Facebook’s Social Media Platforms Crash. Will Libra Be Different?

The outages across Facebook, Instagram, and WhatsApp raise questions about how solid and trustworthy the Libra coin could be. | Source: (i) REUTERS/Dado Ruvic/Illustration/File Photo (ii) Shutterstock (iii) Shutterstock; Edited by CCN.com

A few hours ago, the internet’s top social networks suffered a crash that kept users from sharing photos, videos, and similar files. Almost simultaneously, Facebook, Whatsapp, and Instagram suffered the same malfunction causing, as expected, a big nuisance among netizens, who rushed to position the tags #Instagramdown, #facebookdown, and #whatsappdown on Twitter.

https://twitter.com/StrangerBukhari/status/1146501695528144897

And although many took the opportunity to joke about the superiority of Twitter – the only fully operational platform – this joy was somewhat brief. That’s because shortly after that, the microblogging site also announced its own problems – this time affecting its DM and notifications service:

The Facebook team said on Twitter that they were working to repair this problem; however, they did not explain its causes. According to a tweet shared by MarketWatch Reporter Jon Swartz, Facebook could already identify the cause.

This general malfunction alarmed many members of the community as it happens after Mark Zuckerberg announced earlier this year his decision to rewrite the code of the three platforms to ensure their interoperability.

Facebook’s Experiments May Put Users to Choose Between Security and Convenience

Experts described Facebook’s excessive control over its clients’ data as very risky. In a twitter thread, expert cryptographer Matthew Green previously explained that Facebook could leverage the fact that the platforms have different encryption standards in order to adopt a weaker but common security framework. Also, the handling of metadata could be risky for users:

With this in mind, it’s easy to wonder: Is it a good idea to trust Facebook with our money and use Libra just for convenience?

Is Libra Worthy of Users’ Trust?

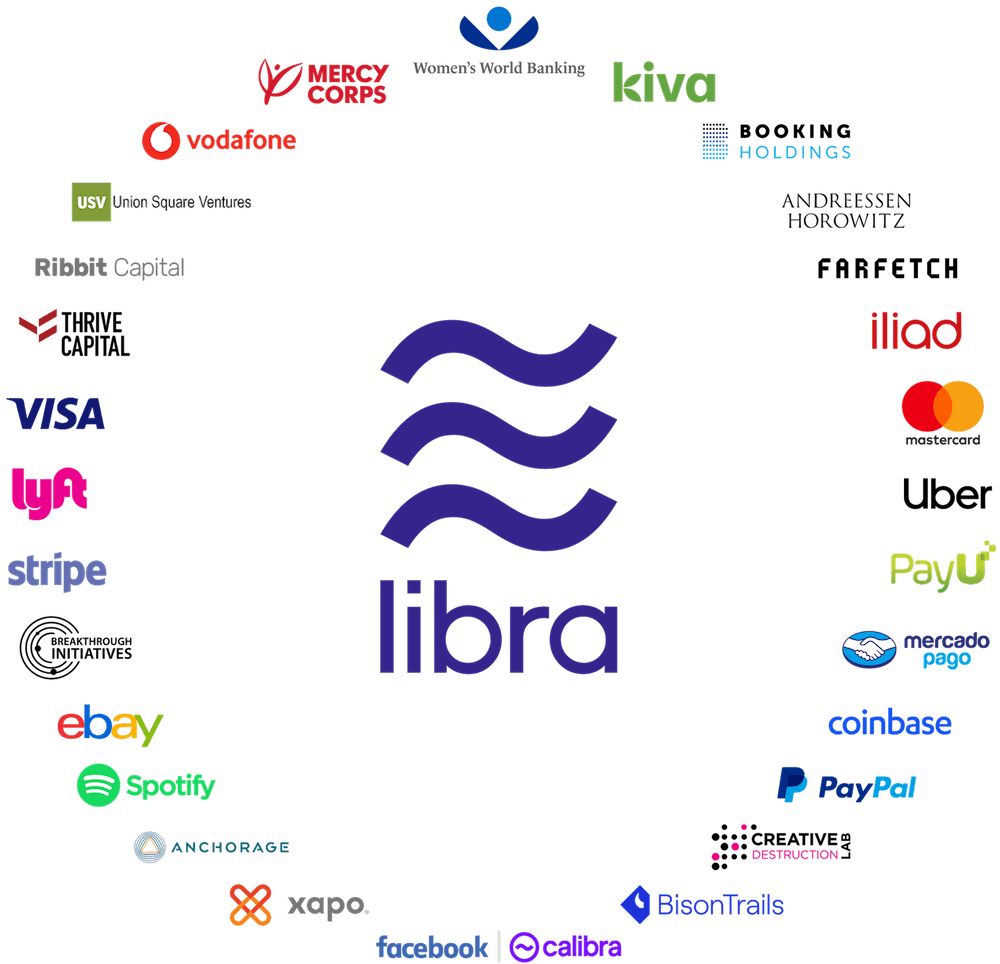

After becoming the king of the Internet 2.0, Facebook wants to become the king of the Internet of Money. Libra, its new adventure, seeks to use blockchain technology to let users send money without passing through the control of banks; instead, they would go through the control of the corporation members of the Libra Association.

Image Courtesy: Libra.org

Precisely the limited number of nodes and the flaws in Facebook’s platforms can be considered as potentially dangerous for a cryptocurrency – without taking into account the risks associated with the control of personal data, which privacy enthusiasts will not appreciate.

Facebook claims it will not share the financial data of its users:

“Aside from limited cases, Calibra will not share account information or financial data with Facebook or any third party without customer consent…The limited cases where this data may be shared reflect our need to keep people safe, comply with the law, and provide basic functionality to the people who use Calibra. Calibra will use Facebook data to comply with the law, secure customers’ accounts, mitigate risk, and prevent criminal activity”.

However, such statements may be hard to believe when they come from the same company that has been involved in scandals such as the case of Cambridge Analytica .

Facebook has more than 2.3 billion monthly active users; WhatsApp has 1.5 billion, while Instagram accounts for over one billion. And in the face of crashes like this one, the only thing users can do is wait, accept an apology and maybe go out and take a walk in the park while pondering whether it’s worth using the so-called “Facebook Coin.”