Students Increasingly Using Financial Aid for Purchasing Cryptocurrencies

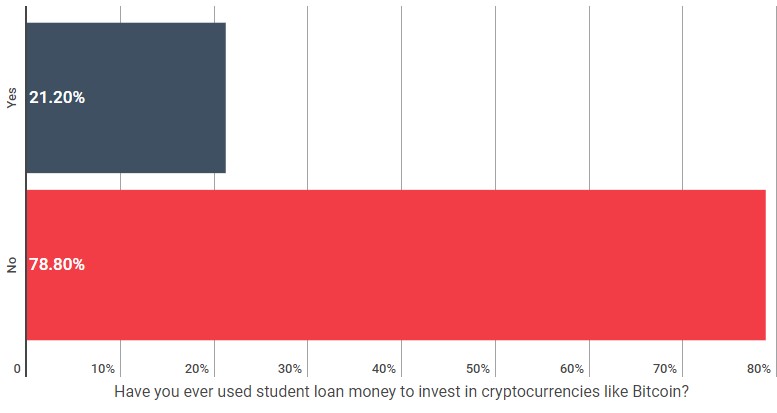

Major credit card issuers may have banned bitcoin purchases, but it’s not cramping the style of college students. According to a recent poll by US-based The Student Loan Report, more than one-fifth, or 21.2% of university students are directing financial aid funds to invest in the top cryptocurrencies. It’s a risky bet, one that could pay off in dividends or leave the students saddled with more debt than they initially inherited in a rising interest rate environment.

Students were asked by The Student Loan Report in no uncertain terms: “Have you ever used student loan money to invest in cryptocurrencies like Bitcoin?”

Interest Rate Conundrum

In the United States, 1.4 million-plus university students turn to private loans to finance their education, while the lion’s share of them use federal loans. With interest rates set to rise, these students could be on the hook for higher interest rates than they bargained for.

Meanwhile, students gain access to the cash money because lenders are in the habit of sending excess funds once courses are paid for back to the borrower. The funds are supposed to go toward living expenses, but investment savvy young adults are instead putting it into an asset class that could potentially deliver higher returns than anywhere in the traditional financial markets. Students aren’t required to disclose how the extra cash was spent. The report mentions bitcoin, Ethereum, Ripple and more.

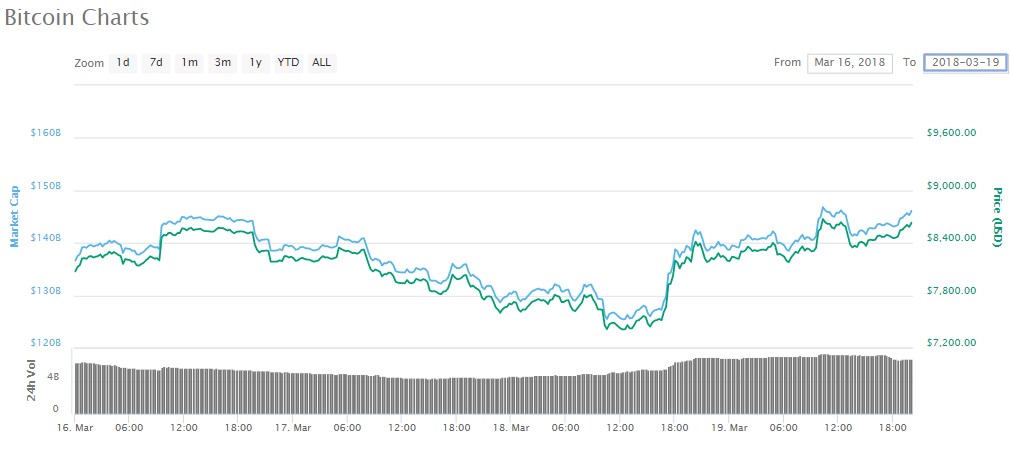

The Student Loan Report polled the university students over a several-day period in March, when the bitcoin price has been under pressure. But 2017 is not far enough in the rearview mirror for them to remember the potential returns that bitcoin and some altcoins can offer, given the gangbuster performance of 2017. The period that the students were polled is reflected in the below bitcoin price chart –

Blockchain Veteran’s Advice

If lenders get wind of the risks students are taking, they could issue tighter controls. Consumers were freely using their credit cards to invest in bitcoin until JPMorgan, Bank of America and others in February said no can do. Prior to the credit card ban, nearly 20% of bitcoin investors were making their purchases with a credit card, as per LendEDU cited in CNBC .

Harkening back to the advice offered by blockchain veteran Wences Casares, he told PayPal’s Dan Schulman: “The main way in which bitcoin could fail is if we begin to put into bitcoin money we cannot afford to lose.”

Featured image from Shutterstock.