Goldman Boldly Predicts Strongest Stock Market Rebound in U.S. History, This Year

It's a bullish call harping back to the times where one tourists routinely packed Wall Street., before a pandemic hit.| Source: Spencer Platt/Getty Images/AFP

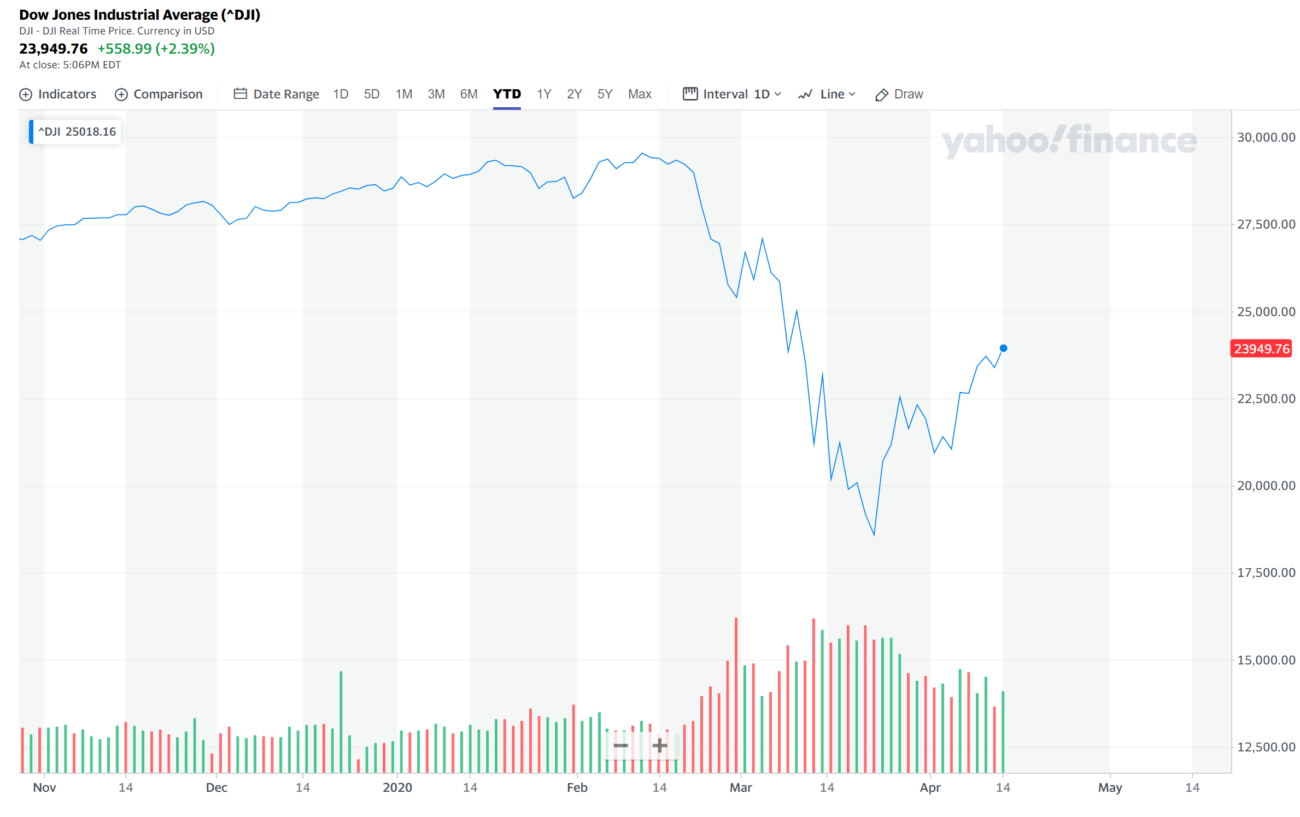

- In a 180-degree turn, Goldman Sachs and other major banks say the U.S. stock market is set to see an explosive recovery.

- By the 2nd half of 2020, economists foresee the strongest stocks rebound in the history of the country.

- Declining hospitalizations and President Trump’s intent to open the economy as soon as possible has Wall Street jubilated.

Goldman Sachs, one of the largest investment banks in the U.S., sees the strongest stock market recovery in the history of the country playing out in the second half of 2020.

In a note to clients , Goldman Sachs chief economist Jan Hatzius said that the optimism towards the stock market and economy is partly related to coronavirus, which raises the probability that the markets may not see another leg down.

Stock market bottom could be in, Wall Street argues

Up until March, the expectations of investors towards a firm stock market rally were heavily dependent on the aggressive fiscal policy of the Federal Reserve.

The Fed and the Treasury have said that they will carry out any operation that is possible to ensure the market has sufficient liquidity to last through the coronavirus pandemic.

The contrasting approach of the Fed in 2020 , when compared with the 2008 financial crisis and the 2019 stock market slump, brought back the confidence of investors in the medium to long-term trend of equities.

U.S. President Donald Trump has also solidified his stance that he has the complete authority to reopen the U.S. economy , a topic that was addressed during a call between top Wall Street executives and the President in late March.

While the number of confirmed coronavirus cases has surpassed 600,000 in the U.S., some virus hotspots like California are projected to reach their peak in the short-term.

California is anticipated to record 66 new deaths on April 15, which the University of Washington’s Institute for Health Metrics and Evaluation has marked as a projected peak for the state.

Strong monetary policy, large-scale stimulus, some progress in containing coronavirus, and the willingness of President Trump to reopen the economy as soon as possible are raising the confidence of major financial institutions in the U.S. for a rapid stock market recovery.

Further, the Goldman Sachs economist also pointed towards the sharp decline in new hospitalizations in New York City and a noticeable drop in healthcare usage as positive indicators that the U.S. is moving towards the peak of the coronavirus outbreak.

All major banks are optimistic in the U.S.

As CCN.com reported on April 14, virtually all major financial institutions in the U.S., including Goldman Sachs, Morgan Stanley, JPMorgan Chase & Co., and Piper Sandler, believe the bottom of the stock market is in.

Some economists at JPMorgan, the biggest bank in the U.S., predicted that the U.S. stock market would see record highs in 2021, a contrasting forecast from that of CEO Jamie Dimon in the first week of April.

In a letter to investors dated April 6 , JPMorgan chairman and CEO Jamie Dimon said that the stock market is likely to see a 2008-esque correction in the near-term.

Dimon stated:

We don’t know exactly what the future will hold – but at a minimum, we assume that it will include a bad recession combined with some kind of financial stress similar to the global financial crisis of 2008,” said Dimon.

The 180-degree shift in the stance of Wall Street giants shows that investors are regaining appetite for U.S. stocks once again.