Heads Must Roll at Dow Jones Component Boeing: Ralph Nader

Consumer advocate Ralph Nader is among the company's fiercest critics and is ramping up his call for the resignation of Boeing CEO Dennis Muilenburg. | Credit: Brendan Smialowski/ AFP

The latest hit for troubled airplane maker Boeing (NYSE: BA) is an analyst downgrade by Credit Suisse. The Wall Street firm lowered its rating on Boeing’s (BA) stock to Neutral with a $323 price target , which reflects a 2% decline from where the stock is currently trading. Analyst downgrades are the least of Boeing’s troubles, however, in the wake of the scandalous details that have emerged since two of the company’s 737 Max planes suffered fatal crashes in 2018.

As CCN.com previously reported, Boeing pilots seemingly knew about the trouble with the 737 Max stalling anti-stall system years ago, and Credit Suisse analysts believe that this is an unforgivable offense that will derail public trust and heap more risk on investors in Boeing’s stock.

Consumer advocate Ralph Nader is among the company’s fiercest critics and is ramping up his call for the resignation of Boeing CEO Dennis Muilenburg, who so far surrendered his chairmanship role in a slap-on-the-wrist conciliatory move, one that Nader described to CNBC as “the first crack.” Nader’s 24-year-old great-niece Samyo Stumo was among the victims of the Ethiopian Airlines Boeing 737 Max 8 disaster.

https://twitter.com/BoeingCEO/status/1179818505010630656

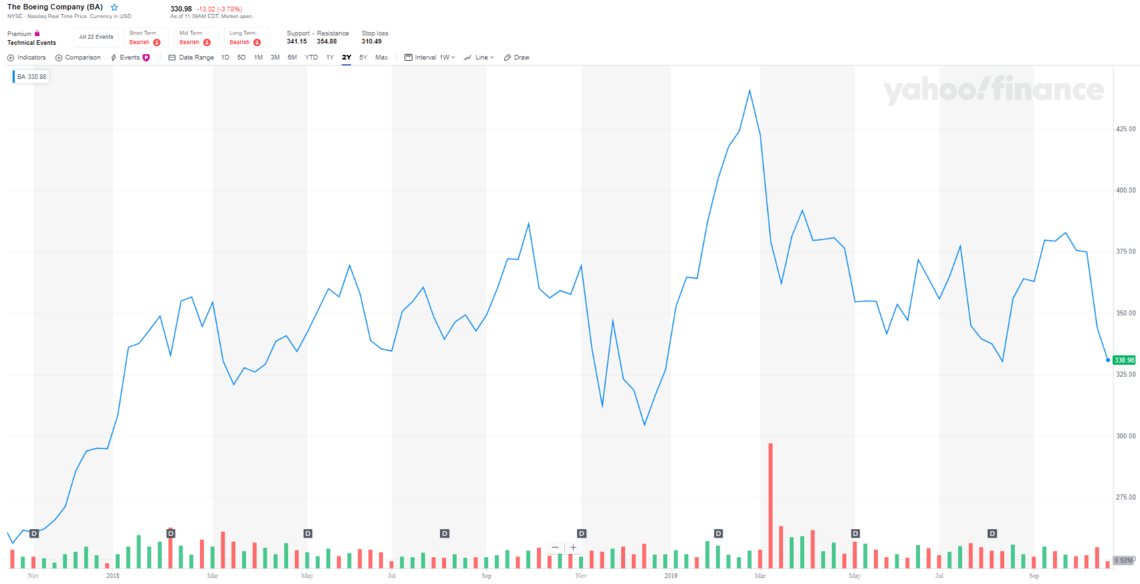

Nader has taken aim at Boeing’s entire C-Suite won’t quit until there is an entirely new board of directors. Boeing, which is a component in the Dow Jones, has taken investors on a wild roller-coaster ride in 2019 and with all the twists and turns the stock has barely budged since the beginning of the year, gaining 2%.

Muilenburg’s Pay in the Spotlight

This is not the first time that Nader has called out Boeing since the crashes. In recent months, he published a letter addressed to Muilenburg , admonishing the Boeing CEO for mismanagement and excessive compensation:

“You overpay yourself at over $23 million in 2018, which comes to about $12,000 an hour!”

Nader has also been quick to criticize Boeing’s use of capital after the company’s aggressive share buyback programs, saying:

“Did you use the $30 billion surplus from 2009 to 2017 to reinvest in R&D, in new narrow-body passenger aircraft? Or did you, instead, essentially burn this surplus with self-serving stock buybacks of $30 billion in that period? Boeing is one of the companies that MarketWatch labeled as “Five companies that spent lavishly on stock buybacks while pension funding lagged.”

He has been calling on the resignation of Muilenburg and Boeing’s entire C-Suite since even before the latest scandalous details surfaced:

“Management was criminally negligent, 346 lives of passengers and crew were lost. You and your team should forfeit your compensation and should resign forthwith.”

Undelivered 737 Max planes have cost Boeing billions of dollars, and the damage may not be done yet. Investors will be listening to the company’s Q3 earnings call on Wednesday to learn if Boeing intends to reinstate the controversial plane model or abandon it completely while Muilenburg’s future as the chief executive hangs in the balance.