Bullish Hedge Funds Speculate on US Stock Market with an Insane Bet

The US stock market is poised for a comeback if hedge funds are to be believed. | Source: Shutterstock

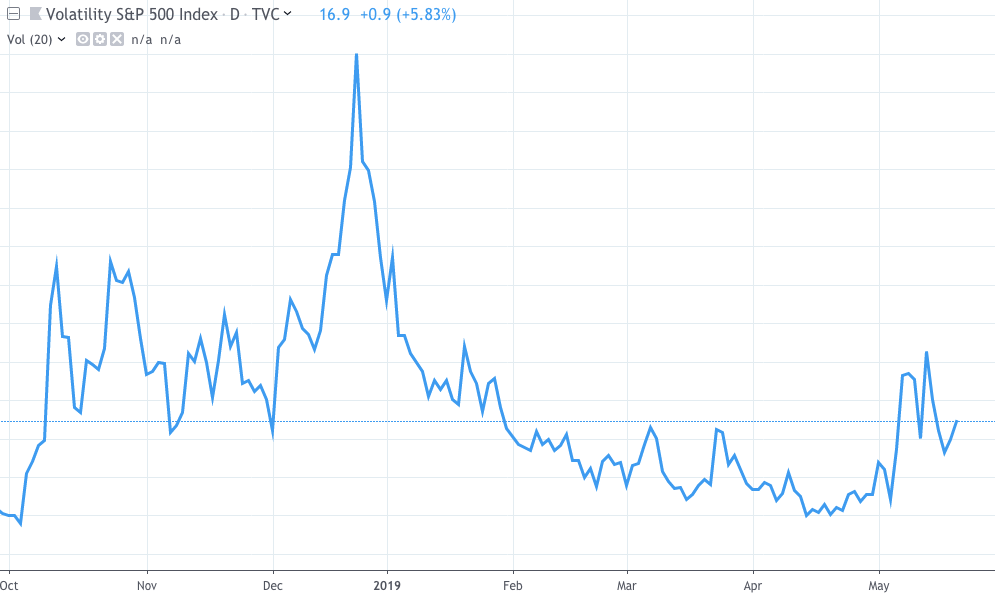

By CCN.com: The number of U.S. hedge funds betting on more stock market volatility has reached lows not seen in months. Hedge funds and other investors speculate on volatility by purchasing Volatility Index options (VIX) from the Chicago Board Options Exchange (CBOE). Ironically the Volatility Index is looking pretty volatile itself.

VIX flew up the chart last December. The Volatility Index peaked at 36 on the worst Christmas Eve in the stock market’s history. But the index has spent most of 2019 in the low teens. Volatility and a decline in markets usually go hand in hand. So the decline in calls for VIX options indicates hedge funds expect a stock market recovery.

A Strangely Resilient Stock Market

Masanari Takada, a strategist at Nomura Holdings, says :

“Investors look to have locked in profits on their long VIX calls (premised on a rise in the VIX). This rollback of downside hedges may have indirectly supported the US equity rebound. As a result, US equity exposure at hedge funds overall has turned upward again.”

But it’s a risky move to make before the U.S. and China trade negotiations finally hammer out a solution that is acceptable to both world powers’ governments.

The Stock Market Ain’t Out of The Woods Yet

What do the hedge funds think will happen to the stock market if there are more U.S. tariff increases? Or more U.S. tariffs levied on additional goods? Or more retaliatory tariffs from China? What do they make of the White House administration angling for another full-blown U.S. military intervention in Iran?

Five years after the U.S. invasion of Iraq the economy cratered into the Great Recession. Many economists believe the Iraq War is what caused the recession. It’s not hard to see why. Wars use up massive amounts of every valuable resource, from commodities to credit. In this view, the recession was a tax to pay for the war in Iraq.

The U.S. China trade talks show no sign of concluding anytime soon. Markets also cannot predict what the Trump Administration or Beijing is going to do next. Maybe they don’t even know what they’re going to do next. They’re two sides of an adversarial geopolitical relationship, and they don’t know what the other will do next.

Trump has gone on record stating that he’s ‘very happy‘ with trade talks, or lack thereof, with China.