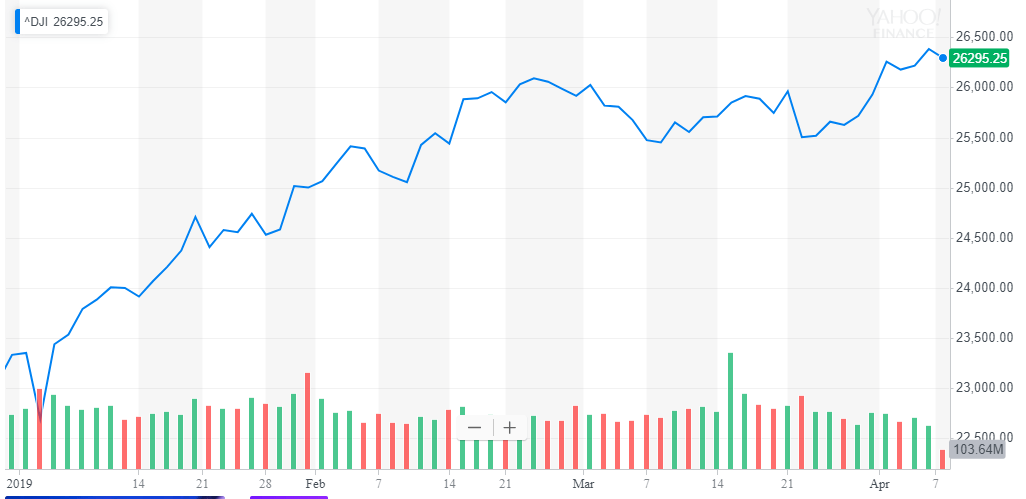

American shoppers have done more good for the economy than any damage that uncertainty stemming from a looming trade war with China has unleashed, sentiment that is spilling over into the Dow. Big spenders are fueling hopes for corporate profits, the expectations for disappointing first-quarter results notwithstanding. This is good news for the Dow, which despite being off fractionally today is posting nearly 13% gains year-to-date even as investors weather trade war and recessionary fears. You can thank the U.S. consumer.

https://twitter.com/ReformedBroker/status/1114968054931316736

Josh Brown, an investment advisor and contributor to CNBC’s Halftime Report, offered some perspective, cheering consumer stocks such as Lululemon, Amazon, Nike, Walmart, McDonald’s, and Disney. With the exception of Lululemon and Amazon, all of these stocks are in the Dow.

“The U.S. consumer is the most powerful economic force on the planet.”

Fundstrat’s Tom Lee agrees, basically saying that the drivers of the global economic demand are two-pronged: the U.S. consumer and China.

Dow Barreling Toward a Record High

As much as other parts of the world bemoan the U.S.’ influence as absurd and might be sick and tired of hearing about it, the numbers don’t lie. Good thing, too, considering the threat of a trade war between the U.S. and China is not over. Without the strength of the U.S. consumer, the Dow would be in trouble. Stocks have been sensitive to the status of talks between President Trump and China’s Xi Jinping, though much of the volatility has been fueled by too much worrying. But that hasn’t prevented the Dow from barreling toward its peak of 26,828 points, a record it set in early October 2018 .

Ray Dalio: Shrinking Middle Class a Major Risk

Meanwhile, billionaire hedge fund manager Ray Dalio is worried about the state of capitalism. He told CNBC that capitalism is in need of an overhaul, pointing to a widening wealth gap that is shrinking the middle class. The pummeling of the middle class, he says, has been a function of tech disruption and globalism that has resulted in fewer dollars going toward this group and their respective school systems.

“The outcomes as a result [of capitalism] are destroying equal opportunity,” said Dalio.

JPMorgan CEO Jamie Dimon recently made a similar argument, suggesting that taxing the wealthy more could be the solution. While it would make people such as Alexandria Ocasio-Cortez happy, it could have the unintended consequence of hurting the economy by shrinking GDP and revenues even as deficits balloon.