Florida Delicenses Healthcare Workers That Default on Student Loans

Florida, if you take away healthcare workers' chances of employment, how can they pay back their student loans? | Source: Shutterstock

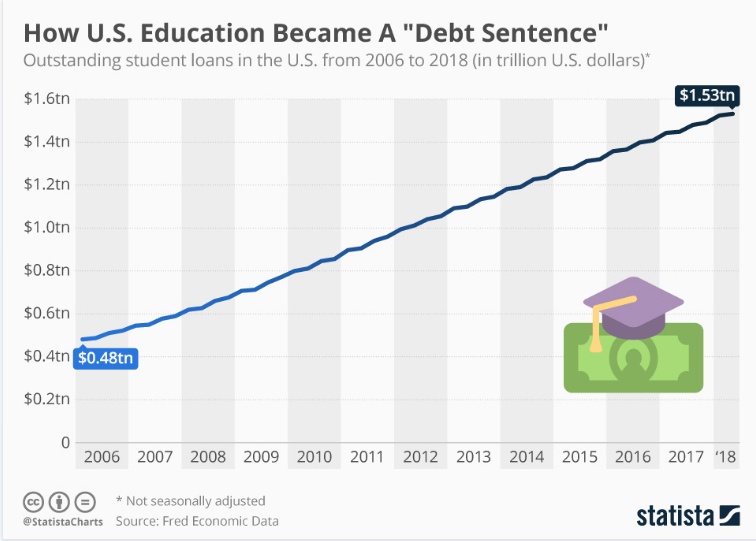

Americans now owe more in student loan debt than they do towards credit cards and vehicles combined. Currently, there are nearly 45 million student loan borrowers with over 10 percent of them in default.

In a move that has been interpreted as counterproductive, Florida’s Board of Health has decided to suspend the licenses of dozens of healthcare workers after they defaulted on their student loans. Since November, the board estimates that up to 120 healthcare workers have had their healthcare licenses suspended .

Some of the healthcare workers affected included pharmacists, opticians, registered nurses and nursing assistants. Nearly 1,000 healthcare workers stood to lose their healthcare licenses, though most worked out repayment plans.

No Job, No Money, No Loan Repayment

For the affected healthcare workers, getting their licenses back will be an uphill task. Florida law requires that student loan defaulters pay a fine equal to ten percent of their student debt. State investigation costs must also be paid before a license can be reinstated.

The development comes in the wake of U.S. Senators Elizabeth Warren and Marco Rubio re-introducing a bill aimed at protecting student loan borrowers from such practices.

Known as the Protecting JOBs Act , the bill bars any state that receives federal funding from the Higher Education Act from revoking, suspending or denying an occupational license to a student loan defaulter.

How the Senate Is Fighting for Defaulters

In a statement , Senator Warren termed license suspensions for student loan defaulters as “senseless roadblocks:”

We shouldn’t punish people struggling to pay back their student loans by taking away their drivers’ or professional licenses, preventing them from going to work and making a living. Our bipartisan bill removes these senseless roadblocks so that borrowers can build better financial futures.

The number of Americans with student loan debt is approximately 44.7 million. The total amount of student loan debt is $1.56 trillion, nearly three times what it was just a decade ago.

The burgeoning levels of student loan debt has resulted in borrowers postponing major life milestones . This includes saving for emergencies (34 percent), saving for retirement (29 percent), paying off other loans (27 percent) and buying a house (23 percent).

Millennials Can’t Buy Homes

Most of the student loan borrowers who have had to put off buying a house are aged 22-35. Per the National Association of Realtors, 83 percent of the non-home owners aged 22-35 blamed their predicament on student debt.

Additionally, the high student loan debt levels will negatively impact economic growth. Per the Federal Reserve Chairman, Jerome Powell, as student loans continue to swell they “absolutely could hold back growth.”