Goldman Sachs’ Dire Tech Stocks Warning Contradicts Its Own Data

Goldman Sachs is blowing cold on FAANG stocks. But is it really? | Source: Shutterstock

By CCN.com: Goldman Sachs issued a dire warning about U.S. tech stocks last weekend. Their valuation premiums are at historic highs. Add the potential threat of U.S. regulatory interventions, and Goldman sees a bear market ahead for tech.

In an investor note Friday, Goldman’s chief U.S. equity strategist, David Kostin, admonished clients about the risks facing tech stocks:

“Rising market concentration and the political landscape suggest that regulatory risk will persist and could eventually weigh on company fundamentals. The valuation premium for growth is elevated today relative to history; Software in particular now carries the highest multiples since the Tech Bubble.”

Goldman is Playing Both Sides of The Fence

David Kostin cautions the valuation premium for revenue growth in tech stocks reveals a bubble. But as Goldman’s own data show, these valuation multiples were hardly any different last October–– when Kostin defended tech stock valuations to investors:

“Popularity has turned into concerns of overcrowding and outperformance has turned into concerns of overvaluation. We believe these risks are overstated.”

Furthermore, software companies like Alphabet, Adobe, and PayPal are among Goldman’s favorite stocks in its portfolio in 2019.

Goldman is Long FAANG

Blue-chip tech companies look as promising as ever. Facebook’s foray into digital payments and major play for profits with Instagram checkout will drive massive sales.

Amazon’s dominance of voice assistants through Alexa promises a very profitable future. Goldman Sachs projects compound annual revenue growth (CAGR) of 21 percent over the next three years.

Alphabet’s consistently profitable innovation and huge cash pile to fund it make GOOGL the overall top Internet stock pick for Heath Terry, Goldman’s lead analyst for the Internet sector in Global Investment Research.

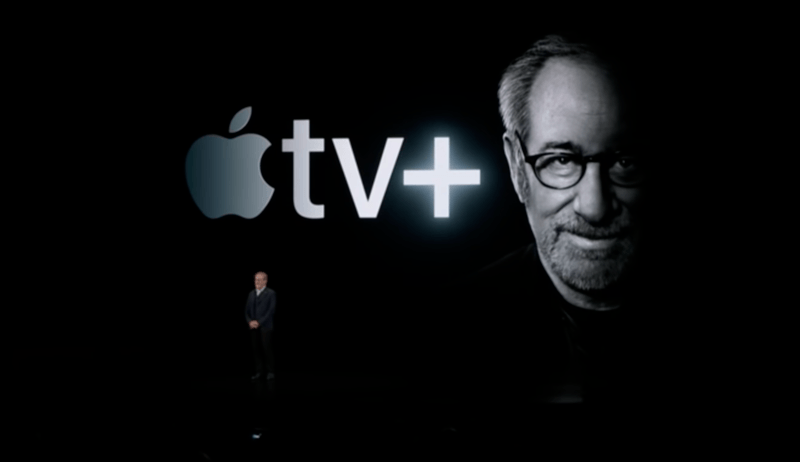

Despite a slowdown in iPhone sales, Apple’s massive ecosystem that lives on its hardware platform and the brand’s fierce customer loyalty are set to drive consistent revenue growth into the future.

For these reasons, the tech stock FUD in Kostin’s recent note doesn’t seem sincere. It contradicts Goldman’s own data, statements, and positions in the market.

Regulation Will Bolster Big Tech Stocks

The threat of antiturst regulation might leave some investors skittish in the short term. But it will likely bolster the value of Silicon Valley companies long term.

At a London keynote last June an interviewer asked enterpreneur-investor Gary Vaynerchuk about regulation. She wanted to know if he thought there should be more regulation of U.S. tech companies. He answered :

“I think it will happen in the U.S. because I think the incumbent companies like Facebook and Google, will realize that’s an advantage to them, not a disadvantage. So they will work with Congress to make these rules.”

Though he’s well-known online as a “motivational speaker,” Vaynerchuk turned hundreds of thousands of dollars in personal income from his digital ad agency into a personal net worth of $50 million by investing early in Facebook, Twitter, and Snapchat.

What he described in his answer about tech industry regulation is a concept called regulatory capture . Regulation actually helps big companies to maintain monopoly profits. It hampers new competitors with barriers to entry via regulatory compliance costs.