‘Extremely Bullish’ Bitcoin Supercharges Crypto Market to Hit $288 Billion

Bitcoin price is pushing beyond $9000 and the crypto market is at 2019 high. | Source: Shutterstock

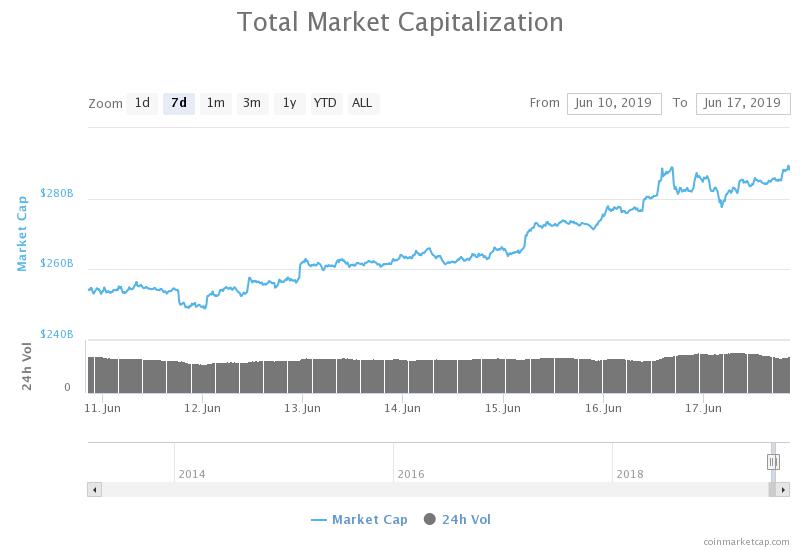

By CCN.com: In the past week, the valuation of the crypto market has increased from $252 billion to $288 billion by over $36 billion as the bitcoin price climbed to $9,391 on major exchanges like Bitstamp and Coinbase.

According to traders, bitcoin has been “extremely bullish” in recent weeks based on technical indicators and is set to see resistance at $9,500 in the near term.

Can crypto market and bitcoin continue to sustain momentum

Up until December 2018, the general sentiment around the near to medium term performance of the crypto market was gloomy; investors foresaw a brutal bear market that could last throughout 2019 and startups within the crypto sector were gearing up for many more months of downward price action.

Several months after plunging to $3,150, the bitcoin price abruptly began to recover as the uncertainty in the global economy slightly subsided and the equities market of the U.S. started to rebound.

Contrary to widespread belief, some strategists have said that bitcoin was affected by the panic sell-off of assets in late 2019 that was fueled by the trade war between the U.S. and China.

As the global economy started to demonstrate signs of recovery, bitcoin began to recover to 2018 levels.

Cathie Wood, the founder and CEO of ARK Invest, said :

“Yes, and crypto hedge funds facing redemptions in the fourth quarter were forced to sell their most liquid cryptoasset, BTC, causing the drop from $6000 to $3000. The bounce back to $6000 in the first quarter was not surprising, the follow-through to $9000 impressive.”

Throughout 2018 and the first half of 2019, the crypto sector has seen a noticeable increase in the inflow of capital from institutional investors.

“JP Morgan analyst acknowledges what has been relatively obvious for about two months already: it is mostly institutions behind the bitcoin bull-run, rather than retail investors, as it was during the 2017 mania,” wrote global markets analyst Alex Krüger.

Although it remains unclear as to which extent the market was impacted by the entrance of institutions, capital brought in by institutional investors typically stays in the market for longer periods of time than capital from retail investors.

As such, bitcoin may not have seen a spike in an inflow of capital in recent weeks but the capital from institutional investors that have consistently flown into the market in the past year and a half is said to maintained the momentum of the market.

Josh Rager, a crypto trader and technical analyst, said :

Bitcoin has been extremely bullish and foresee a test of the major resistance between $9500 to $9600 the 0.382 fib (is a typical ‘take profit’ area is at $9532) But last time everyone expected a major pullback in the $6ks it busted right through to $7k+.

Billionaires optimistic

In an interview with CBS Sunday Morning, the Winklevoss twins stated that they believed bitcoin would disrupt gold when it purchased 1 percent of the dominant crypto asset’s supply.

At the curernt price of $9,300, 210,000 BTC is worth $1.953 billion.

The Winklevoss twins added:

“Our thesis at the time was bitcoin’s going to disrupt gold. And gold has a market cap of $7 trillion today. So if bitcoin’s going to be worth $7 trillion or more, this seems like a cheap asset. It was a complete Wild West.”

As the market continues to sustain momentum, investors are likely to become more confident in the macro landscape of crypto assets.